Pi Coin Stands Firm Amid Market Decline, Experiencing Only Minor Losses

In a landscape where prominent cryptocurrencies such as Bitcoin and Ethereum faced declines ranging from 3% to 12%, Pi Coin demonstrated unexpected resilience. The token managed to restrict its losses to a mere 1.5%, reflecting significant investor confidence even in the face of increased market volatility.

Experts indicate that the relative stability of Pi Coin could be a sign of growing interest and accumulation among retail investors and early adopters. This defensive performance underscores the ability of selective tokens to draw in capital, even amidst broad market sell-offs.

Financial Indicators Point to Concealed Accumulation Stage

From August 1 to October 9, Pi Coin’s price experienced a series of declining lows, even as its Money Flow Index (MFI) showed an upward trend. This bullish divergence suggests that purchasing momentum is subtly growing even in the face of apparent market fragility.

Retail participants seem to be building their positions during downturns, which is leading to an increase in underlying demand. Traditionally, these trends often signal brief recoveries after the selling pressure eases and liquidity flows back into the market.

Pi Coin Faces Short-Term Weakness as RSI Reveals Hidden Bearish Pattern

In contrast to MFI readings, the Relative Strength Index (RSI) indicates a possible waning of momentum for Pi Coin in the short term. From October 6 to 13, the token exhibited a lower high, whereas the RSI achieved a higher high, indicating a concealed bearish divergence.

This setup often indicates a weakening in purchasing confidence, increasing the likelihood of brief upward movements. Without a significant increase in momentum, efforts to recover may falter before successfully breaking through the barriers above.

Recommended Article: Pi Network Unveils DEX and AMM to Transform DeFi Ecosystem

Market Cycle Shows Contradictory but Complementary Phases

As the MFI underscores the aspect of accumulation, the RSI points to a sense of hesitation; together, these factors reflect the characteristics of a conventional market cycle. These signals probably indicate two facets of a singular trend: the gathering of assets by institutions followed by uncertainty among retail investors.

Market participants are split, with certain traders gearing up for a possible shift in direction, while others expect an extended period of stability. Until a definitive breakout takes place, it is prudent to adopt a cautious stance to reduce exposure to volatility.

Pi Coin Forms Falling Wedge Pattern Signaling Potential Bullish Reversal

On the daily chart, Pi Coin is exhibiting a falling wedge pattern, a well-known indicator of a potential bullish reversal. This pattern consolidates fluctuations and frequently signals a significant directional shift when the price surpasses critical resistance levels.

The key threshold to observe is $0.29. A consistent close above this level would signal a positive shift, likely sparking increased buying activity and enhancing upward movement.

Essential Support Levels Establishing a Risk Zone for Traders

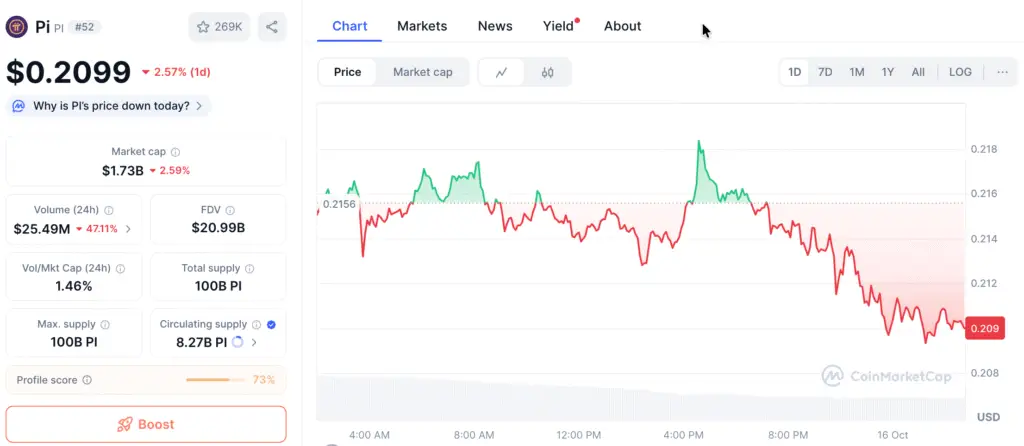

Pi Coin is presently valued at approximately $0.21, with clearly established support levels at $0.18 and $0.15. Maintaining positions above these levels indicates a strong foundation, while a fall below $0.15 would invalidate the optimistic pattern.

If buyers sustain their grip around $0.18, Pi Coin may have the opportunity to revisit the $0.24–$0.25 range and possibly extend towards $0.29. A breakthrough in this area could signal the beginning of a prolonged recovery trend.

Pi Coin Momentum Builds as Buying Pressure Eyes Recovery Toward $0.29

The upcoming trading sessions could reveal if the buildup of positions surpasses the decline in momentum. If the buying pressure from MFIs persists, Pi Coin may experience a significant rebound towards the $0.29 level.

If the current weakness continues, the token could potentially test lower support levels before any significant turnaround occurs. Regardless, the wedge structure of Pi Coin stands as the decisive factor ready to determine if the market shifts towards a bullish trend or persists in its consolidation phase.