Polkadot Price Jumps Sharply Following Strong Bullish Breakout

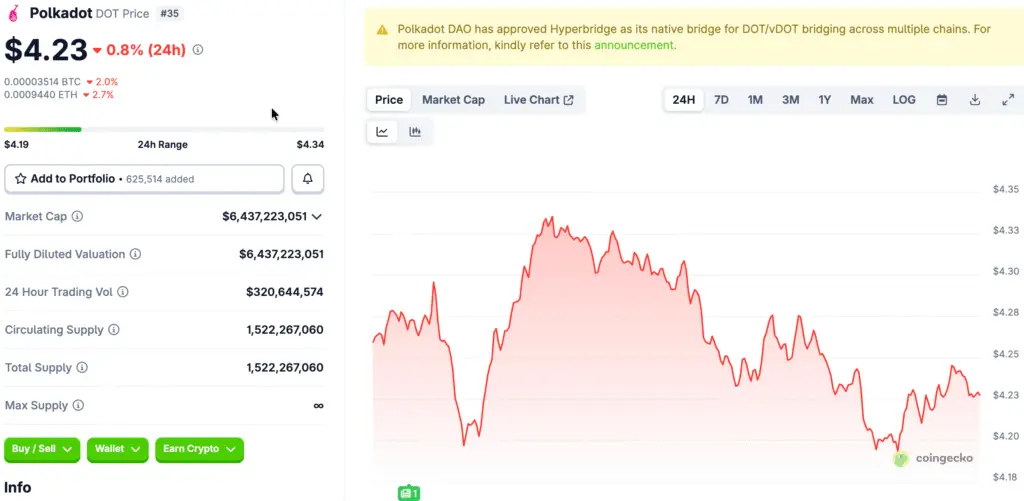

Polkadot has seen a significant rise, with DOT prices increasing from $3.88 to $4.11 in just twenty-four hours. The abrupt shift came after a strong breakout accompanied by notable trading volume, indicating a resurgence of confidence among traders who are paying close attention to critical resistance levels.

The breakout pushed DOT towards a new resistance level, drawing in investor interest as the overall market conditions shifted positively. This price action underscores the potential of bullish momentum, especially when backed by robust trading activity, to propel rapid movements throughout major altcoin markets efficiently.

Surge in Volume Boosts DOT’s Ascending Trend Amid Breakout

Trading volume surged to more than 7 million units within just one hour, marking a fivefold rise compared to daily averages. A notable surge occurred alongside a four percent hourly increase around 8:00, underscoring heightened engagement from both retail and institutional market players.

Experts observe that significant increases in volume frequently affirm breakout patterns, reinforcing trader confidence in the rapid upward price movements decisively. The observed patterns indicate a unified buying interest that supports sustained rallies, as opposed to fleeting speculative spikes, thereby enhancing the overall credibility of DOT’s current movement.

Resistance Emerges Near $4.11 Level

Technical analysis revealed the emergence of new resistance around $4.11, where sellers started to exert pressure after the initial price breakout. This level serves as an important short-term obstacle that traders are observing to assess if momentum can keep building further upward.

Should DOT manage to break through and hold above this resistance, experts suggest that further gains may ensue as confidence strengthens. On the other hand, ongoing failures might lead profit-takers to take control, which could result in short-term pullbacks before another attempt at a breakout occurs.

Recommended Article: 21Shares SUI and Polkadot ETFs Gain Momentum With DTCC

Strategic Profit-Taking Fuels Consolidation Near Support Levels

Following the morning rally, DOT has settled into a consolidation phase between $4.05 and $4.07, indicating a systematic approach to profit-taking by initial participants. Support levels remained robust above $4.05 throughout this timeframe, indicating a solid underlying demand that is bolstering the recent bullish breakout pattern.

This type of consolidation is frequently seen in a favorable light, enabling markets to recalibrate momentum while maintaining the elevated price levels set during previous rallies. This behavior aids in avoiding overheated situations and places DOT in a favorable position for potential upward movements if buying strength returns decisively.

Technical Indicators Highlight Structured Breakout Behavior

CoinDesk Research’s model noted that DOT’s overall trading range increased by $0.30 during the breakout session on Thursday. The breakout structure displayed two clear correction waves amid profit-taking, reflecting a robust market digestion following swift price gains.

This organized behavior indicates that DOT’s rally was not merely speculative but rather backed by systematic trading activity and thorough resistance testing. The dynamics at play bolster the optimistic outlook, suggesting ongoing enthusiasm among traders who perceive this breakout as strategically important for the long haul.

Wider Market Resilience Offers Extra Backing for DOT

Polkadot’s surge aligned with a five percent increase in the CoinDesk 20 Index, showcasing widespread vigor throughout the cryptocurrency market. Key assets also saw an increase in momentum, establishing a favorable macro environment that greatly enhanced the individual breakout effect of DOT.

When wider markets move upward together, breakouts frequently experience longer durations as related assets bolster the overall positive sentiment. The alignment between DOT’s technical structure and market context offers further confidence that the current gains may be significant.

DOT Holds Favorable Technical Position Backed by Volume and Sentiment

As we move forward, traders are keenly observing the $4.11 resistance zone for indications of either continuation or exhaustion. A clear breakout above this level, supported by consistent volume, may pave the way for additional bullish extension rallies.

On the other hand, a lack of decisive movement past resistance could result in brief consolidations or corrective pullbacks prior to another effort to rise. Currently, DOT is in a technically favorable position, supported by robust volume, prudent profit-taking, and a solid market environment.