Floki Strengthens Amid Market Consolidation Signs

Floki demonstrates significant structural resilience as it remains near crucial long-term support along an upward trendline. Despite a 3.20% decrease, analysts indicate that the asset retains a strong technical foundation, hinting at the possibility of renewed bullish momentum. This ongoing trend suggests accumulation phases are developing at key levels, with momentum stabilizing in anticipation of a breakout wave.

Market participants perceive this consolidation as a preparation for another upward movement toward prior resistance levels. The psychological range of $0.000093 to $0.000098 is critical for traders gauging imminent breakouts. Sustaining this structure bolsters the technical perspective that long-term buyers are gradually re-entering the market.

Long-Term Trendline Indicates Underlying Bullish Structure

Analyst Ether NasyonaL characterized the present situation as a period of “strategic calm,” reflecting the consistent upward trend that has been in place since 2022. Every pullback during this period has acted as a base for new growth, strengthening the steady bullish momentum throughout the market. The ascending channel characterizing this pattern underscores a methodical recovery strategy throughout mid-term price cycles.

Each higher low on the long-term chart indicates ongoing accumulation, reinforcing the overall investor confidence in Floki’s growth path. This persistent trend suggests that holders remain hopeful, particularly as the token maintains stability above crucial technical supports. Keeping this pattern highlights the possible preparedness for a breakout continuation phase.

Floki Channel Structure Points to Possible Breakout Toward 2021 Supply Resistance

The token has reliably moved within a clearly established upward channel for over two years at this point. As it approaches the lower boundary of that formation, traders frequently view this zone as a significant accumulation area. In the past, these instances have often led to substantial price increases as they approach key resistance points.

This situation aligns with Floki’s ongoing pattern of recovery observed during the cycles from 2022 to 2024. Every adjustment has sparked a resurgence in investor interest, as price compression has created the essential momentum for upward movements. The inclusion of the 2021 supply region reinforces forecasts suggesting the potential emergence of another bullish cycle.

Recommended Article: Floki Price Targets 2x Rally as Analysts Confirm Breakout

Breakout Momentum Grows Around Key Resistance Level

Analyst Hailey LUNC emphasizes that the token’s technical outlook has improved, showing tightening movements close to descending resistance. The recent rise above this important threshold indicates increasing confidence among traders who are expecting continued momentum. These conditions frequently indicate the initial phases of pattern reversals within larger market cycles.

A significant breakout from this formation may lead to considerable buying momentum, possibly pushing prices into the $0.00012–$0.00015 range. When paired with increasing volume, these signals would validate the strength of the breakout, aligning with earlier bullish reversals. These dynamics reflect recoveries fueled by accumulation observed in past expansion phases.

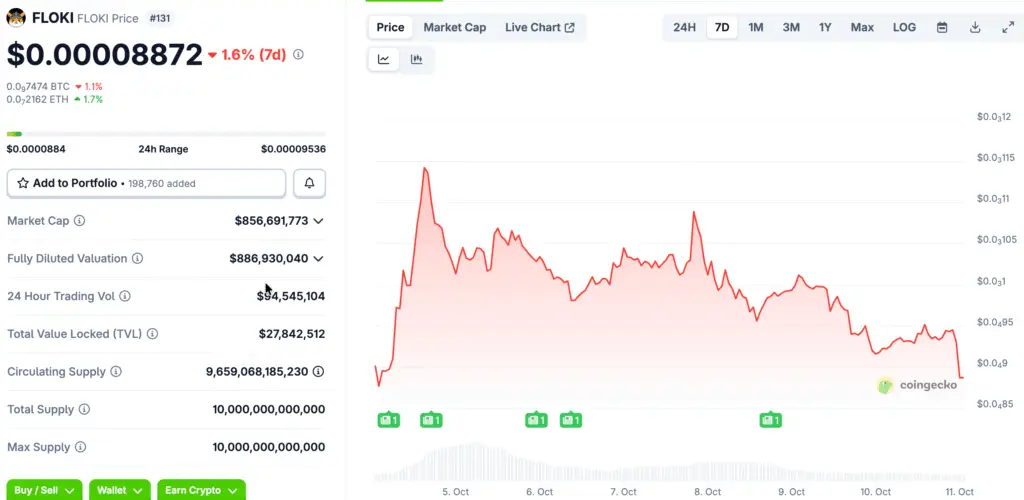

Floki Market Cap Holds Near $917 Million as Investors Take Profits and Rebalance

Floki has seen a 24-hour decline of 3.20%, lowering its value to approximately $0.00009481, with a market capitalization near $917 million. This decline appears to be a judicious profit-taking move following earlier gains, supported by a steady trading volume of about $114.75 million.

The current scenario reflects active investor participation and stable consolidation phases prior to potential upward momentum. Short-term analyses reveal minor pullbacks above $0.000095, followed by stabilization within a narrow range. This sideways trading suggests traders are cautious yet engaged, awaiting confirmation signals, with the possibility of returning to higher volatility soon.

Technical Levels Define Possible Directional Path Forward

Experts underscore the importance of the $0.000093 support level for maintaining bullish momentum in the near term. A steady defense of this level could trigger renewed attempts to reach the $0.000098 resistance, enhancing positive market sentiment. Successfully reclaiming this threshold would indicate a stronger likelihood of continued bullish momentum, with aspirations for higher recovery ranges.

Conversely, if price momentum falls below $0.000093, traders expect to investigate lower liquidity zones around $0.000090 to assess renewed buying interest. Historical trends indicate that this range has previously attracted inflows, igniting upward cycles. Monitoring these key thresholds is essential for predicting upcoming short-term market trends.

Floki Maintains Long-Term Uptrend as Higher Lows Signal Growing Accumulation Strength

The technical composition clearly indicates that Floki continues to uphold its long-term upward trajectory across wider market timeframes. Higher lows are consistently emerging along the trendline, indicating a persistent accumulation strength that bolsters the potential for an upward recovery trajectory. These factors indicate a developing positive momentum in energy accumulation within key trading ranges.

Should consolidation continue with ascending lows, experts anticipate a recovery setup aimed at the 2021 all-time high area. Ongoing investor engagement, along with an increase in volume, may enhance the confirmation signals of trends. The upward trendline continues to be a key indicator shaping expectations for the upcoming strategic recovery phase.