The Increasing Value of Dogecoin Sparks Payroll Innovation

The recent surge in Dogecoin’s price underscores its rising significance in cryptocurrency payroll systems, profoundly impacting business strategies across the globe today. This increase elevates Dogecoin beyond its status as a meme token, highlighting its potential usefulness in actual financial transactions across various industries worldwide.

Organizations are currently reevaluating their payroll frameworks to incorporate Dogecoin, showcasing both cultural transformations and practical possibilities for creative compensation models. The token’s recent recognition indicates a shift in acceptance, prompting businesses to consider integration opportunities, even with the associated risks of volatility.

Institutional Interest Fuels Integration Progress

Involvement from institutions in cryptocurrency markets enhances Dogecoin’s position as a developing payroll tool, fostering greater corporate trust in financial systems. Major organizations are increasingly assessing Dogecoin-based payroll options, indicating a change in perspectives regarding decentralized payment methods and creative compensation solutions worldwide.

These developments enhance conversations about operational frameworks and employee preferences, especially in fintech sectors that are seriously examining disruptive payroll mechanisms. The growing liquidity and recognition of Dogecoin are directly enhancing its attractiveness to innovative companies that are actively pursuing digital financial transformation.

Regulatory Frameworks Shape Dogecoin Payroll Adoption

Regulation significantly impacts Dogecoin’s payroll path, shaping the adoption strategies of corporations as they navigate today’s intricate compliance environments. The MiCA regulation of the European Union sets forth standardized guidelines for the use of cryptocurrency, enhancing transparency and promoting organized initiatives for integrating Dogecoin into payroll systems.

It is essential for businesses to synchronize their payroll practices with forthcoming tax reporting requirements such as DAC8. This alignment will promote transparency while also preserving operational flexibility and adhering to regulatory standards. More defined guidelines will speed up adoption, minimizing legal ambiguities and facilitating sustainable payroll innovations that effectively leverage Dogecoin’s changing economic role.

Recommended Article: Dogecoin Climbs Over $0.24 As Traders Rally Despite Shutdown

Methodical Strategies Enhance Payroll Execution

Businesses looking into Dogecoin for payroll should adopt varied strategies to manage volatility while ensuring consistent and reliable compensation for their global workforce. Diversification entails merging Dogecoin with stablecoins, ensuring financial stability while effectively utilizing token popularity to boost employee satisfaction globally.

Risk management frameworks play a crucial role, integrating liquidity buffers and hedging instruments to effectively reduce the impact of unpredictable price fluctuations. By implementing these strategies, companies can confidently incorporate Dogecoin, guaranteeing secure payroll processes amidst the swiftly changing global market landscape.

Market Dynamics Influence Dogecoin Payroll Viability

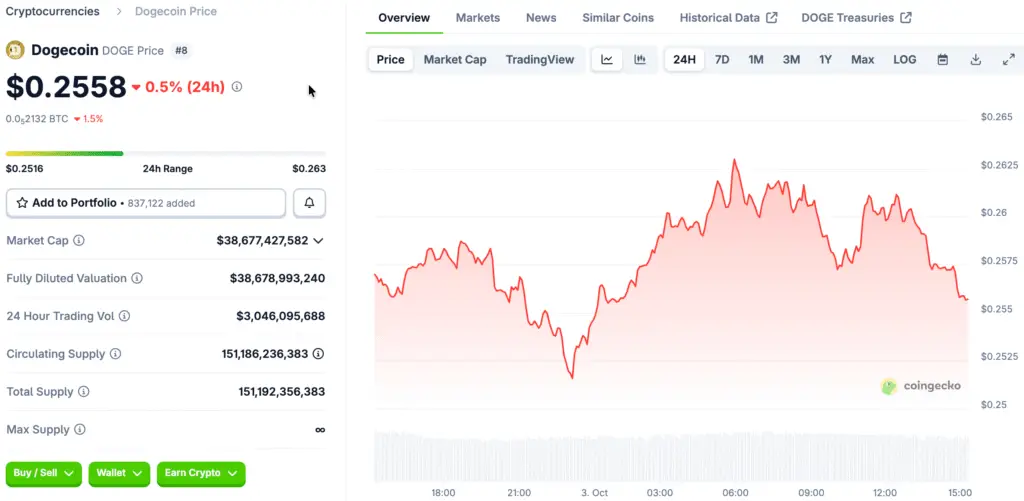

The fluctuations in Dogecoin’s price have a significant impact on payroll planning, compelling businesses to meticulously adjust their payment schedules in response to market trends and technical indicators. Volatility presents a mix of challenges and opportunities, prompting the development of innovative financial management strategies that effectively address the changing valuations of tokens in today’s market.

Keeping an eye on support and resistance levels is crucial for strategically timing payroll transactions, helping to reduce potential losses during adverse market fluctuations. Thorough market analysis empowers businesses to execute payroll operations with greater precision, proactively aligning with the dynamic price structures of Dogecoin.

Operational Risks and Infrastructure Challenges Persist

The integration of Dogecoin into payroll systems encounters obstacles tied to infrastructure constraints and prevailing market sentiment, necessitating strategic approaches from businesses worldwide. Numerous payroll platforms focus on stablecoins, resulting in a lack of support for Dogecoin that needs to be tackled through strategic partnerships and technological advancements.

Moreover, volatility continues to pose a considerable challenge, necessitating meticulous treasury management to ensure payroll stability amid ongoing unpredictable price fluctuations. Tackling these operational risks will be crucial for Dogecoin’s journey from a speculative asset to a sustainable mainstream payroll solution in the long run.

Dogecoin’s Future Role in Payroll Systems

The rise of Dogecoin highlights significant shifts in the cryptocurrency payroll landscape, showcasing its potential to transform compensation models on a global scale. As regulations become more stable and infrastructure advances, businesses will take a more serious and strategic approach to assessing the practicality of integrating Dogecoin for payroll purposes.

Through the implementation of well-rounded strategies and maintaining flexibility, businesses can leverage the momentum of Dogecoin while minimizing the risks associated with volatile digital assets. This changing environment places Dogecoin as a significant player in payroll systems, seamlessly connecting technological advancements with practical use in today’s world.