Starknet Integrates Bitcoin for Transaction Validation

Bitcoin officially became part of Starknet’s ecosystem on Tuesday, as the Ethereum Layer-2 network enabled BTC staking to help secure its infrastructure. Users can now delegate Bitcoin to participate in transaction validation and earn rewards, StarkWare announced.

Previously, only Starknet’s native STRK token could be staked for network participation. This new integration significantly broadens Starknet’s security base while inviting Bitcoin holders into its DeFi ecosystem.

STRK Incentives Target Rapid Bitcoin Adoption

To accelerate Bitcoin activity, the Starknet Foundation has allocated 100 million STRK tokens as staking incentives. These rewards aim to attract BTC delegators and kick-start liquidity flows into the network’s emerging Bitcoin-based applications.

RE7, a London investment firm, is also developing a Bitcoin-denominated yield product on Starknet. This initiative signals growing institutional interest in bringing Bitcoin capital into Layer-2 ecosystems.

Starknet Aims to Unlock Dormant Bitcoin Liquidity

StarkWare CEO Eli Ben-Sasson described Bitcoin as “pristine capital” that has remained underutilized in DeFi due to centralized exchanges’ superior liquidity and user experience. By integrating BTC staking, Starknet seeks to unlock this dormant liquidity for decentralized use cases.

Ben-Sasson argued that Starknet is well positioned to become Bitcoin’s “financialization and execution layer,” enabling borrowing, lending, and other financial services without compromising decentralization.

Bitcoin Staking Expands DeFi Utility Without Custody Risks

Unlike some centralized solutions, Bitcoin staking on Starknet does not require users to give up custody of their BTC. StarkWare emphasized that this design maintains strong security guarantees while allowing users to earn yield through delegation.

This approach may appeal to Bitcoin holders seeking passive income opportunities without transferring control of their assets, addressing a long-standing limitation in Bitcoin’s DeFi participation.

Competing Layer-2 Solutions Explore Bitcoin Integration

Starknet isn’t alone in bridging Bitcoin with programmable DeFi. GOAT Network and similar projects have introduced Bitcoin staking models, typically rewarding users in both BTC and native tokens.

Starknet differentiates itself through its STRK-based incentive structure, ecosystem grants, and integration into Ethereum’s Layer-2 environment, which provides a large existing liquidity base and developer community.

Recommended Article: Ethereum Price Outlook: Rare Double TD Buy Signal Triggers Bullish Rebound Hope

STRK Token Faces Price Decline Despite Ecosystem Growth

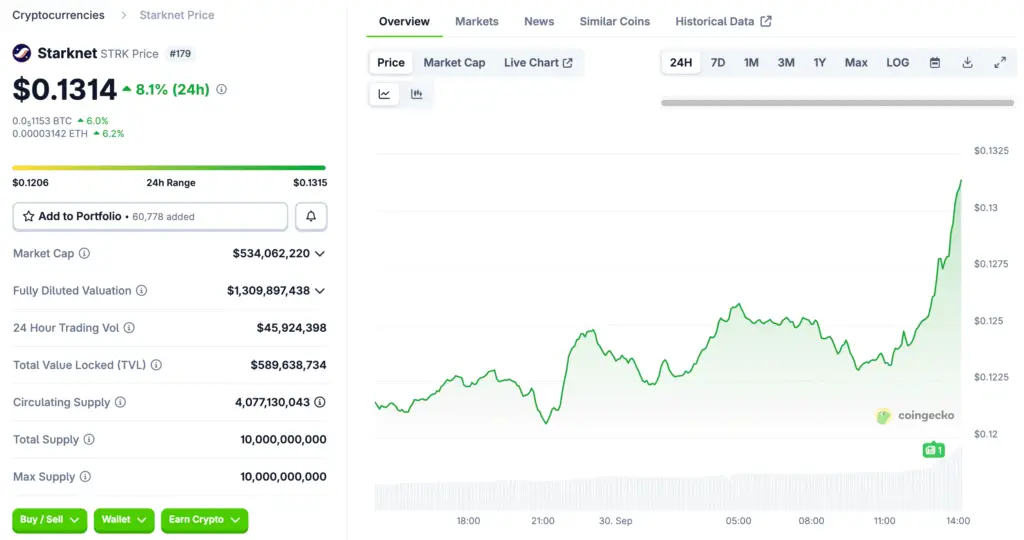

Despite these ecosystem advancements, STRK’s token price has experienced significant declines. According to CoinGecko, STRK’s market cap stands at $498 million, with the token trading at $0.122 — down 74% year-on-year from its $4.41 peak in 2024.

The staking incentives could help revitalize STRK demand by increasing network activity and utility. However, market sentiment will depend on adoption speed and yield competitiveness against other DeFi opportunities.

Coinbase Base Integration Highlights Industry Momentum

Starknet’s BTC staking debut mirrors broader trends across crypto. Coinbase recently integrated with lending protocol Morpho on its Base Layer-2, facilitating nearly $1 billion in loans through decentralized infrastructure.

This growing momentum highlights the increasing role of Layer-2 networks in financializing Bitcoin and other assets, positioning Starknet as a key player in this evolving landscape.

Bitcoin Layer-2 Race Heats Up With Starknet Move

Starknet’s Bitcoin staking launch signals a new phase in the race to integrate BTC with DeFi ecosystems. By offering STRK incentives, custody-free staking, and Ethereum compatibility, Starknet aims to attract both institutional capital and long-term Bitcoin holders.

If successful, this integration could establish Starknet as a leading Bitcoin Layer-2 solution, reshaping how BTC is deployed in decentralized finance over the coming years.