A Groundbreaking Legislative Push for a National Bitcoin Reserve

In a move that could redefine the Philippines’ financial strategy, a groundbreaking new bill is gaining attention for its proposal to incorporate Bitcoin into the nation’s strategic reserves. Philippine Representative Miguel Luis R. Villafuerte introduced House Bill No. 421, formally titled “An Act Creating the Strategic Bitcoin Reserve and Appropriating Funds Therefor.”

The measure has national significance and is currently under consideration by the House of Representatives’ Committee on Banks and Financial Intermediaries. This legislative effort signals a proactive approach to economic sovereignty, aiming to future-proof the nation’s financial resilience in an era of rapid digital transformation.

Details of the Proposed Bill and Acquisition Strategy

The bill outlines a clear and structured plan for the creation of a Strategic Bitcoin Reserve, to be managed by the Bangko Sentral ng Pilipinas (BSP), the country’s central bank. Under the proposal, the BSP would be directed to purchase up to 10,000 BTC. This acquisition would not happen all at once but rather in a phased approach of 2,000 BTC annually over five years.

The bill specifies that these assets would be held in trust for a period of 20 years, underscoring a long-term vision for this strategic holding. The funding for the reserve would come directly from the BSP’s existing budget, demonstrating a commitment to the initiative without requiring new taxes or external funding.

The Rationale Behind the Bitcoin Initiative

Representative Villafuerte emphasized the bill’s intent to “maximize pressing economic opportunities to safeguard our financial standing.” He argued that while the Philippines currently holds traditional dollar and gold reserves, the increasing global significance of Bitcoin makes it imperative for the country to take legislative action.

The bill’s proponents believe that Bitcoin’s capped supply and decentralized nature offer valuable protection against inflation and systemic financial risk, providing a modern complement to traditional reserve assets. This forward-thinking perspective is a core part of the bill’s appeal to policymakers who are looking for innovative ways to secure the nation’s economic future.

Building a Secure and Decentralized Custody Network

To ensure the security and resilience of the Bitcoin reserve, the bill includes specific provisions for a sophisticated custody framework. The BSP Governor would be tasked with establishing a decentralized network of Bitcoin storage facilities across the country. This plan for a dispersed cold storage infrastructure is a crucial step to ensure operational resilience and protect the assets from both physical and digital threats.

The governor would also be responsible for managing the holdings, coordinating with multiple government agencies, and publishing quarterly public reports that would be audited by a third party. This commitment to transparency and robust security measures is designed to build public trust in the initiative.

Inter-Agency Collaboration for Effective Management

The successful implementation of the Strategic Bitcoin Reserve would require close cooperation between key government bodies. The bill outlines a clear mandate for the BSP Governor to coordinate with the Departments of Finance, Defense, and Information and Communications Technology. This inter-agency collaboration is vital to ensure all aspects of the reserve, from financial management to national security and cybersecurity, are handled with the utmost care.

The involvement of multiple departments highlights the seriousness with which this proposal is being considered, as it recognizes that managing a national reserve of a digital asset requires a comprehensive, multi-faceted approach.

Addressing Concerns Over Volatility and Risk

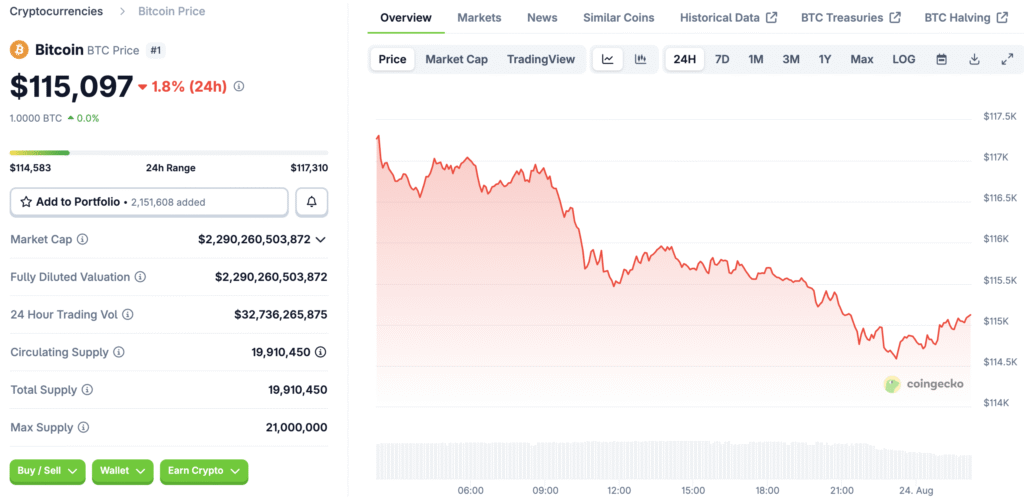

While the bill has strong proponents, it also faces criticism, particularly concerning price volatility and regulatory uncertainty. Detractors argue that Bitcoin’s volatile nature could pose a risk to the stability of the national reserves, a concern that is valid given the asset’s history of significant price swings. However, proponents counter this by emphasizing that the phased acquisition over five years is designed to mitigate this risk through a dollar-cost averaging strategy.

This approach aims to reduce the impact of short-term price fluctuations. Furthermore, the bill’s firm language on protecting private property rights and prohibiting confiscation is a direct response to potential regulatory and legal ambiguities, seeking to provide a clear and secure framework for Bitcoin’s future in the country.

Protecting Private Bitcoin Property Rights

In addition to its focus on national reserves, the bill also includes firm language on private property rights. The legislation prohibits the confiscation of legally held Bitcoin and explicitly reaffirms the freedom of individuals and businesses to acquire, use, and transfer the asset. This provision is designed to provide legal clarity and protection for the growing community of crypto users in the Philippines.

By creating a clear legal framework that both secures a national reserve and protects the rights of private citizens, the bill aims to foster a secure and innovative environment for the entire digital asset ecosystem.

Recommended Articles: Major Bitcoin Heist Exposes Key Security Flaws