The End of Slow, Expensive Payroll Systems

Traditional payroll methods often leave global teams waiting days for payments while losing a portion to fees. In 2025, blockchain technology offers a faster and cheaper solution through XRP and stablecoins. These assets enable near-instant transactions, cutting operational delays and costs. Businesses now recognize that digital settlements improve employee satisfaction and cash-flow management.

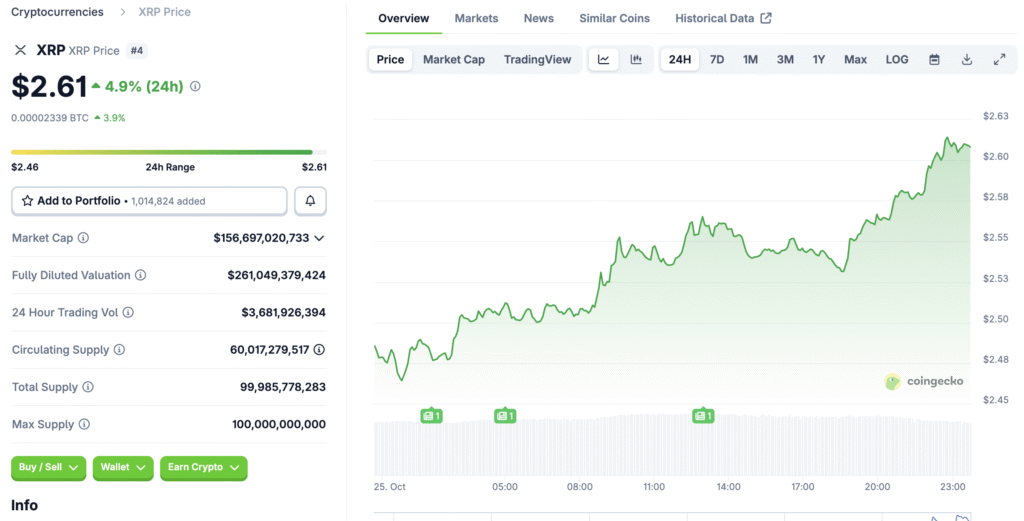

XRP’s Speed and Cost Advantages Lead the Shift

XRP has become the preferred asset for payroll transactions due to its unparalleled speed. Payments settle in just three to five seconds with fees of less than a cent per transfer. This efficiency eliminates the need for multiple intermediaries and foreign exchange conversions. For multinational companies, this translates into seamless payments across borders without the friction of traditional banking systems.

Stablecoins Solve the Volatility Challenge

While XRP ensures speed, stablecoins address price volatility. Pegged to fiat currencies, they preserve purchasing power and predictable value. Global employers use stablecoins to protect wages from exchange-rate swings, especially in emerging markets. This dual approach—speed from XRP and stability from stablecoins—creates an ideal framework for modern payroll.

Recommended Article: Remittix Emerges as Top 2025 Payments Token While XRP Slows

Legal Clarity Strengthens Institutional Confidence

Ripple’s recent legal progress with the SEC has been a turning point for corporate adoption. Courts and regulators have affirmed that XRP functions as a utility token, not a security. This clarity encourages financial institutions to integrate XRP into payment systems legally and transparently. As compliance improves, more enterprises feel secure experimenting with blockchain payroll models.

Integrating Blockchain Payroll With Existing Systems

The XRP Ledger and related APIs integrate smoothly with existing enterprise resource planning platforms. Businesses can automate payroll disbursement, tax withholding, and reporting through programmable smart contracts. Cross-chain compatibility ensures companies can switch between digital assets as needed. This interoperability drives broader adoption among tech-forward organizations.

Real-World Implementation and Success Stories

Several companies already deploy XRP and stablecoins for payroll at scale. Freelancers receive instant settlements, while employees in unstable economies preserve earnings from currency devaluation. These use cases demonstrate measurable improvements in efficiency, accuracy, and transparency. Early adopters report reduced administrative costs and improved employee trust in payment reliability.

Compliance and Identity Verification Remain Crucial

Blockchain payroll must comply with local financial regulations and anti-money-laundering protocols. Tools embedded in the XRP Ledger support identity verification and compliance checks. By automating these safeguards, businesses can expand globally without sacrificing oversight. This balance of innovation and accountability defines the new standard for cross-border payroll.

The Future of Payroll: Fast, Fair, and Borderless

XRP and stablecoins are transforming payroll into a real-time, global infrastructure. As adoption spreads and technology matures, traditional payroll intermediaries may become obsolete. With continued regulatory cooperation and enterprise partnerships, blockchain-powered payroll is poised to become mainstream. For forward-thinking companies, embracing this model means staying ahead in the global digital economy.