Kaspa Breaks Daily Transaction Record with Remarkable Throughput

Kaspa has amazed the crypto community by handling more than 158 million transactions in just one day, coming close to matching Bitcoin’s total for an entire year. This significant milestone took place on October 5, 2025, establishing Kaspa as a formidable player in the Layer-1 blockchain arena.

The Kaspa Report indicates that Bitcoin handled approximately 160 million transactions from October 2024 to October 2025. Kaspa achieved this milestone in merely 24 hours, demonstrating a degree of scalability that is seldom observed in proof-of-work systems.

Scalability Milestone Highlights Kaspa’s Unique Blockchain Architecture

Shortly after reaching this record, Kaspa accomplished another remarkable feat by processing 5,705 transactions per second. This figure surpasses earlier throughput levels and showcases the network’s capacity to manage substantial on-chain activity effortlessly.

In contrast to numerous blockchains that struggle with congestion during peak usage, Kaspa’s design ensured stability throughout this increase in demand. This performance highlights the project’s dedication to effective scaling while maintaining the security benefits of proof-of-work consensus.

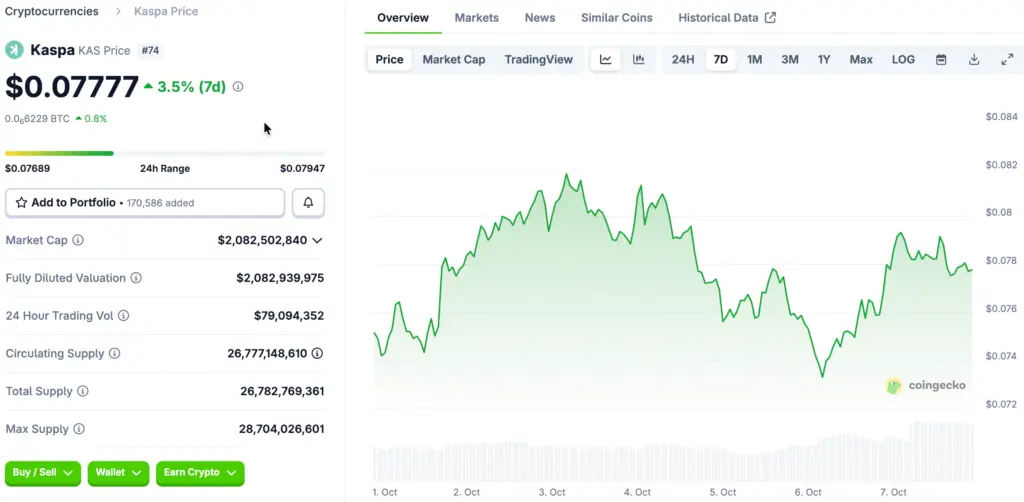

Volatility Squeeze Signals Calm Before a Potential Market Storm

In light of the significant network activity, it is noteworthy that Kaspa’s price has shown remarkable stability. The weekly chart shows Bollinger Bands tightening significantly, suggesting a prolonged phase of low volatility.

This type of compression frequently occurs before significant price movements. In the past, periods of low volatility resembled a coiled spring, holding potential energy that can lead to swift upward or downward movements once traders decide on a direction.

Recommended Article: Kaspa Price Eyes Breakout as Traders Track Key Levels

Bullish Sentiment Builds as On-Chain Fundamentals Strengthen

The atmosphere around Kaspa is becoming more optimistic as indicators of network activity and scalability show consistent improvement. Investors are closely monitoring these fundamental indicators, indicating robust underlying momentum.

Kaspa’s capacity to achieve unprecedented transaction throughput has significantly enhanced its standing in the cryptocurrency community. Traders are getting ahead of the curve, expecting that strengthening fundamentals may soon lead to a significant price breakout.

Kaspa Nears Silver’s Scarcity as Stock-to-Flow Ratio Climbs Past 20 and Keeps Rising

Kaspa’s stock-to-flow ratio has recently surpassed 20 and is set to exceed silver’s S/F ratio in the coming month. This metric evaluates the relationship between current supply and new issuance, highlighting the increasing scarcity of an asset as time progresses.

For reference, silver has a stock-to-flow ratio just above 20, whereas gold’s is approximately 60. Kaspa’s swift rise in this discussion indicates a growing rarity, bolstering its story as a significant, deflationary digital asset with enduring potential.

Essential Technical Levels Outline Kaspa’s Breakout Area

Market participants are paying close attention to the $0.08–$0.09 range, viewing it as a pivotal breakout area for KAS price. In the past, a decrease in volatility alongside strong fundamental growth has often led to notable upward trends.

If Kaspa can break through this resistance band, the technical momentum could increase swiftly. Conversely, an inability to break through may prolong consolidation, postponing any significant rally. Market participants are closely monitoring price movements for signs of confirmation.

Kaspa’s Next Move Could Reshape Its Market Trajectory

The performance of Kaspa’s network, along with its scarcity metrics and increasingly tight technical structure, presents a distinctive scenario that could lead to a bullish continuation. The surge in on-chain activity coupled with reduced volatility indicates that a significant price movement could be on the horizon.

Regardless of whether the breakout happens this week or at a later date, Kaspa’s recent accomplishments solidify its status as one of the most technically proficient Layer-1 blockchains. A strong rebound from the current levels may indicate the beginning of its next major market phase.