Ethereum’s Path Toward $7,500 Gains Momentum

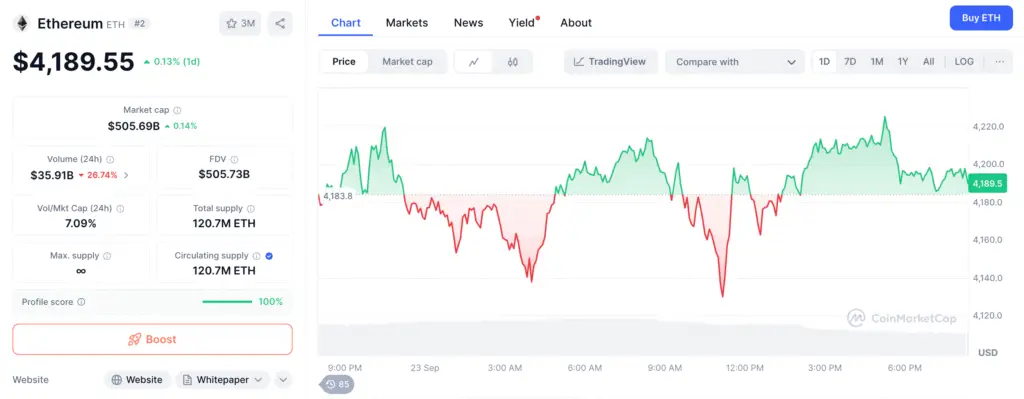

Ethereum is capturing attention as analysts project the price could climb toward $7,500 by December 2025. Standard Chartered recently raised its year-end target from $4,000, citing institutional inflows and strong upgrade momentum.

This bullish outlook is fueled by steady ETF demand and treasury acquisitions. Analysts note that institutions now hold close to 4% of ETH supply, highlighting growing market confidence. Stablecoin adoption further strengthens Ethereum’s case as transaction volumes and network activity continue rising.

Key Drivers Behind Ethereum’s Bullish Forecast

One of the most compelling drivers for Ethereum’s growth is the booming stablecoin sector. Standard Chartered projects that stablecoin usage could expand nearly eightfold by 2028, most of it on Ethereum. This surge would translate into higher fees and more sustained network demand.

Adding to the optimism, Ethereum developers are preparing the Fusaka upgrade in December 2025. This upgrade will make transactions up to eight times faster and cheaper, positioning Ethereum as a leader in scalability. Together, these factors are shaping the network’s long-term strength as a DeFi backbone.

Mutuum Finance Raises $16 Million in Presale

While Ethereum dominates headlines, new DeFi protocols are also gaining momentum. Mutuum Finance (MUTM) has raised over $16 million in its presale, drawing in more than 16,450 holders. Currently in its sixth phase, the presale prices tokens at $0.035 with a planned launch price of $0.06.

That represents nearly a twofold jump, with early supporters positioned for potential 2x gains at launch. Some investors believe MUTM could reach $0.15–$0.25 in early trading once listings go live.

Recommended Article: Mutuum Finance (MUTM) Nears Next Phase With 14.3% Price Hike After $16M Raised

Presale Incentives and Investor Engagement

Mutuum’s presale includes incentives to reward community participation. A Top 50 leaderboard highlights the largest contributors, with additional MUTM bonuses set aside for them. The project also launched a $100,000 giveaway campaign to further expand adoption. On its dashboard, investors can track holdings in real time and calculate expected ROI.

These features have built strong engagement, helping the presale quickly sell through multiple stages. With Phase 7 bringing a 20% price increase, the current entry point looks increasingly attractive to buyers.

Building a Decentralized Lending and Borrowing Protocol

At the core of Mutuum Finance is its lending and borrowing framework. The protocol offers two main models: Peer-to-Contract (P2C) and Peer-to-Peer (P2P). In the P2C model, users deposit assets into liquidity pools, earning interest as borrowers access funds.

The system automatically adjusts rates based on utilization, ensuring fair returns. Meanwhile, the P2P model allows users to set custom terms, enabling lending or borrowing even for volatile tokens like PEPE or DOGE. This dual approach adds flexibility and broadens utility across the platform.

Staking Rewards and Token Utility

Beyond lending, Mutuum Finance incorporates staking mechanics that create additional token demand. Users who stake mtTokens—proofs of deposit like mtUSDT—receive MUTM rewards bought back from the open market. This buy-and-redistribute system ties platform usage directly to token circulation.

By aligning revenue with staking, Mutuum incentivizes long-term holding while providing passive income streams. Such tokenomics are designed to strengthen investor confidence and sustain growth after launch. This layered approach distinguishes MUTM from typical presale tokens that lack real-world utility.

Roadmap and Exchange Listing Outlook

Mutuum’s roadmap outlines a multi-stage rollout that coincides with its exchange debut. A beta platform will launch alongside token listings, offering immediate access to P2C and P2P markets. Early exchange deals with BitMart and LBank suggest wider availability shortly after launch.

The team is also advancing to a public testnet phase, allowing users to experience the system before full deployment. Longer-term goals include developing a native stablecoin and expanding across multiple blockchains. These milestones show clear intent to scale within the DeFi market.

Ethereum and Mutuum Finance: Dual Opportunities for 2025

Ethereum’s potential climb to $7,500 reflects institutional adoption, scalability upgrades, and growing stablecoin reliance. In parallel, Mutuum Finance is building its case as a high-upside DeFi project, raising over $16 million and offering presale opportunities ahead of a $0.06 launch price.

Together, ETH and MUTM represent two sides of the same growth story: one as an established market leader, the other as a rising star with innovative lending solutions. For investors, both could play pivotal roles in shaping 2025’s crypto narrative.