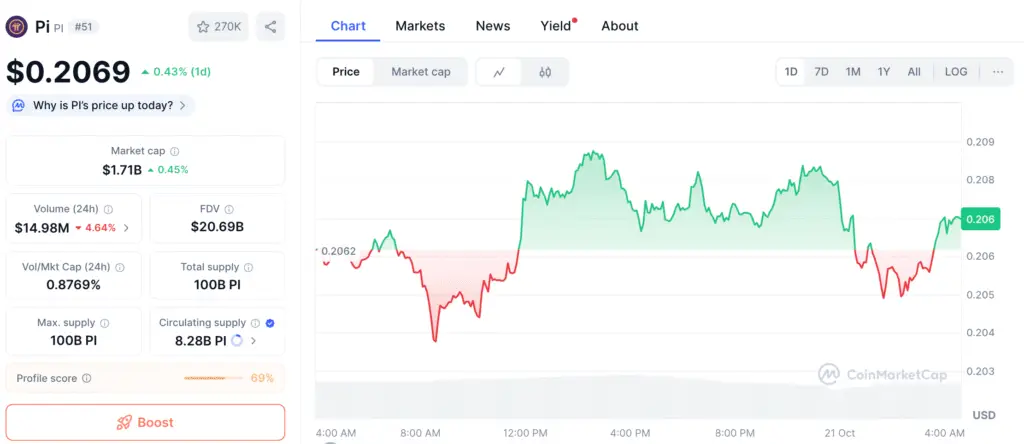

Pi Network Stabilizes Above Key Psychological Level

Pi Network (PI) has shown resilience by holding above the critical $0.20 threshold, suggesting early signs of a potential bullish reversal. The token continues to trade above this key support, showing consolidation after a steady recovery phase.

Market data reveals a clear W-shaped pattern forming on the daily chart, a setup commonly associated with bottoming phases and bullish reversals. If confirmed, this structure could signal the end of Pi’s correction period and open the path for an upward move toward the $0.23 to $0.28 range.

Exchange Outflows and Foundation Movements Show Mixed Signals

On-chain data from PiScan shows that centralized exchanges have recorded outflows totaling 1.23 million PI in the past 24 hours, around 0.01% of total supply. This trend suggests growing accumulation as investors move tokens off exchanges, typically viewed as a positive signal.

However, the Pi Foundation’s secondary wallet also recorded an outflow of 1.28 million PI. These nearly equal and opposite movements create a mixed short-term sentiment, implying internal rebalancing or liquidity adjustments rather than a clear directional trend. Experts believe these mirrored flows point to a careful accumulation phase in its early stages.

Technical Indicators Turn Bullish After MACD Crossover

Technical indicators add strength to the positive outlook for Pi Network. The MACD indicator turned bullish on Saturday after crossing above its signal line, hinting at a shift in momentum. Since then, Pi has risen about 1% over three consecutive sessions, suggesting renewed buying activity.

The Relative Strength Index (RSI) has climbed from oversold territory to 31, showing reduced selling pressure. This gradual improvement provides space for buyers to regain control if the positive momentum persists throughout the week.

Recommended Article: Pi Network Moves Toward Global Currency Use With ISO 20022

Pi Network Stability Above $0.20 Crucial to Sustain Upward Momentum

Pi currently trades within a consolidation range between $0.1996 and $0.2295, boundaries that have defined its market structure since early October. A breakout above the $0.2295 upper limit would confirm the W-shaped reversal pattern and set a short-term target near $0.2755, aligning with the central Pivot Point.

On the downside, maintaining support above $0.1996 remains critical. A breakdown below this level could trigger another pullback toward $0.1731, which corresponds with the S1 Pivot Point. Analysts emphasize that holding the $0.20 zone is essential for sustaining Pi’s developing upward trend.

Market Sentiment and Wider Landscape

Pi Network’s recovery aligns with improving sentiment across the broader crypto market. Investors are showing renewed interest in mobile-first, utility-driven projects, particularly those developing Web3 payment solutions. Pi’s growing emphasis on decentralized finance and peer-to-peer payments enhances its real-world relevance.

Amid short-term fluctuations in on-chain data, analysts highlight Pi’s technical rebound and strong community base as key factors that could attract more speculative attention as the project nears further exchange listings.

Pi Network Forecast: Journey to $0.27 and Further

Pi Network’s current indicators suggest that resistance around $0.23 may soon be tested, with potential upside toward $0.27 to $0.28. Sustained buying pressure and validation of the W-pattern could confirm a midterm bullish trend.

Failure to maintain the $0.20 support, however, could delay the recovery trajectory. With a stronger technical foundation and increasing user engagement, Pi Network’s continued focus on utility may help secure its position among emerging global payment networks.