XRP Pulls Back but Trading Activity Accelerates

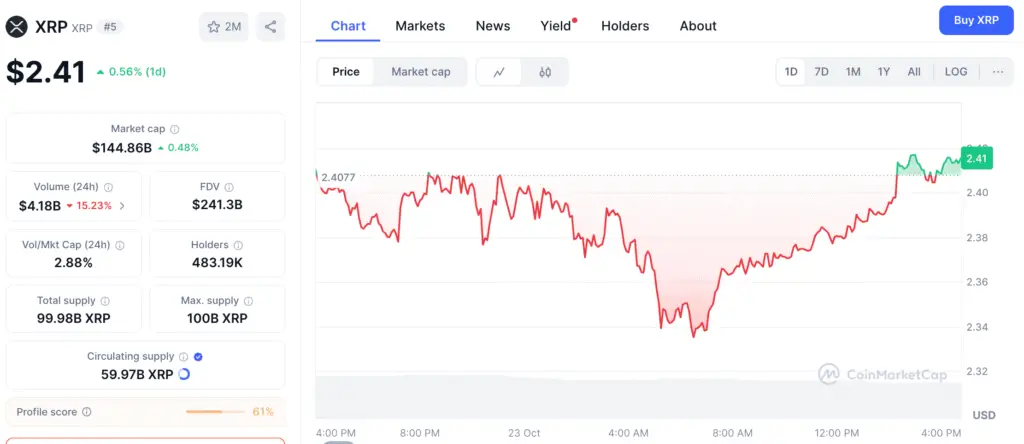

XRP is stabilizing at $2.41, following a 0.93% drop in the past 24 hours. Despite the drop, daily trading volume increased by 6% to $4.67 billion, indicating a busy market. Short-term traders profit from falling prices, while long-term investors and whales build positions.

XRP’s market value is $144.1 billion, making it one of the top cryptocurrencies globally. Analysts suggest this trend is similar to historical accumulation cycles, suggesting a possible comeback phase instead of a long-term correction. The difference between a falling price and a growing volume indicates that short-term traders are taking profits.

Indicators Point to Short-Term Weakness, Long-Term Stability

XRP’s recent drop below its 200-day EMA has raised technical concerns for traders. However, the Relative Strength Index (RSI) remains neutral, indicating potential for buyers to drive the token higher. If the price breaks over $2.50 with high trading volume, it may signal a change in the trend.

If not, it could temporarily drop to $2.08–$1.77 due to declining triangle patterns. Despite volatility, XRP remains in a solid structural range, indicating a consolidation part of XRP’s long-term accumulation trend. Technical experts believe this consolidation is part of this trend.

XRP Forms Descending Triangle as Traders Watch $2.82 Breakout Level

XRP is trading in a descending triangle pattern, which often precedes breakouts or short-term downturns. The bearish RSI divergence suggests a short-term retreat before momentum returns. Analysts predict a rebound surge if XRP breaks over $2.82 and stays above it, potentially reaching the $3.10 resistance zone.

Conversely, if the price remains weak below $2.20, it may continue to fall, challenging psychological support under $2.00. Despite this, XRP’s stability at important EMAs indicates that big holders are protecting important levels, as seen in the 2017 and 2020 accumulation zones.

Recommended Article: XRP Co-Founder $120M Sell-Off Sparks Market Caution

Long-Term Chart Patterns Indicate Upside Potential

Long-term XRP investors are optimistic due to historical fractals and predictions of price increases between 2026 and 2029. Experts believe XRP could reach $8, $13, and $27 between 2026 and 2029, based on similar trends to previous bull cycles.

Technical analyst @ChartNerdTA suggests a probable logarithmic breakout path, mirroring XRP’s structure before the 2017 rise. These bold estimates suggest XRP can continue growing exponentially until global liquidity returns. XRP is above its monthly EMA support at $2.40 and has no overbought RSI signs, suggesting potential for a market upswing.

Whales Buying XRP Suggest Potential Price Surge in Coming Months

A number of on-chain measures show that whale activity has increased around current price levels. The increase in address activity among holders with 10 million to 100 million XRP implies that institutional investors are getting back into the market, probably because they expect more clarification from regulators and more remittance options in the future.

This kind of activity generally comes before big price rises, as happened over the last several accumulation cycles after short corrections. Long-term holding distribution, on the other hand, is still low, which boosts confidence in XRP’s price stability over the next few months.

Broader Market Context: Ripple’s Expanding Utility

Ripple’s growth in cross-border payments and collaborations with institutions continues to support XRP’s intrinsic strength, in addition to technical factors. The addition of on-demand liquidity (ODL) providers across Asia, the Middle East, and Latin America increases the demand for XRP transactions. This gives it a real-world use that sets it apart from speculative meme tokens.

Analysts think that this growing ecosystem will help XRP’s market stability, especially as global payment companies are looking at ways to make RippleNet’s infrastructure work with other blockchains.

XRP Consolidates Above $2.20 as Volume and Whale Activity Increase

XRP’s drop below $2.40 looks more like a good consolidation period than a bearish collapse. There seems to be accumulation going on under the surface since the volume is going up, whales are consistently active, and there is strong multi-year trendline support.

If bulls can get back to $2.50 with volume confirmation, XRP may swiftly go after $2.82 and then $3.10 in the next few weeks. On the other hand, it will be important to keep support at $2.20 to keep the correction from going further. XRP’s current pattern may be the start of its next big rally, as on-chain indications are turning positive and historical fractals are lining up.