Bullish Momentum Builds Above Key AVAX Support Levels

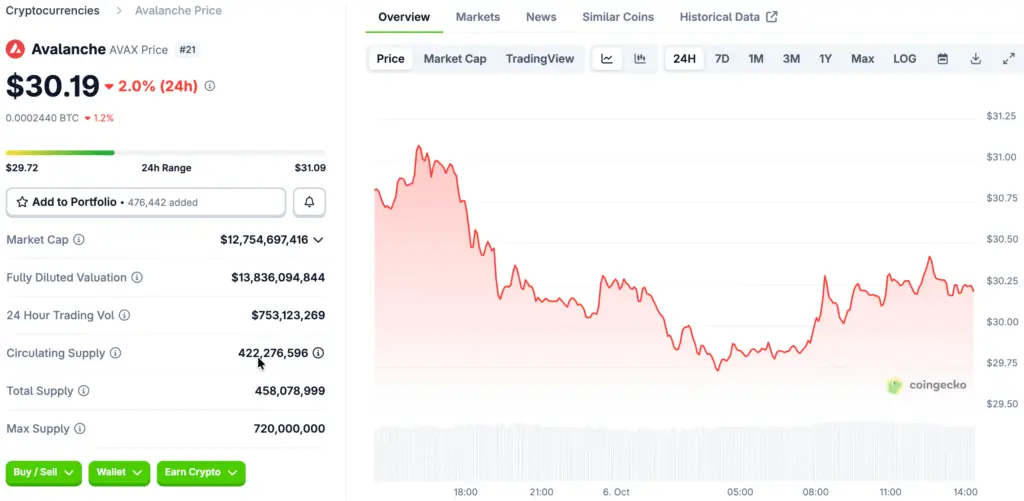

Avalanche (AVAX) is maintaining its position above key structural support, drawing growing interest from institutions and traders this quarter. Market participants are keenly observing breakout zones, as price movements correspond with significant on-chain activity and indicators of technical accumulation.

A clear retest of the $27 support has strengthened bullish confidence, establishing this level as the base for a fresh upward trend. Should buyers retain their dominance, experts anticipate that AVAX will swiftly reach its midterm resistance range of $45 to $55.

Accumulation Patterns Strengthen as Price Holds Range Breakout

Experts point out that AVAX is presently trading within a specific accumulation range, establishing advantageous risk-reward scenarios for those looking to take a bullish stance. Walter White highlighted this breakout retest zone as the “ultimate accumulation window” prior to a possible move towards double-top liquidity.

The chart layout demonstrates a clear alignment between horizontal support and mid-term trendlines, enhancing the validity of accumulation stories. This alignment indicates that market participants are slowly preparing for a continuation, utilizing the consolidation phase to establish significant exposure.

On-Chain Data Reveals Significant Network Activity Growth

The positive framework of Avalanche is firmly backed by the swift growth of on-chain activity within its decentralized exchange ecosystem. Within a mere three days, Avalanche achieved an impressive $2.2 billion in DEX trading volume, showcasing a significant increase in demand and enhanced transactional activity.

Historically, sustained growth in DEX volume is linked to significant price expansion, driven by deeper liquidity and stronger ecosystem fundamentals. The recent increase in activity highlights Avalanche’s significance amid wider market fluctuations, setting the stage for potential upward movement in AVAX.

Recommended Article: Avalanche Targets Q4 Rally While Holding $30 Support

Long-Term Triangle Formation Signals Imminent Breakout Potential

Dr. Emi, a technical analyst, has pinpointed AVAX coiling within a multi-year symmetrical triangle, a configuration that frequently signals significant market shifts. Increasing volumes within this framework suggest heightened involvement, lessening sell-side pressure, and signaling potential breakout momentum in the near future.

If Avalanche successfully breaks through the upper boundary, experts anticipate significant momentum leading to the $45–$55 range in the following sessions. This breakout pattern has a history of initiating prolonged rallies, highlighting the significance of current positioning levels for traders.

Institutional Interest Adds Fundamental Support to Bullish Outlook

Institutional involvement is becoming a significant factor supporting Avalanche’s long-term valuation path in this market cycle. Avalanche Treasury Co. is set to acquire $1 billion in AVAX in collaboration with Mountain Lake Acquisition Corp., as reported by Coin Bureau.

These significant commitments not only decrease the circulating supply but also reinforce confidence in the fundamental growth potential of Avalanche. Historically, institutional accumulation amplifies breakout follow-through, bolstering price expansion and improving market depth and stability.

Key Resistance Targets Define AVAX Breakout Roadmap

Market participants are keenly observing the $45 and $55 resistance levels, which serve as crucial milestones in Avalanche’s upward trajectory. A successful breakout beyond these thresholds may indicate a lasting trend reversal and pave the way for enhanced midterm upward momentum.

On the other hand, not overcoming these obstacles could lead to brief periods of consolidation before progress continues when conditions improve. Currently, maintaining structural stability above $27 solidifies the bullish outlook, bolstering trader confidence in the potential for a breakout.

Avalanche Nears Breakout as Technical Patterns, On-Chain Data, and Institutional Support Align Strongly

Avalanche is at a pivotal moment, as technical patterns and on-chain dynamics converge to indicate a potential breakout on the horizon. The phases of accumulation, increased activity within the ecosystem, and robust support from institutions come together to enhance the optimistic perspective for AVAX in 2025.

Should buyers hold $27 as a solid support level and successfully break through the $45–$55 resistance, Avalanche may enter a significant growth phase once again. This arrangement places AVAX among the most scrutinized large-cap altcoins as we approach the last quarter of 2025.