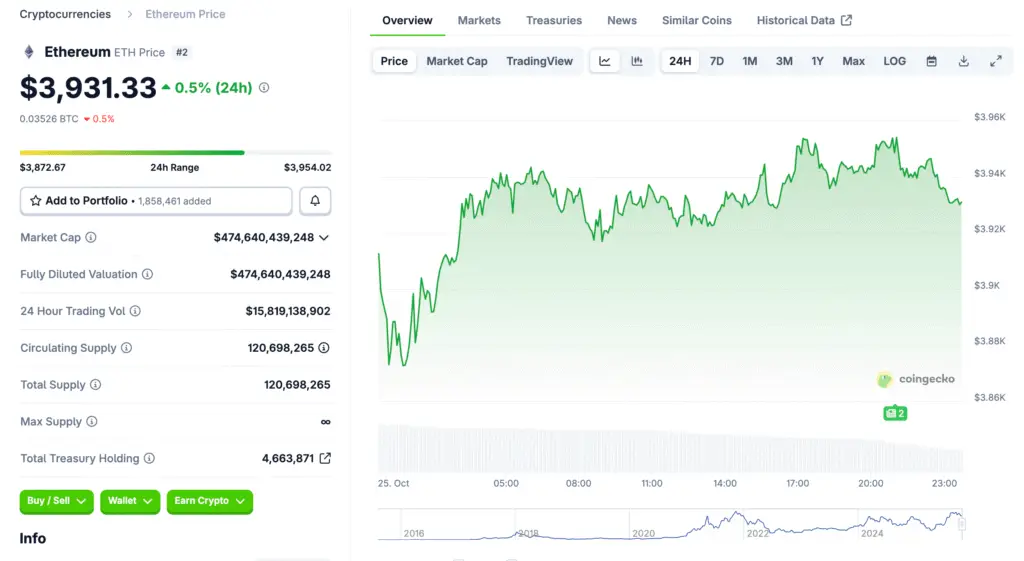

Ethereum Holds Steady Near the $3,900 Mark

Ethereum’s price continues to hover around the $3,900 level after weeks of mixed momentum. Despite minor fluctuations, ETH remains resilient following a market-wide cooling phase. Over the last month, the asset has retraced roughly 7%, falling from $4,755 to a low of $3,460. Traders are now closely monitoring consolidation ranges that could dictate Ethereum’s next major move.

Institutional Activity Signals Long-Term Confidence

Large investors remain active even as short-term traders hesitate. Blockchain analytics from Lookonchain revealed that two wallets tied to Bitmine recently accumulated 45,814 ETH valued at approximately $184 million. Such moves suggest that institutional entities continue viewing Ethereum as a long-term asset despite short-term volatility. These inflows offset broader market fatigue and reinforce structural confidence in ETH’s fundamentals.

Exchange Outflows Indicate Bullish Accumulation

Whale behavior further supports accumulation theories. A major wallet known as “0x86Ed” withdrew 8,491 ETH—around $32.5 million—from OKX earlier this week. Exchange outflows typically indicate intent to hold assets securely rather than sell, a signal often seen before market recoveries. Together with Bitmine’s purchases, these transfers hint that key players expect Ethereum’s valuation to rebound over the medium term.

Recommended Article: Ethereum ETF Inflows Hit $141M as Bull Flag Signals $6K Rally

Analysts Identify $3,700 as Critical Support Zone

Analysts remain cautious, noting that $3,830 and $3,700 represent pivotal supports. Ali Martinez predicts that a breakdown below $3,830 could expose ETH to further downside toward $3,700. Another analyst, TedPillows, views $4,100 as the breakout threshold that could reverse momentum. A decisive close above that mark would set the stage for potential rallies targeting $4,500 and $4,800.

Wyckoff Reaccumulation Pattern Suggests Smart Money Positioning

Some technical experts propose that Ethereum’s structure aligns with a Wyckoff reaccumulation phase. This model implies that institutional investors are quietly absorbing supply during low-volatility periods. Analyst Ash Crypto reinforced this perspective, predicting $8,000–$10,000 ETH later in the cycle if the pattern completes. Similar formations in previous cycles have preceded strong bullish continuations.

Technical Indicators Show a Balanced Market

The Relative Strength Index currently sits at 46.2, reflecting neither overbought nor oversold conditions. Moving averages paint a picture of equilibrium, with the 10-day EMA and SMA clustered near $3,900. Meanwhile, the 20-day and 50-day moving averages lean slightly bearish, signaling consolidation rather than trend reversal. The 200-day EMA remains supportive around $3,577, maintaining Ethereum’s broader uptrend.

What Could Trigger Ethereum’s Next Breakout

A catalyst-driven breakout remains possible if buying volume intensifies above $4,100. Positive ETF developments or renewed DeFi inflows could energize the next rally. Conversely, macroeconomic uncertainty or regulatory pressure may temporarily suppress price action. For investors, maintaining risk-adjusted exposure while tracking volume patterns offers the most prudent approach.

Conclusion: Short-Term Pullback, Long-Term Strength

While analysts acknowledge the risk of a correction toward $3,700, Ethereum’s long-term narrative remains strong. Institutional accumulation, exchange outflows, and robust on-chain activity continue to define bullish undercurrents. A successful defense of key supports could pave the way for renewed upward momentum toward previous highs. For now, Ethereum stands at a pivotal juncture, balancing short-term caution with long-term optimism.