HYPE Price Consolidation Demonstrates Market Resilience

Hyperliquid holds firm above $47, showcasing a strengthening market confidence alongside rising volume and active staking involvement. Market participants are keenly observing these fluctuations, anticipating a possible bullish trend if resistance levels are convincingly surpassed.

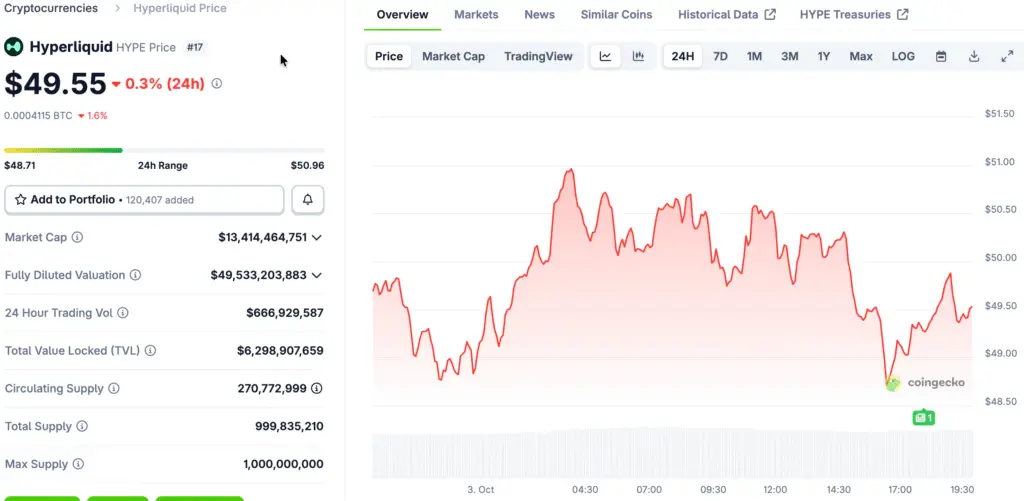

The token is presently valued at $47.12, having increased by almost 5% in the past 24 hours, bolstered by an uptick in liquidity inflows. The recent weeks of accumulation have led to an improvement in momentum, setting HYPE up for potential further gains if the technical levels remain robust.

Community Sees $60 As Key Bullish Target

The $60 price level has become the focal point for the community as they anticipate HYPE’s next bullish move in the upcoming sessions. Market sentiment is in harmony with technical setups, establishing a conducive environment for a swift rebound once resistance is convincingly overcome.

The price has established a series of higher lows following the recent correction, steadily enhancing its structural strength and bolstering optimistic expectations regarding community-driven targets. Market participants perceive this correlation between sentiment and chart formations as a significant trigger for breakout opportunities.

Revenue Indicators Ecosystem Resilience

Hyperliquid generates approximately $3M in daily fees, showcasing robust ecosystem activity even in the face of heightened competition from new platforms. Fee generation ensures stability, delivering essential support that maintains price momentum even amid fluctuating market conditions.

Experts highlight that fee income serves as a crucial foundation, guaranteeing steady network functionality and bolstering trust among long-term token holders. This consistent cash flow enhances overall sentiment and supports ongoing bullish momentum.

Recommended Article: Aster Price Loses Ground Over Hyperliquid (HYPE) as PDP Aims for a 1000x Uptober

Technical Indicators Point To Upward Momentum

The price continues to show strength above the $42 support level, as moving averages start to align positively for bullish traders. The RSI values suggest potential for upward movement, bolstering confidence that the momentum is conducive to additional gains as we approach higher breakout zones.

Key breakout levels are pinpointed between $44 and $49, where consistent closes could notably enhance HYPE’s upward movement. A smooth transition through these regions is likely to draw in more buyers and bolster bullish confidence even more.

Staking and Buybacks Tighten Circulating Supply

On-chain data indicates that over 660K HYPE tokens have been staked, which effectively diminishes supply and enhances overall price stability in the face of selling pressure. Ongoing systematic buybacks are boosting scarcity and strengthening the upward momentum within the ecosystem.

Every staking cycle enhances structural support, effectively locking tokens away from circulation and constricting available liquidity during rally efforts. The interplay of fee inflows with these mechanisms establishes a robust feedback loop that connects fundamentals and technicals effectively.

Essential Price Levels Outline Breakout Situation

The price maintains its position above the crucial $46.1 support level, which has been tested multiple times as buyers actively protect the structure from downward momentum. A continued hold in this area creates a strong basis for another examination of the $48–$49 breakout range.

A clear breakout above $49 would positively alter the overall sentiment, possibly revealing upside targets in the $52–$55 range swiftly. Market participants emphasize these levels as key decision-making points for the forthcoming trading period.

Breakout Could Propel HYPE Toward $60 Target

If bulls achieve a significant breakout, momentum may swiftly surge toward the $55–$60 range, confirming the fair-value projections held by the community. The combination of fee strength, staking activity, and a supportive technical structure presents a strong bullish scenario.

Breaking below the $46 support level may lead to temporary weakness; however, the overall sentiment stays positive as long as key areas are upheld. Traders are closely monitoring volume spikes near resistance levels for confirmation signals.