The Volatile Trading of the Bonk Meme Coin

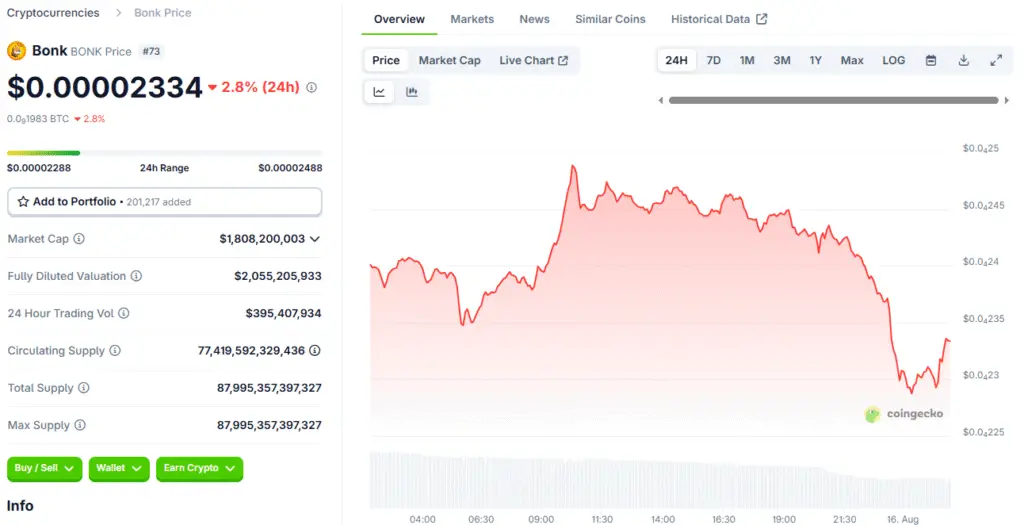

The Bonk (BONK) token, a major player in the Solana meme coin ecosystem, has weathered a volatile 24-hour period, with significant institutional activity defining both the highs and lows of its trading range. The token reached a price of $0.000026 before encountering a massive sell wall, where 4.02 trillion tokens changed hands during a midday rejection. This event established a clear technical ceiling for the short term, as a major wave of selling pressure pushed the price down.

From there, BONK slipped 6% to find a floor near $0.000023, a price point that has now emerged as a key support level. This zone was tested multiple times without breaking, with buyers absorbing the selling pressure and ultimately preventing a more severe price decline. The volatile trading action highlights the token’s high liquidity and its sensitivity to large-scale institutional moves.

The Shifting Dynamics of Open Interest

The recent price correction in Bonk has been accompanied by a shift in its derivatives market. The futures Open Interest (OI), which measures the notional value of outstanding futures contracts, has shrunk to $38 million after peaking at approximately $73 million in July. This persistent decline in OI implies that overall market sentiment and interest in the Solana-based meme coin have been subdued.

However, despite this drop, the futures-weighted sentiment remains positive, with traders increasingly leveraging long positions in BONK. This is an interesting dynamic that suggests a disconnect between the overall market’s declining interest and the bullish positioning of active traders. The market is now at a pivotal point, with the direction of the next move dependent on whether this subtle bullish sentiment can overcome the recent decline in open interest and volume.

A Technical Outlook Awaiting a Breakout

The technical outlook for Bonk is now defined by a clear battle line. The token has successfully held above a key support level at $0.000023, a zone that has been tested multiple times without breaking. This support, combined with a confirmed resistance level at $0.000026, has created a consolidation zone that traders are now watching closely.

A sustained push above $0.000025 could signal the beginning of a more pronounced upward move, with a breakout above the $0.000026 resistance potentially leading to a new rally. However, a break of the lower bound at $0.000023 risks retesting earlier lows from August. The Relative Strength Index (RSI), a key technical indicator, continues to decline below the midline, indicating that selling pressure is still a factor. For a bullish reversal to take hold, the RSI would need to turn upward and cross back above the midline.

Institutional Participation and High Liquidity

Bonk’s continued high liquidity, even amid recent volatility, underscores its position as one of the most active tokens in the meme coin sector. The recent price action, with significant institutional volumes defining both the highs and lows, shows that large-scale players are actively participating in the market.

While this institutional participation has kept price action tightly bound, it has also increased the potential for sudden breakouts should order books be thin at key levels. The rebound in the late-session trading, fuelled by sharp volume spikes, suggests that accumulation from larger players is occurring just above prior support, a sign that sophisticated traders see potential upside from the current consolidation zone.

Read More: Bonk Price Forecast Brightens as Meme Coin Holds Key Support

A Crucial Consolidation Phase

The current consolidation zone, trading between $0.000024 and $0.000025, is a crucial phase for the Bonk token. This period of sideways price movement is often a time when the market is gathering momentum for its next major move. For traders, this is a time to watch closely for signs of a breakout. A sustained push above the upper bound of this consolidation zone would be a powerful bullish signal, while a break below the lower bound would be a clear bearish signal.

The outcome will depend on a number of factors, including the broader market sentiment, the activity of institutional traders, and the token’s ability to attract new buying pressure. The coming sessions will be a major test for Bonk as the market decides which direction it will take.

The Broader Context of Meme Coin Sentiment

Bonk’s price action is happening in the context of a broader market where meme coin sentiment has been shaky. The token’s recent decline from its July peak, while substantial, is not an isolated event. Many other meme coins have also been in a period of correction. The ability of Bonk to defend a key support level in the face of this broader market uncertainty is a testament to its underlying resilience.

It suggests that while the token may be in a period of correction, it has a strong base of holders and a dedicated community that is providing a floor for its price. The technical rebound and the signs of accumulation from institutional traders are a glimmer of hope in a market that has been largely bearish for meme coins in recent weeks.

A PIVOTAL Moment for Bonk’s Future

The current moment is a pivotal one for Bonk’s future. The price is at a critical technical level, with a bullish chart pattern and key support levels to defend. The market’s subdued interest, as reflected by the decline in open interest, is a concern, but the bullish positioning of some traders provides a glimmer of hope.

The coming sessions will be a major test for the token, as it must either rally and confirm the bullish breakout or succumb to the selling pressure and extend its decline. The outcome will have a significant impact on Bonk’s price trajectory and will provide valuable insight into the broader sentiment of the meme coin market. For traders and investors, all eyes are on the chart, waiting to see if Bonk can hold its ground and begin its next ascent.