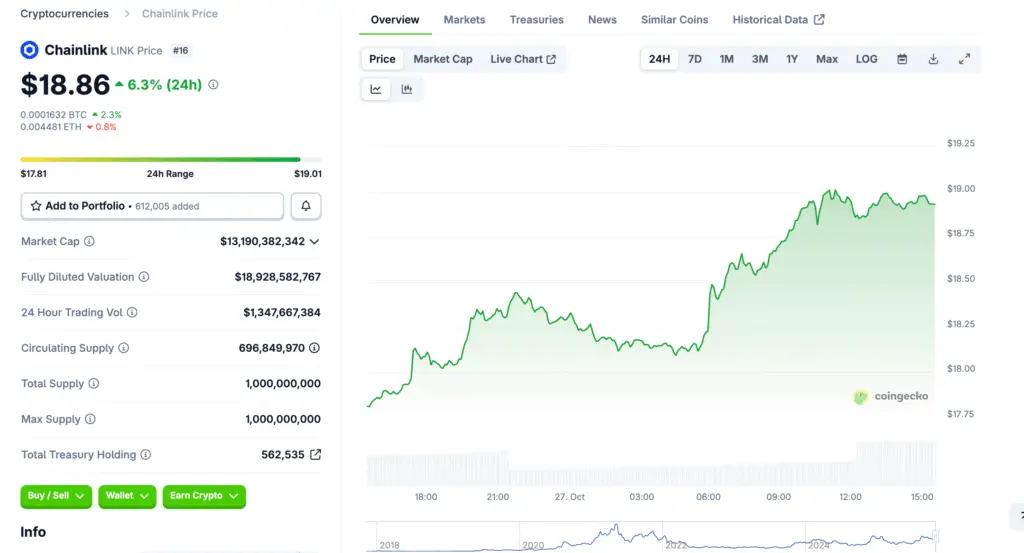

Chainlink Rebounds From October Decline

Chainlink has recovered strongly from its October lows, climbing 6% in the past 24 hours to trade around $19. This rebound follows weeks of consolidation near the $16–$17 range, where accumulation intensified. The renewed strength signals growing investor optimism as market conditions improve. Analysts note that this pattern mirrors previous accumulation cycles that preceded major uptrends.

Technical Setup Points Toward a $46 Target

Prominent market analyst Ali Martinez projects a potential 300% rally for Chainlink. He identifies a wide ascending channel that has guided LINK’s price movement since mid-2023. According to his analysis, the token could retest $15 before breaking out toward $46.31. This structure highlights a long-term bullish outlook supported by consistent technical formations.

Fibonacci Levels Reveal Strategic Entry Points

The 0.618 Fibonacci retracement zone near $15 serves as a key accumulation area for long-term investors. Martinez suggests that this level presents an optimal buying opportunity ahead of the next breakout. The next resistance is expected near $20.04, while $46.31 aligns with the 1.272 Fibonacci extension. These levels collectively outline the potential roadmap for Chainlink’s continued upward trajectory.

Recommended Article: Chainlink Price Outlook and BlockchainFX Presale Shine in 2025

Whale Accumulation Signals Long-Term Confidence

On-chain data reveals aggressive buying among large holders despite October’s earlier decline. Whale wallet “0xf386” accumulated over 1.1 million LINK worth approximately $19 million, while another address “0xe8aa” withdrew over 66,000 LINK from exchanges. This accumulation trend demonstrates conviction among major investors who anticipate a multi-month uptrend. Historically, such patterns precede significant market rallies.

Exchange Outflows Reinforce Bullish Market Structure

Data from Santiment confirms declining exchange balances, signaling that whales are moving LINK to long-term storage. This shift reduces sell pressure and contributes to a tighter supply environment. The pattern reflects growing institutional participation and aligns with accumulation signals seen in prior bull markets. As liquidity diminishes, even moderate demand could trigger outsized price movements.

Analysts Eye Short-Term Resistance at $20

Chainlink now faces psychological resistance near $20, a level that could determine short-term price direction. Analysts believe that a clean breakout above this zone would confirm renewed bullish momentum. CoinCodex forecasts a near-term price increase of 9.4%, targeting $19.48 by November 22. Sustaining this strength could open the door for LINK to approach $25 before year-end.

Long-Term Projections Extend Toward $100

Long-range forecasts envision Chainlink reaching between $50 and $100 by 2026 if adoption continues. Potential catalysts include institutional integration, increased oracle demand, and the approval of a Chainlink ETF. The project’s consistent network upgrades and strategic partnerships support this outlook. These factors position LINK as one of the strongest performers among top-tier blockchain assets.

Conclusion: Chainlink Poised for a Major Market Breakout

Chainlink’s recovery from October’s weakness, combined with whale accumulation and solid technicals, suggests a bullish phase ahead. The $15–$17 accumulation zone remains the critical foundation for further gains. If momentum continues, LINK could rally toward the projected $46 target and beyond. With fundamentals strengthening and sentiment improving, Chainlink appears ready to lead the next altcoin surge into 2026.