BNB Sees Price Drop Following Major U.S. Exchange Listings

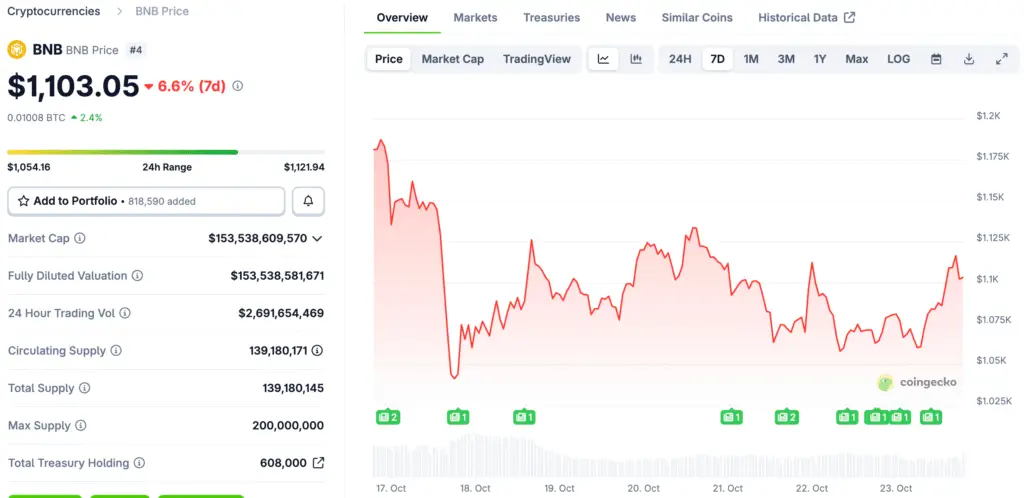

According to CoinGecko, BNB, the native token of BNB Chain (previously Binance Chain), fell to $1,070 on Wednesday, a 2.1% drop in the last 24 hours. The drop comes after Robinhood and Coinbase both said they will support the Binance-linked coin.

Even if the price fell in the immediate term, the announcement of the listing is a big step forward for BNB’s availability in the U.S. market. Robinhood’s official statement revealed that the fourth-largest cryptocurrency by market cap, which is now worth $149.5 billion, may be traded on its platform. The news spread swiftly, getting more than 530,000 views on X (previously Twitter).

Coinbase and Robinhood Expand U.S. Market Access for BNB

The Robinhood inclusion comes only a week after Coinbase added BNB to its list of coins to trade, which means that trading will start on the same day. The synchronized listings greatly increase BNB’s visibility in regulated markets, where access to Binance-related coins has hitherto been limited.

Coinbase has hundreds of assets listed, but Robinhood has a limited, selected selection. Right now, U.S. consumers may only access 41 cryptocurrencies using the Robinhood mobile app. The fact that BNB is available on both platforms shows that more people want it and that it is useful in DeFi, gaming, and Web3 apps.

From Hard-to-Access Asset to Mainstream Listing

American traders have had trouble getting to BNB for a long time because of rules and limits on exchanges. Kraken, a competing exchange, didn’t start supporting BNB until April 2025, after years of not doing so.

The fact that the token is now listed on both Robinhood and Coinbase is a big step toward its wider use in the U.S. It shows that major trading platforms are becoming more open to high-cap utility tokens than Ethereum and Solana.

Recommended Article: BNB Price Holds Above $1,100 as BSC Activity Surges in October

Market Reaction: BNB Pulls Back After Setting Record High

Even if the listing news was good, BNB’s market price dropped 22.3% from its all-time high of $1,370, which it hit less than ten days earlier. Analysts say the drop is because people are collecting profits and the market is correcting itself after the token’s parabolic rise earlier in October.

Trading data suggests that the altcoin market is more volatile than usual. Investors are moving money into Bitcoin and Ethereum ETFs, which recently saw over $600 million in new inflows. The change in liquidity may have caused BNB to drop in value in the near run.

BNB’s Global Recognition Makes It Essential for Leading Crypto Exchanges

Shane Molidor, the founder and CEO of Forgd, says that BNB’s presence on both Robinhood and Coinbase shows how the market is changing as a whole. He says that all large exchanges should assist such a well-known commodity, even if it helps a rival like Binance in a roundabout way.

Molidor said, “It’s so well known in global Web3 communities that an exchange would be doing itself a disservice by not supporting trading of that asset.” He said that BNB’s decentralization, usefulness, and liquidity make it a good fit for any trading platform that is already up and running.

Coinbase Strengthens Its Position as a Neutral Marketplace

Molidor further said that Coinbase’s choice to promote BNB shows how dedicated it is to being impartial and open to everyone. He remarked, “By listing BNB, Coinbase is showing that it is a mature, unbiased, two-sided marketplace.” “It keeps their customers from having to go to competitors to trade one of the biggest cryptocurrencies in the world.”

This fits with Coinbase’s recent efforts to make itself an open platform that supports assets based on merit, liquidity, and user demand, no matter what other companies it competes with.

Broader Implications for Exchange Competition and Market Growth

The listings also suggest that the way exchanges work together may be changing. Platforms that were formerly split by competition are now starting to work together deliberately to get more people to use them. Analysts say that these partnerships may help make it easier for people in different regulatory areas to trade the most popular cryptocurrencies.

But many in the market say that listing events typically cause short-term volatility because traders who are betting on news-driven momentum take advantage of it. Even if BNB’s price dropped in the near term, its strong fundamentals and growing network would continue to support long-term optimistic optimism.

BNB Poised for Continued Ecosystem Growth

Analysts are still positive about BNB’s long-term future, even though the present pullback shows short-term consolidation. They point to the token’s extensive integration with DeFi platforms, NFT markets, and layer-2 scaling initiatives on the BNB Chain.

As more institutions adopt BNB and more people can buy it, it may become one of the top cryptocurrencies in terms of both market capitalization and usefulness. If momentum picks up again above $1,100, traders expect the $1,300–$1,370 zone to be tested again, which may lead to a new all-time high later in 2025.