Bitcoin Reaches New All-Time High as Macro Forces Fuel Demand

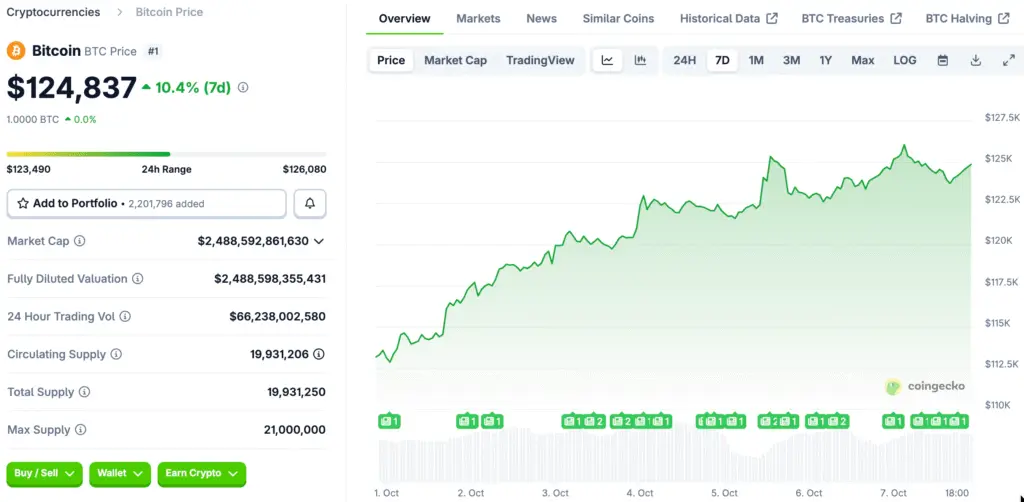

Bitcoin has reached a remarkable milestone, surpassing £93,000 for the very first time, solidifying its status as the world’s largest cryptocurrency. The value has seen a twofold increase in the last year, driven in part by Donald Trump’s reentry into the White House and changing global monetary conditions.

The recent 10% weekly surge was sparked by the current US government shutdown, which has eroded confidence in the dollar and driven investors to seek refuge in alternative assets such as Bitcoin and gold. Experts observe that persistent inflation and increasing global borrowing are intensifying these movements.

Scarcity Narrative Strengthens As Supply Shock Intensifies

The limited supply of 21 million bitcoins is a fundamental aspect of its optimistic outlook. Almost 95% of all BTC is already in circulation, resulting in restricted availability for new buyers. Proponents contend that this scarcity effect inherently pushes prices upward as demand keeps rising.

Increased ETF inflows are putting additional pressure on supply. Approximately 6.7% of Bitcoin’s supply is currently secured in exchange-traded funds, while an additional 3% is retained by companies that focus on accumulation. Experts characterize this as the initial phase of a possible significant supply disruption that may intensify price trends.

Institutional Investors Drive Unprecedented ETF Inflows

This cycle is notably driven by institutional capital, in contrast to earlier bull markets that were primarily led by retail traders. Last week, exchange-traded funds on Wall Street saw an impressive influx of over $3.5 billion (£2.6 billion), allowing affluent investors to gain exposure without the need to directly hold BTC.

Samson Mow, the CEO of JAN3, likened the recent surge in Bitcoin’s price to “a ball pushed underwater,” asserting that demand is finally aligning with the restricted supply. He is confident that Bitcoin’s market cap may exceed $10 trillion (£7.4 trillion) as companies and countries start to accumulate it on a large scale.

Recommended Article: Bitcoin News: BTC Price Expected to Reach $150K Level in Q4, Other Viral Crypto Tokens Make Headlines This Week

Optimistic Predictions Suggest $500,000 Bitcoin Goals

Recent projections suggest that a single Bitcoin might reach a value of $500,000 (£371,000), potentially positioning it as the second-largest global asset following gold. He contends that the majority of corporations, billionaires, and even nation-states still lack significant exposure, presenting considerable upside potential.

Advocates argue that with the increasing institutional adoption and the rise of ETFs, the limited supply of Bitcoin will enhance its price appreciation. They overlook sustainability issues, contending that the true danger is in underestimating BTC’s significance as a robust monetary asset amid global instability.

Skeptics Warn of Volatility and Market Manipulation

There are those who do not share this sense of optimism. David Gerard, a prominent critic of Bitcoin and a published author, cautions that the BTC markets are still lightly traded and susceptible to manipulation. He contends that trading mainly takes place on unregulated offshore exchanges, resulting in greater volatility for the asset compared to conventional stocks.

Gerard warns that investors who approach Bitcoin as if it were a regulated market may face substantial losses. He asserts that structural issues persist, characterizing Bitcoin as an “easily manipulated house of cards” instead of a reliable long-term investment option.

Historical Patterns Suggest Caution for the 2026 Cycle

The historical patterns of Bitcoin’s rise and fall have typically adhered to a four-year cycle. The surge to $20,000 in 2017 was succeeded by a dramatic 80% decline. In 2021, BTC reached a peak of $69,000, only to fall to $17,000 within the span of a year. Present prices exceed all past highs, yet experts caution that comparable declines may happen in 2026.

Certain financial institutions currently advise that portfolios should allocate merely 2–4% to cryptocurrency, recognizing both the potential of Bitcoin and the associated risks. Elevated valuations heighten the risks for newcomers if past trends hold true.

Global Economic Uncertainty Fuels Bitcoin’s Popularity

In the context of rising inflation, increased monetary supply, and ongoing political uncertainty, the attractiveness of Bitcoin as a safeguard against economic fluctuations is becoming more pronounced. Approximately seven million individuals in the UK currently possess some type of cryptocurrency, indicating widespread involvement from retail investors in addition to the expansion of institutional interest.

The rapid ascent continues to draw worldwide interest, yet the discussion remains unsettled. Bitcoin may either maintain its upward momentum or encounter another challenging downturn. Regardless, its position at the heart of international financial conversations is more robust than ever.