Wall Street’s Bullish Bet on Ethereum

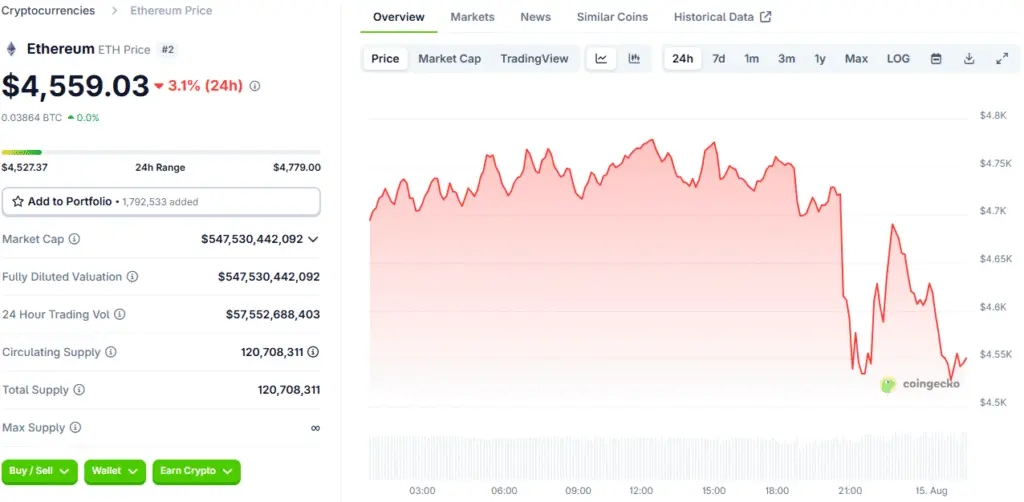

The price of Ethereum (ETH) is surging, with the cryptocurrency now trading near its 2021 record levels. This rally is being fueled by a growing bullish sentiment on Wall Street, with some experts calling Ethereum the “biggest macro trade over the next 10-15 years.” This is a significant shift, as institutional investors and traditional finance players are now viewing Ethereum not just as a speculative asset but as a foundational piece of the future financial system.

According to Fundstrat head of research Tom Lee, the majority of Wall Street crypto projects and stablecoins are being built on the Ethereum infrastructure. This fundamental utility, combined with its high trading liquidity, is making it an increasingly attractive option for institutional capital seeking a long-term position in the digital asset space.

The Impact of Regulatory Clarity and Stablecoins

The price rally in Ethereum is being supported by a number of key developments that are providing much-needed regulatory clarity. The recent passage of the GENIUS Act legislation, which creates clear guardrails for the stablecoin industry, has been a major boon. With a significant portion of stablecoins being built on the Ethereum network, this new regulation provides a stable and secure environment for growth.

Additionally, the SEC’s recent “Project Crypto” announcement, an initiative to modernise the agency and establish clear regulations for the digital asset industry, has further fueled the rally. This more favourable regulatory environment is giving institutional investors the confidence they need to allocate capital to the Ethereum ecosystem, solidifying its position as a legitimate and compliant platform for financial innovation.

The Rise of Digital Asset Treasury Companies

A major driver of Ethereum’s price surge is the rise of digital asset treasury companies. This strategy, pioneered by firms like MicroStrategy with Bitcoin, involves raising capital to add cryptocurrencies to a corporate balance sheet. The model is now being applied to Ethereum, with a new wave of companies pursuing similar strategies. For example, BitMine Immersion Technologies (BMNR), which is chaired by Fundstrat’s Tom Lee, has announced plans to sell up to another $20 billion worth of stock to increase its holdings of Ethereum.

The company’s goal is to eventually acquire 5% of the world’s outstanding ETH tokens. Other firms, such as SharpLink Gaming (SBET), are also pursuing similar strategies. The influx of capital from these companies is a powerful force, creating a supply squeeze and driving the price of ETH higher, while also attracting further investor enthusiasm into the space.

Ethereum’s Supply Squeeze A New Market Dynamic Fuels Price Rally

The scramble among public companies to acquire Ethereum has created a supply squeeze on over-the-counter (OTC) desks and exchanges. This is a powerful market dynamic that is directly contributing to the price rally. As more of the total ETH supply is locked up in ETFs and company reserves, the available supply for retail traders on exchanges decreases, putting upward pressure on the price.

According to data, Ethereum ETFs and strategic reserves now account for almost 8% of ETH’s total supply, a significant increase from just a few months ago. This structural demand is what is fueling bullish price predictions. While some analysts see ETH hitting prices as high as $15,000 by year-end, BitMine CEO Tom Lee has gone even further, predicting long-term prices above $80,000. These predictions, whether ultimately reached or not, highlight the new level of bullish sentiment and confidence in Ethereum’s future.

Performance Compared to Bitcoin

Ethereum’s recent performance has been particularly impressive when compared to Bitcoin. Over the past five sessions, Ether is up an impressive 16%, while Bitcoin has seen a more modest rise of 4%. This outperformance suggests that traders and institutions are now making a strategic bet on Ethereum, viewing its utility and high trading liquidity as key advantages.

While Bitcoin remains a dominant player as a store of value, Ethereum’s role as a foundational infrastructure for stablecoins, DeFi projects, and other applications gives it a unique value proposition. This is a sign of a maturing crypto market, where different assets are being valued for their distinct use cases and strengths. The market is no longer a one-size-fits-all approach, and Ethereum’s recent surge is a clear indication that it is now a leader in its own right.

The Influx of Capital into the Ecosystem

The influx of capital into the Ethereum ecosystem is not just coming from digital asset treasury companies. The highly successful IPO of fintech giant Circle Internet Group has also been a major boon for the network. Circle, which offers the stablecoin USD Coin, has a strong presence on Ethereum, and its success further validates the legitimacy of blockchain technology and its potential to revolutionise traditional finance. The network has also gained widespread recognition as the ecosystem of choice for most stablecoin mintings, according to trade publications.

This dominance in a crucial sector of the crypto market is a clear sign that Ethereum is a reliable and robust platform for financial innovation. The combination of corporate treasuries, ETFs, and a strong stablecoin ecosystem is creating a powerful flywheel effect that is driving the price of ETH higher and solidifying its position as a central player in the future of finance.

Ethereum’s New Era: Institutional Adoption and Utility Drive Value

The recent price surge of Ethereum, driven by a combination of institutional demand, regulatory clarity, and the rise of digital asset treasury companies, signals a new era of an integrated financial system. The lines between traditional finance and decentralised technologies are blurring, and Ethereum is at the very centre of this convergence. The success of this model will not only reshape corporate treasuries but will also have a profound impact on the entire cryptocurrency market.

As more companies and institutions recognise the value of Ethereum as a foundational infrastructure, its role as a key asset in the global financial system will continue to grow. This is a new chapter in the story of crypto, where utility and institutional adoption are now the primary drivers of value, and Ethereum is leading the way.

Read More: Ethereum Treasury Giant BitMine Announces Massive Stock Sale to Buy ETH