ADA Forms Ascending Triangle Near Resistance

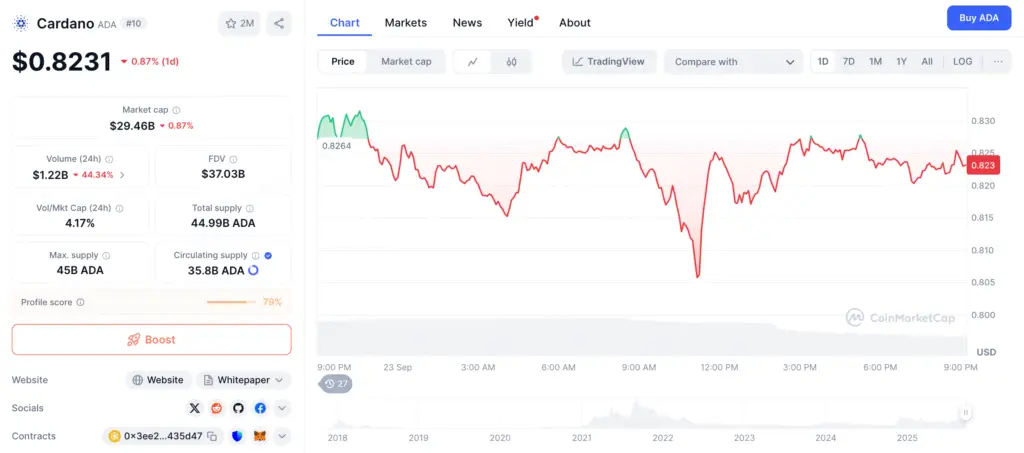

Cardano (ADA) is trading at approximately $0.82 after declining 7% since Monday, extending its weekly losses to just over 5%. Despite this, the daily chart shows ADA forming an ascending triangle pattern, a bullish structure often signaling continuation if resistance is breached.

The upper boundary of the triangle sits at $0.95, which has repeatedly rejected ADA’s price since mid-July. With higher lows supporting the pattern, analysts note a potential breakout could accelerate gains. Market tracker TapTools commented that a decisive move above $0.95 would likely clear the path toward the $1.20 zone.

Indicators Show Low Volatility Ahead of Move

Technical indicators suggest ADA is entering a period of consolidation before a potential breakout. Bollinger Bands on the daily chart have narrowed, signaling reduced volatility. The Supertrend indicator, positioned below the price at $0.8089, reflects ongoing bullish bias without signaling reversal.

Historically, these conditions often precede price expansion. A daily close above $0.95 would shift market momentum firmly upward, while rejection could force a retest of trendline support near $0.80.

Potential Upside Toward $1.20

If ADA breaks above the $0.95 resistance, the next upside levels to monitor are $1.05 and $1.20. These zones align with previous consolidation points and represent natural targets for profit-taking.

On the downside, failure to breach resistance could trigger selling pressure. A breakdown below $0.80 would expose ADA to further declines, with support expected between $0.72 and $0.75, areas that held during past corrections.

Recommended Article: Cardano Price Forecast ADA Nears Breakout Towards One Dollar

Whale Activity Creates Selling Pressure

Recent whale movements have added complexity to ADA’s current setup. According to analyst Ali Martinez, addresses holding between 1 million and 10 million ADA offloaded roughly 160 million tokens over the last four days. This reduced their cumulative balance from 5.6 billion ADA to 5.44 billion.

Despite the sell-off, ADA’s price has remained relatively steady, suggesting strong underlying demand. A previous instance of heavy whale distribution saw 530 million ADA moved in just two days, but buyers absorbed most of the pressure.

Cardano’s eUTXO Model Draws Interest

Beyond short-term price moves, Cardano’s extended unspent transaction output (eUTXO) model continues to attract interest from developers and long-term supporters. Content creator David highlighted that the eUTXO framework enables more predictable transaction execution compared to account-based models used by Ethereum.

Supporters argue that this feature provides Cardano with a competitive advantage in scalability and reliability. Over time, such structural benefits could strengthen ADA’s positioning in the crowded smart contract ecosystem.

Outlook: Key Breakout or Retest Ahead

Cardano’s near-term outlook hinges on the $0.95 resistance level. A breakout above this barrier could unlock a run toward $1.20, reinforcing bullish momentum as Q4 approaches. Conversely, rejection at resistance may lead to further consolidation or a retest of lower support zones.

Whale movements, combined with macro factors in the broader crypto market, will likely play a decisive role in shaping ADA’s price trajectory in the coming weeks. For now, investors are closely watching whether ADA can finally clear the hurdle and reclaim higher levels.