The PPI Report: A Surprise for the Markets

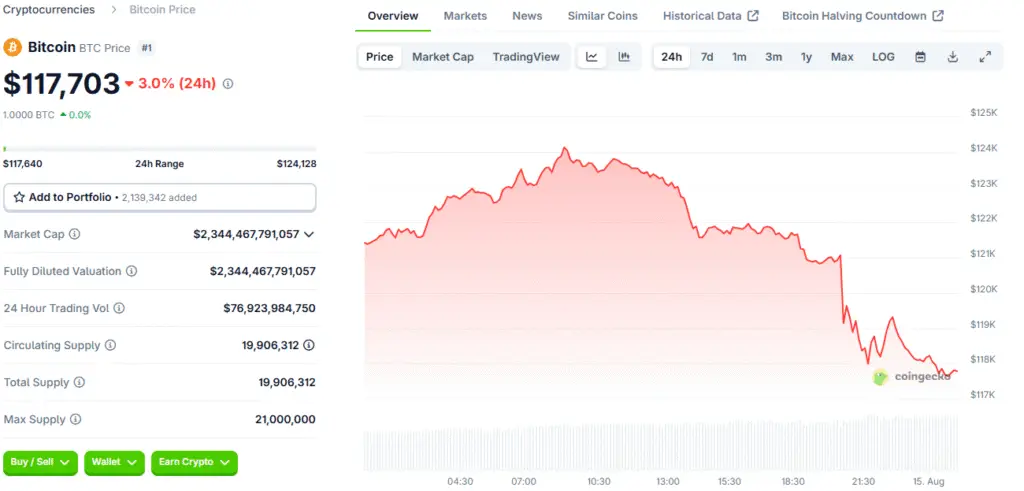

The cryptocurrency market, and Bitcoin in particular, recently experienced a period of sharp volatility in response to new U.S. economic data. The Producer Price Index (PPI), a key inflation indicator that measures wholesale goods prices, surged by an unexpected 0.9% for the month. This was a significant surprise to economists who had forecasted a much more modest 0.2% increase, and it represented a sharp acceleration from the previous month’s stagnant 0.0% reading.

This hotter-than-usual PPI data immediately fueled a rally in the U.S. dollar, as analysts viewed the report as a sign of potential rising inflationary pressures upstream. The dollar’s strength often comes at the expense of riskier assets, and in this case, it prompted an initial sell-off in the crypto market.

The Impact on Bitcoin and Fed Policy Expectations

The higher-than-expected PPI data heightened market expectations that the U.S. Federal Reserve might need to maintain its restrictive monetary policy stance for a longer period. This shift in sentiment had a direct impact on Bitcoin, which fell to a low of $117,719 before recovering. However, the market’s reaction was not unanimous.

While the inflation data places increased focus on the upcoming September Federal Open Market Committee (FOMC) meeting, prediction markets and the CME FedWatch tool show that the sentiment for a rate cut remains high, with a 96.5% chance of a rate cut on September 17. This suggests a disconnect between the initial market reaction to the PPI data and the broader expectation of a policy shift. The volatility highlights the ongoing debate within the market about the Fed’s next move and whether a single inflation report is enough to derail a planned rate cut.

Bitcoin’s Rebound and Underlying Strength

Despite the initial tumble, Bitcoin swiftly rebounded back above the $118,000 mark and eventually reached a price of over $119,000 before settling back down. The day prior, it had even reached a new all-time high of $124,517 per coin. This quick recovery demonstrates the underlying strength and resilience of the cryptocurrency. It suggests that while macro news can cause short-term volatility, a strong base of investors remains committed to the asset.

The market will now be watching for further inflation data, as well as commentary from the Federal Reserve, to gauge the central bank’s next move. The PPI surprise serves as a powerful reminder of how interconnected the cryptocurrency and traditional financial markets have become and how a single piece of economic data can have a profound and immediate impact on asset prices.

PPI Data vs. Rate Cut Odds A Disconnect Drives Volatility

The most interesting aspect of this event is the clear disconnect between the surprising PPI data and the high probability of a rate cut shown by the CME FedWatch tool. Typically, a hot inflation report would significantly lower the odds of a rate cut, but this was not the case. This could be due to a number of factors, including a belief that the uptick in core inflation is a temporary blip or a strong conviction that the Fed is committed to a rate cut in September regardless of a single month’s data.

This tension between data-driven reality and market-driven expectations is what is creating the volatility. Investors will now be closely monitoring all future economic reports and Fed communications to see which of these two narratives ultimately prevails. The outcome will have significant implications for both cryptocurrency and currency markets in the coming months.

PPI Surprise and Tariffs: New Factors in the Fed’s Decision

The upcoming September FOMC meeting is now more important than ever. Market participants will be looking for clues on whether the Fed will maintain its current rate, as some of the data might suggest, or if it will proceed with the rate cut that the market is so heavily anticipating. The PPI surprise, which was driven in part by tariffs, highlights the persistent inflation concerns that the central bank must grapple with.

The decision will have a ripple effect across the entire financial world, and the outcome will be pivotal for the future direction of crypto prices. While the volatility of the past day has been a challenge for traders, it is also a sign that the market is maturing and is now a central part of the global financial conversation.

Read More: Kazakhstan’s Bitcoin ETF Launches on Astana International Exchange