Ethena Labs Partnership Ignites Significant Progress for SUI Blockchain

SUI has garnered considerable interest from investors following its announcement of a strategic collaboration with Ethena Labs to introduce two native stablecoins. This partnership underscores SUI’s determination to bolster its position in the stablecoin and DeFi landscapes, aiming to increase transaction volume and potential for adoption.

In August 2025, SUI facilitated an impressive $229 billion in stablecoin transfers, highlighting a significant surge in usage. This collaboration seeks to enhance network scalability, liquidity, and practical transaction applications, bolstering optimistic outlooks throughout the wider cryptocurrency market.

Current Price Action Reflects Consolidation Before Potential Breakout

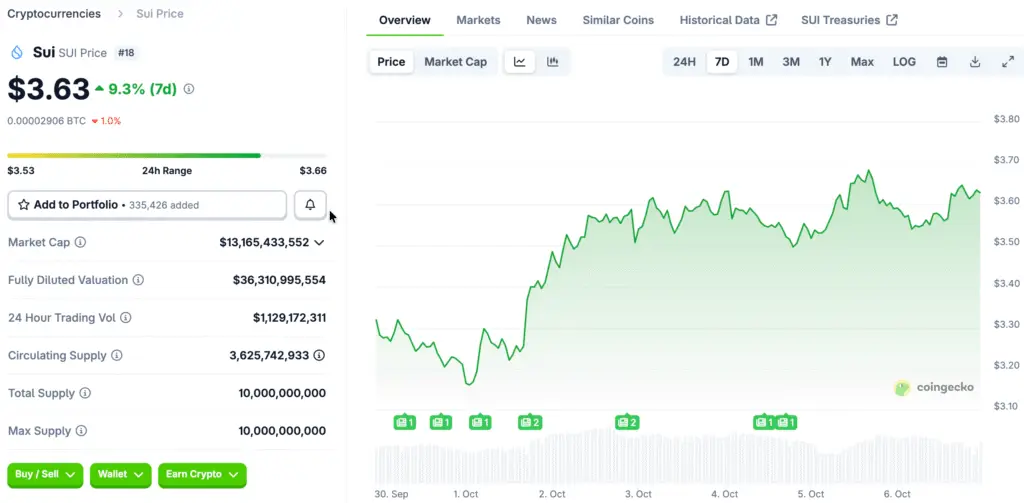

Currently, SUI is priced at $3.57, showing a daily decrease of 0.47% within an intraday range of $3.53 to $3.69. The network, boasting a market capitalization of $12.97 billion and a daily trading volume of $1.23 billion, continues to capture the attention of investors.

Experts suggest that SUI’s ongoing price consolidation indicates a foundation is being established, potentially leading to a breakout later this quarter. The increasing transaction capacity of blockchain technology and the expanding stablecoin ecosystem are key drivers that may lead to significant growth in the upcoming months.

Analysts See Bullish Chart Patterns Above Key $2.20 Level

Crypto analyst Zeru has pointed out that maintaining support above $2.20 could confirm a W-reversal pattern, which has historically been a robust indicator of bullish continuation. This pattern suggests a target range of $6.90 to $8.98 by late 2025 or early 2026, in line with optimistic market forecasts.

Nevertheless, not upholding this essential level may lead to a retreat to the $1.44–$2.63 range. Experts highlight that trading in October could stay within the range of $2.48 to $3.55, creating a solid consolidation phase prior to a potential breakout.

Recommended Article: SUI Rises 5% as Stablecoin Launch Drives Market Momentum

SUI Derivatives Market Shows Balanced but Bullish Positioning

According to data from CoinGlass, open interest has decreased by 2.19% to $1.82 billion, indicating that traders are reducing their exposure after previous accumulation. Even so, trading volume surged by 7.38% to reach $3.12 billion, suggesting that there is still significant short-term engagement.

The OI-weighted funding rate is currently at 0.0058%, indicating a slight bullish sentiment in the market. Market participants are increasingly favoring long positions, indicating a belief in a stable or slowly increasing price trend in the near future.

SUI Strengthens Position With Stablecoin Throughput and Ethena Labs Integration

The SUI network boasts remarkable stablecoin throughput and a robust integration with Ethena Labs, establishing a solid groundwork for sustained growth. By integrating stablecoins into its fundamental framework, SUI boosts transaction efficiency and strengthens ecosystem loyalty, strategically positioning itself in the competitive Layer-1 landscape.

Experts anticipate that this strategic alignment will foster ongoing adoption and liquidity inflows, especially from institutions in search of a stable and scalable infrastructure for decentralized finance applications.

Bullish Price Targets Point Toward $9.01 by 2026

Both technical and fundamental indicators align towards an ambitious price target of $9.01 by 2026. Experts suggest that the interplay of increasing transaction volume, the growing use of stablecoins, and a robust technical framework may drive a sustained upward trend for SUI over the coming years.

Forecasts from Coincheckup support this scenario, indicating that surpassing crucial resistance levels could draw in new capital and broaden SUI’s presence within DeFi sectors.

SUI Holds Steady as Ethena Partnership Fuels Hopes for Bullish Reversal Patterns

Despite ongoing short-term fluctuations, the general sentiment regarding SUI is stable yet hopeful. The collaboration with Ethena Labs indicates a distinct path of growth, and traders are attentively monitoring for signs of bullish reversal patterns.

Should the key technical levels remain intact, experts anticipate that SUI may shift from its current consolidation phase into a rapid rally, positioning it as a highly monitored Layer-1 token as we approach 2026.