ETF Filings Spark Institutional Optimism

Solana’s latest price surge is closely tied to renewed institutional interest triggered by recent Solana ETF amendments. Multiple asset managers, including Grayscale, Fidelity, and Bitwise, submitted updated S-1 filings that feature staking capabilities, a move expected to attract yield-seeking investors.

ETF analyst Nate Geraci noted that approval could come by mid-October thanks to streamlined SEC processes. This timeline has increased speculative flows, as traders position themselves ahead of potential regulatory catalysts that could unlock significant capital inflows.

Improved Market Sentiment Lifts Altcoins

The broader crypto market has shifted toward a more positive momentum compared to last week’s choppy trading. Bitcoin stabilized above $110,000, and Ethereum rebounded slightly, boosting overall risk appetite among traders.

Altcoins like Solana tend to outperform during early phases of market recoveries as investors rotate into high-beta assets. This favorable macro backdrop is amplifying the impact of Solana-specific catalysts and supporting today’s 2% price increase.

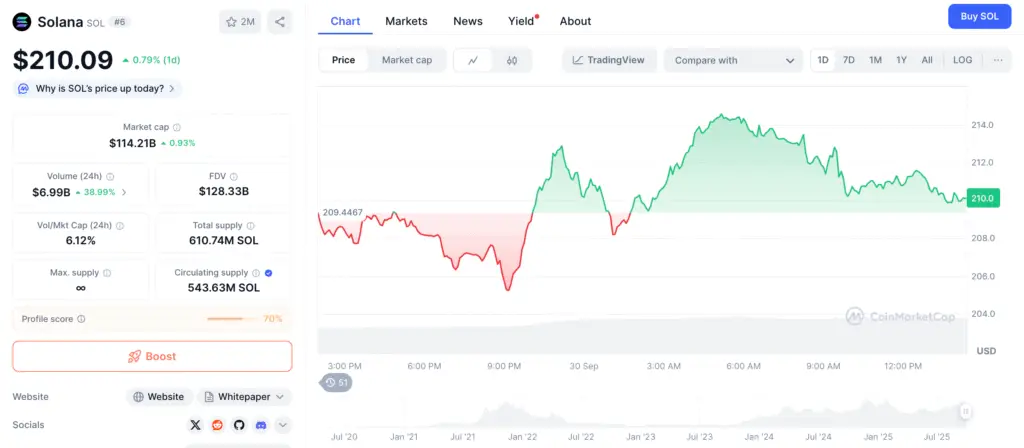

Critical Support at $200 Strengthens Bullish Setup

Technically, Solana has recently defended the $200 support level, which has become a key line in the sand for traders. The asset is currently consolidating above this zone, setting the stage for a potential breakout.

Holding above $200 is essential for sustaining bullish momentum. A decisive rebound from this level signals accumulation, while repeated failures could lead to a retest of lower support zones near $180–$190.

Recommended Article: Solana Price Prediction: ETF Optimism Meets $218 Resistance Barrier

Retesting the $220 Resistance Zone

Price action shows Solana attempting to push through the $220 region, a level that previously acted as both resistance and support in past trading cycles. Clearing this zone would open the door for a run toward $230–$238, which is the next major resistance cluster on most technical charts.

Traders are closely watching this breakout attempt, as successful continuation could confirm a short-term bullish trend reversal after weeks of consolidation.

Staking Provisions Boost Solana’s Yield Appeal

The inclusion of staking in the ETF filings is a particularly bullish development. By allowing ETFs to earn yield through Solana’s proof-of-stake mechanism, institutional investors gain access to both capital appreciation and staking rewards.

This dual-benefit structure could make Solana ETFs uniquely attractive compared to traditional crypto funds, driving stronger demand upon regulatory approval and increasing on-chain staking activity.

Key Levels for Traders to Watch

For Solana to maintain its upward trajectory, it must hold above $200 and close multiple daily candles above $220. If successful, the next upside targets lie between $230 and $238, where sellers have previously stepped in.

Conversely, if price drops below $200 and fails to recover quickly, traders expect downside pressure to return, potentially pushing the asset toward the $180–$190 range before buyers reemerge.

Broader Adoption Narrative Remains Intact

Beyond price movements, Solana continues to benefit from expanding real-world adoption across DeFi, NFTs, and institutional finance. Recent network improvements have strengthened scalability and lowered transaction fees, increasing developer activity.

Institutional recognition through ETF filings adds another layer to this narrative, reinforcing Solana’s role as a major layer-1 ecosystem with growing global demand.

Conclusion: ETF Hype and Technical Momentum Drive the Rally

Today’s Solana rally is the result of converging factors—ETF staking filings, improved market sentiment, and key technical levels holding firm. If the momentum persists, Solana could soon challenge higher resistance zones and potentially enter a new bullish phase.

However, traders remain cautious as any failure to defend $200 could trigger renewed selling pressure. ETF approval decisions in mid-October will likely be the next major catalyst shaping Solana’s trajectory.