Ethereum Defies Market Turmoil With Strong Inflows

In the face of widespread market volatility, Ethereum (ETH) managed to draw in $205 million in inflows last week, underscoring a robust sense of investor confidence. This increase occurred despite total digital asset funds experiencing $513 million in outflows, primarily attributed to the volatility triggered by Binance’s liquidity shock on October 10.

Institutional traders recognized the recent decline in Ethereum’s price as an ideal moment for accumulation. A significant surge was observed with a 2x leveraged ETP, which alone attracted $457 million in inflows, highlighting that investors continue to express confidence in Ethereum’s midterm recovery path.

Bitcoin Suffers Nearly $1B in Outflows as Sentiment Shifts

In a striking development, Bitcoin (BTC) funds experienced $946 million in outflows during the same week, bringing total losses to $668 million since the cascade triggered by Binance. The prevailing negative sentiment surrounding Bitcoin indicates a momentary uncertainty rather than an inherent flaw in its structure.

According to analysts at CoinShares, the outflows were mainly influenced by holders within the crypto space, rather than those investing in exchange-traded products. In the face of the recent sell-off, Bitcoin continues to show resilience amid the turmoil affecting U.S. regional banks, reflecting patterns reminiscent of early 2023.

Ethereum Momentum Boosts Altcoins Across the Market

The strength of Ethereum resonated throughout the altcoin market, leading to significant capital inflows for various prominent assets. Solana (SOL) experienced a significant influx of $156 million, driven by excitement surrounding its forthcoming ETP launch, while XRP attracted $73.9 million as institutional interest continued to rise.

Several other prominent altcoins saw significant inflows: Sui (SUI) attracted $5.9 million, Cardano (ADA) brought in $3.7 million, Chainlink (LINK) increased by $1.8 million, and Litecoin (LTC) amassed $1 million. These actions highlight a growing interest among investors in a broader range of digital assets, extending beyond just Bitcoin.

Recommended Article: Ethereum Price Analysis Shows Key Support at $3,400 Level

Institutional Trading Volumes Surge to Record Highs

Weekly trading volumes in exchange-traded products (ETPs) surged to $51 billion, indicating strong participation from institutional investors. This increase indicates that significant investors are strategically adjusting their positions instead of withdrawing from the cryptocurrency markets altogether.

The notable rise in leverage and derivatives exposure indicates a strong belief in Ethereum’s potential to recover from its recent downturns. Recent market data indicates a decline in liquidation pressure since early October, implying a stabilization in risk sentiment.

Regional Flows Reveal Diverging Investor Behavior

The United States led the way in withdrawals, reporting $621 million in outflows, with additional smaller exits from Sweden at $54.2 million and Hong Kong at $9.8 million. These areas exhibited increased vigilance in light of economic unpredictability and stricter policy measures.

On the other hand, European investors seized the dip as a chance to make purchases. Germany, Switzerland, and Canada together recorded more than $144 million in net inflows, with German institutional funds taking the lead by boosting their investments in Ethereum and Solana-based instruments.

Experts Uphold Sustained Optimism for Ethereum’s Future

Analysts contend that Ethereum’s steady inflows reinforce its position as the foundation of the decentralized finance (DeFi) landscape. The network’s continuous improvements, featuring scalability enhancements and layer-2 integration, consistently draw in institutional capital looking for sustainable investment opportunities.

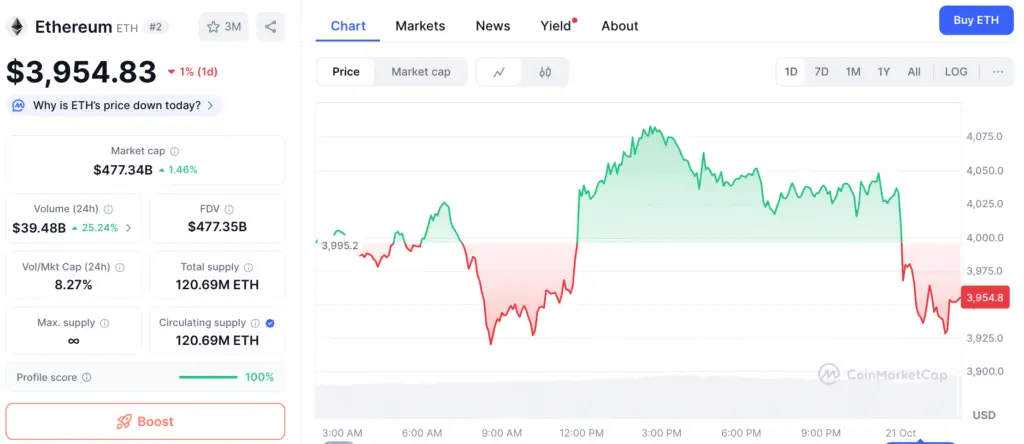

The prominence of Ethereum in staking and smart contract applications enhances its prospects for the future. Experts predict that the latest influxes may drive a rebound toward the $3,000–$3,200 range, provided that overall risk sentiment remains positive through the fourth quarter of 2025.

Ethereum Takes the Lead in the Path to Recovery

Despite significant withdrawals impacting Bitcoin, Ethereum’s performance indicated that investors continue to regard it as a strong asset of choice. The significant influx of capital, increasing participation in exchange-traded products, and the spillover effects from alternative cryptocurrencies indicate that a shift in investment strategies is currently taking place within the cryptocurrency markets.

If the current trend continues, Ethereum could reinforce its position as a leader in the upcoming market recovery, connecting traditional finance with decentralized innovation as worldwide acceptance grows.