Metaplanet Initiates $500M Bitcoin-Backed Share Buyback

Metaplanet has announced a 75 billion yen share buyback program financed through a $500 million Bitcoin-backed credit facility. The Tokyo-listed company aims to address the widening gap between its share price and the value of its 30,823 Bitcoin holdings. This repurchase plan, covering up to 150 million common shares, represents 13.13% of total outstanding shares. The move underscores Metaplanet’s commitment to capital efficiency and long-term Bitcoin treasury growth.

Addressing Discount to Net Asset Value

Metaplanet’s market-to-net-asset-value ratio recently dropped to 0.99, marking one of the steepest discounts among major Bitcoin treasuries. The company’s stock, once trading at a significant premium, has fallen nearly 70% since its June highs. Management views the buyback as a method to restore alignment between market valuation and underlying crypto reserves. The initiative also supports the firm’s broader effort to enhance shareholder value through Bitcoin accumulation.

Bitcoin Treasuries Face Industry-Wide Compression

Metaplanet’s challenge reflects a broader trend across Bitcoin-holding companies worldwide. According to K33 Research, one-fourth of all listed Bitcoin treasuries now trade below their net asset values. The industry’s average premium has compressed from 3.76x in April to just 2.8x in October. Analysts attribute this decline to a slowdown in treasury Bitcoin accumulation, which recently dropped to its weakest pace since May.

Recommended Article: Bitcoin Miners Pivot to AI as Profits Shift to Smarter Power Plays

Market Volatility Drives Investor Recalibration

The cooling enthusiasm in Bitcoin-related equities has prompted investors to reassess long-term valuations. Companies such as NAKA, Twenty One, and Semler Scientific have all experienced sharp drawdowns in their market multiples. Japan equity analyst Mark Chadwick described the situation as a “bubble correction” after months of euphoric speculation. However, he suggested that long-term Bitcoin investors may see current valuations as attractive entry points.

Strengthening Bitcoin Yield Per Share

Representative Director Simon Gerovich stated that the initiative aims to “maximize BTC Yield,” which represents the increase in Bitcoin per share. This strategy ensures that remaining shareholders benefit from concentrated exposure to Bitcoin reserves. By leveraging its Bitcoin-backed credit facility, Metaplanet can execute repurchases without depleting existing liquidity. The company intends to sustain this approach until its valuation multiple rises above 1.0x.

Credit Facility Enhances Capital Flexibility

The new $500 million credit line is collateralized by Bitcoin holdings, enabling flexible funding for repurchases and future investments. It also serves as bridge financing for an upcoming preferred share issuance to diversify capital sources. This structure ensures continued liquidity for Bitcoin acquisitions under Metaplanet’s long-term treasury growth plan. The firm aims to reach 210,000 Bitcoin holdings by the end of 2027.

Bitcoin Treasury Strategy Anchors Long-Term Vision

Since April, Metaplanet has accelerated its Bitcoin Treasury Strategy despite market headwinds. Management believes that consistent BTC accumulation enhances both balance sheet resilience and shareholder value. This policy has made Metaplanet Asia’s largest listed Bitcoin treasury and the world’s fourth-largest overall. The firm’s disciplined accumulation model contrasts with speculative trading approaches common in the broader crypto market.

Investor Sentiment and Market Outlook

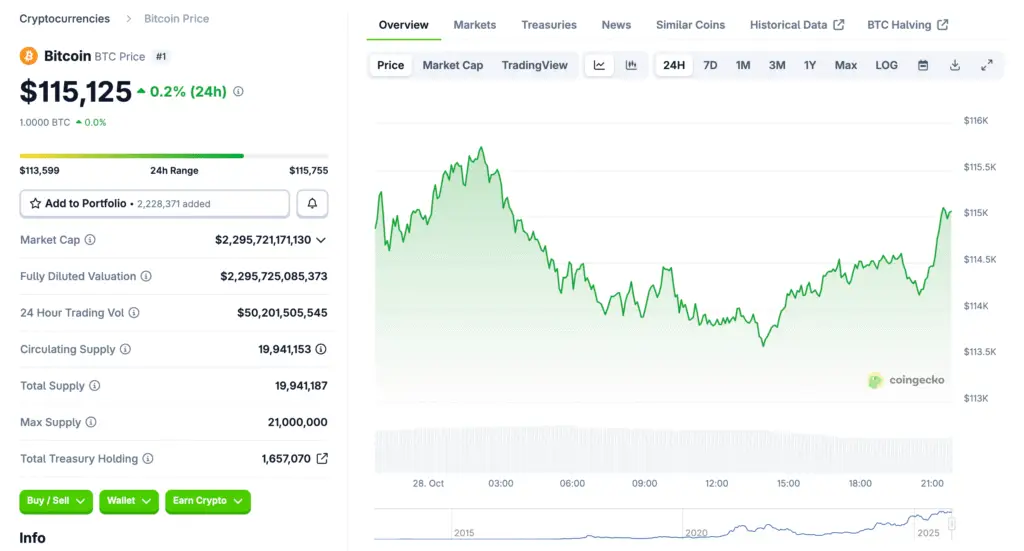

While short-term volatility persists, analysts view Metaplanet’s buyback as a signal of confidence in Bitcoin’s long-term potential. The initiative could catalyze renewed investor interest as treasury stocks seek to close valuation gaps. With Bitcoin’s institutional adoption expanding, treasury-backed equities may once again trade at premiums to their net assets. Metaplanet’s bold repurchase strategy positions it at the forefront of this next phase in digital asset valuation.