Cardano Holds Strength Yet Faces Growth Constraints Ahead

Cardano stands out as a highly regarded blockchain platform, focusing on innovation backed by research and a secure decentralized architecture on a global scale. While it demonstrates consistency and reliability, its substantial market capitalization constrains the potential for explosive growth that aggressive investors typically pursue for quicker returns.

Predictions suggest that Cardano may vary between $0.89 and $1.52 by 2026, influenced by economic trends and market attitudes. The consistent strategy attracts institutional stakeholders, yet it presents limited asymmetrical advantages when compared to more innovative and nimble competitors driving developments in DeFi.

Remittix Emerges as PayFi Leader Bridging Global Remittances

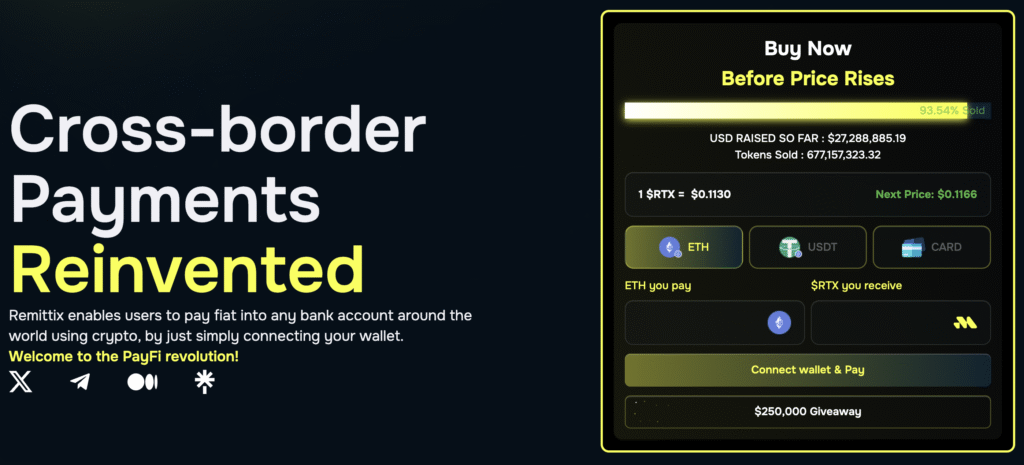

Remittix has positioned itself as a game-changer in the financial sector, merging cryptocurrency with traditional banking systems to provide efficient remittance solutions across the globe. Having raised over $27.1 million and achieved full verification from CertiK, Remittix showcases investor confidence through its commitment to transparency and robust technological support.

The initiative enables smooth transfers from crypto to bank accounts in over 30 countries, featuring real-time settlements that promote global financial inclusion. Remittix stands out as a leader in bridging the gap between decentralized finance and traditional payment networks through its integration focus.

Real Utility Drives Growing Popularity and Adoption Metrics

The adoption of Remittix is rapidly increasing, driven by its effective applications in freelancer payments and cross-border settlements for small businesses. More than 40,000 holders have become part of the network, affirming its significance beyond mere speculation and community excitement.

The blend of practical technology, verified trustworthiness, and regular accessibility forms the foundation for lasting assurance. Remittix demonstrates that the success of blockchain adoption is rooted in the harmony between financial efficiency, compliance, and practical utility, rather than solely in the fluctuations of token value.

Recommended Article: Remittix Set to Surpass XRP as PayFi Revolution Gains Speed

Investors Compare Growth Potential Against Cardano Outlook

Experts point out Remittix as a promising growth candidate that has the potential to surpass Cardano’s steadier, albeit slower, path through 2026. Cardano attracts conservative investors, whereas Remittix offers significant potential for growth due to its scalability and advantages from being in the early stages of adoption.

Due to its smaller capitalization, Remittix presents a theoretical opportunity for 100× upside potential, provided that market conditions and adoption are favorable. This performance outlook draws in investors eager for significant growth as the PayFi sector evolves and the remittance market undergoes modernization.

Changing Market Sentiment Favors Emerging PayFi Platforms

Investor behavior showcases a continuous shift towards flexible ecosystems that emphasize rapidity, adherence to regulations, and worldwide accessibility. Numerous traders are opting to diversify into emerging assets like Remittix instead of focusing their exposure on established chains like Cardano.

This trend indicates a strong interest in innovative approaches that merge decentralized liquidity with the integration of real-world payment systems. The current market atmosphere is favoring innovative approaches that combine the scalability of decentralized finance with practical financial solutions in global commerce settings.

Navigating Compliance Remains Key to Sustainable Growth

Even with swift progress, the alignment of regulations remains a significant factor influencing Remittix’s operations in various jurisdictions. Ensuring clarity and actively collaborating with regulators is crucial for obtaining institutional involvement and fostering worldwide payment acceptance.

The emphasis on compliance readiness by Remittix may play a crucial role in whether its PayFi model successfully integrates into the mainstream or encounters challenges from regulatory authorities. Maintaining equilibrium between innovation and regulation is crucial for preserving credibility in the ever-changing landscape of financial ecosystems.

Remittix Strengthens Momentum With Solana and Polygon Partnerships for PayFi Growth

Remittix’s technical momentum and strategic partnerships strengthen its position as a promising next-generation payment network. The live beta wallet facilitates authentic user testing, while the multi-chain integrations with Solana and Polygon enhance the potential for interoperability.

With 2026 on the horizon, the difference between Cardano’s established presence and Remittix’s fresh approach highlights the evolving focus of the market. Investors assessing PayFi face a decision between established reliability and innovative potential as Remittix aims to transform financial connectivity.