Bitcoin Starts the Week With a Sharp Downturn

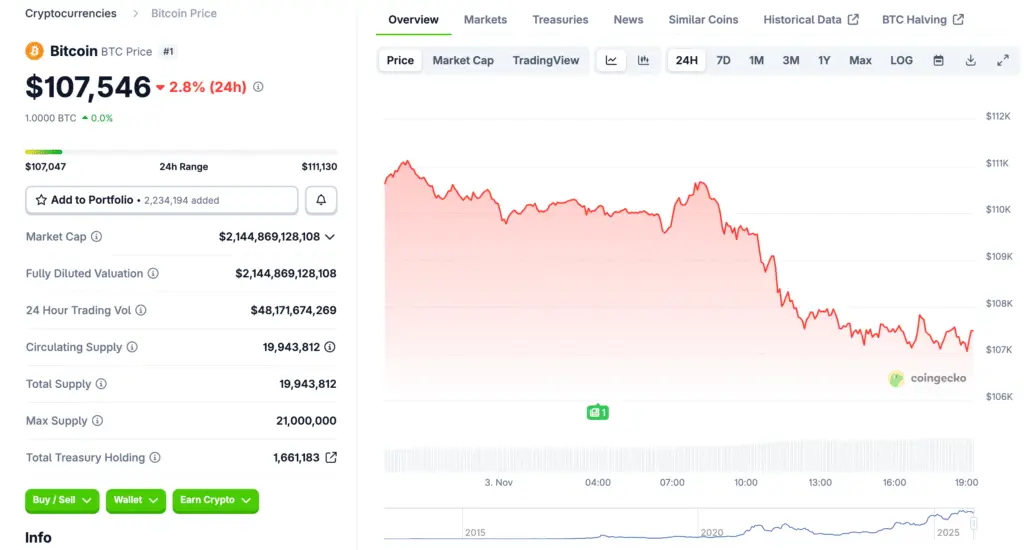

Bitcoin opened Asia’s trading week with a notable drop below $108,000, breaking its strong October momentum. The fall marks a shift in sentiment as traders grow cautious following recent remarks by U.S. Federal Reserve officials about future interest rate decisions. The once bullish “Uptober” narrative has cooled, giving way to renewed risk aversion in crypto markets.

Market Caution Rises After Fed Chair Powell’s Comments

Federal Reserve Chair Jerome Powell’s warning that a December rate cut is not guaranteed has injected hesitation among investors. Markets had been pricing in a faster cycle of monetary easing, but Powell’s stance dampened hopes. As a result, crypto traders are now aligning strategies around data-driven cues rather than relying on aggressive dovish forecasts.

Bitcoin and Altcoins Suffer Widespread Losses

Bitcoin’s slide to $107,734 represented a 2.1% decline, while Ether and XRP posted losses of 3.8% and 3.1%, respectively. The total crypto market capitalization fell 3.1% to $3.69 trillion. Analysts noted that lower liquidity due to Japan’s holiday trading session amplified volatility across major digital assets.

Recommended Article: Bitcoin Sentiment Slides as Bearish Odds Rise

Leverage Unwinds Add Pressure to Market Correction

The market’s downturn was further intensified by leveraged positions being forced to close. Throughout October, traders had taken on high leverage anticipating continuous gains. When prices retreated, long positions were liquidated, adding more downward momentum. Experts suggest this deleveraging is a necessary reset that strengthens long-term market structure.

Investor Sentiment Shifts From ‘Uptober’ to ‘Red October’

Community discussions across crypto forums now label the month’s end as “Red October.” Despite short-term losses, many analysts emphasize Bitcoin’s on-chain health remains robust. Long-term holders continue to show minimal selling activity, supporting a base for potential recovery ahead of the historically bullish month of November.

Key Economic Data Could Steer Crypto’s Next Moves

Traders are now turning their focus to upcoming U.S. economic data, including job openings, payroll reports, and inflation expectations. Strong employment data could reinforce the Fed’s cautious tone, while softer numbers might rekindle optimism for earlier rate cuts. Bitcoin’s near-term direction is expected to correlate closely with these macroeconomic indicators.

Analysts View Current Correction as ‘Healthy Deleveraging’

According to Delta Exchange analyst Riya Sehgal, the market is in a “healthy deleveraging phase.” Sehgal highlighted Bitcoin’s realized cap above $1.1 trillion as proof of its underlying strength. This suggests that while short-term profit-taking continues, the crypto market remains fundamentally sound.

Long-Term Outlook Remains Structurally Bullish

Despite the current correction, many investors maintain a positive long-term outlook. Bitcoin’s consistent network activity, robust liquidity, and historical November performance suggest potential upside once macro uncertainties stabilize. Traders are advised to monitor dollar strength and interest rate signals closely, as these will continue to shape sentiment across global digital asset markets.