Ethereum Price in a Critical Stage

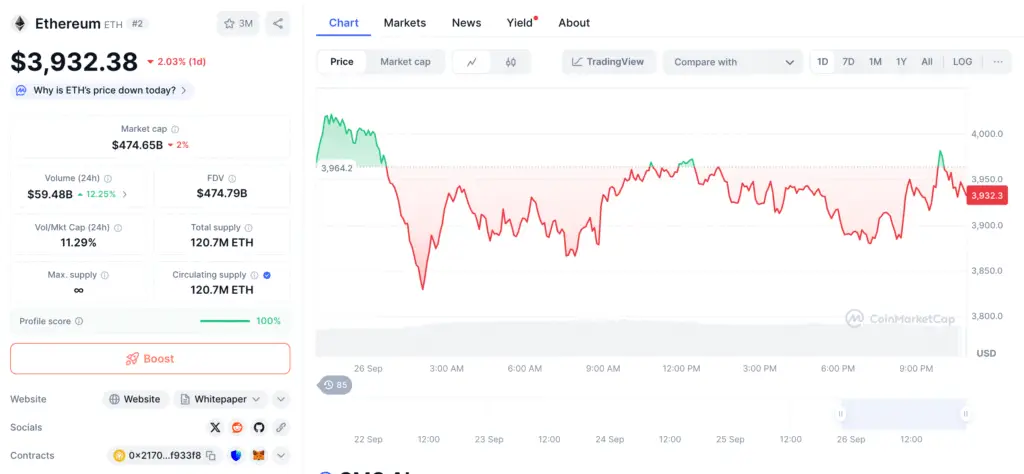

Ethereum (ETH) has once again slipped below the key $4,000 support, dropping 4% in the past day. The move has traders watching closely, as it marks a decisive break from recent stability.

Analysts say ETH must climb back above $4,841 to reverse the bearish trend. Without this recovery, momentum suggests a deep correction may push ETH down toward $2,750 in the coming weeks.

Analysts Warn of Steep Correction Ahead

Crypto strategist Ali Martinez cited MVRV price bands, showing danger zones if ETH fails to reclaim $4,100. His analysis points to increasing pressure on bulls to defend current levels.

Daan Crypto Trades echoed this, warning the weekly chart remains fragile. He noted the latest red candle structure, saying it may set ETH up for another leg down if momentum doesn’t shift soon.

Market Sentiment Weakens Amid Whale Moves

Over the past 12 days, Ethereum has fallen nearly 20%, with leveraged longs flushed out in mass liquidations. This heavy selling has shaken investor confidence, keeping ETH under constant pressure.

Even treasury-backed firms such as BitMine are finding it difficult to manage exposure, highlighting how quickly sentiment has turned from bullish to cautious in the altcoin market.

Recommended Article: Vitalik Buterin Endorses Ethereum Layer-2 Base, Praises Security and User Experience

ETF Outflows Add More Selling Pressure

Data from Farside Investors shows outflows from spot Ethereum ETFs totaling $250 million on September 25. Fidelity’s FETH accounted for $158 million of that alone, amplifying the sell-side imbalance.

Such ETF outflows are often seen as a vote of no confidence. With institutional players pulling back, short-term weakness could persist until inflows stabilize.

ETH Co-Founder Jeffrey Wilcke’s Transfer Sparks Concern

On-chain trackers flagged a 1,500 ETH transfer (worth $6 million) from co-founder Jeffrey Wilcke to Kraken. The move coincided with ETH dipping from $4,000 to $3,900.

While exchange transfers don’t always confirm selling, Wilcke’s history of liquidations has traders on edge. Many fear his activity could trigger additional downside if sales accelerate.

Historical Transfers Add to Uncertainty

Wilcke has a pattern of large transfers that rattle the market. In August, he sent $9.22 million worth of ETH to Kraken, stirring speculation of a potential sale.

Earlier still, he moved more than $262 million in ETH, much of it redistributed to fresh wallets. His repost on X hinting at more possible sales has only deepened uncertainty.

What to Watch Next for ETH

For Ethereum bulls, holding above the $4,100 mark is critical to avoid cascading losses. A recovery above $4,841 would be the signal needed to restore confidence.

If support breaks again, however, ETH may slide toward $2,750, which analysts identify as a worst-case correction target. The next week could be pivotal in deciding ETH’s trajectory.