Tether Dominates 2025 With Massive $10B Profit

Stablecoin giant Tether has quietly emerged as one of the world’s most profitable companies. In its latest report, the firm announced $1.1 billion in third-quarter earnings, bringing total profits for 2025 to $10 billion. These results position Tether alongside global banking powerhouses in profitability.

Treasury Yields Drive Record-Breaking Income

The bulk of Tether’s income stems from its vast holdings in U.S. Treasuries, now totaling $91 billion. Elevated interest rates have generated extraordinary returns, contributing roughly $25–30 million in daily earnings. Analysts note that Tether’s exposure exceeds that of several national reserves, including Brazil and Canada.

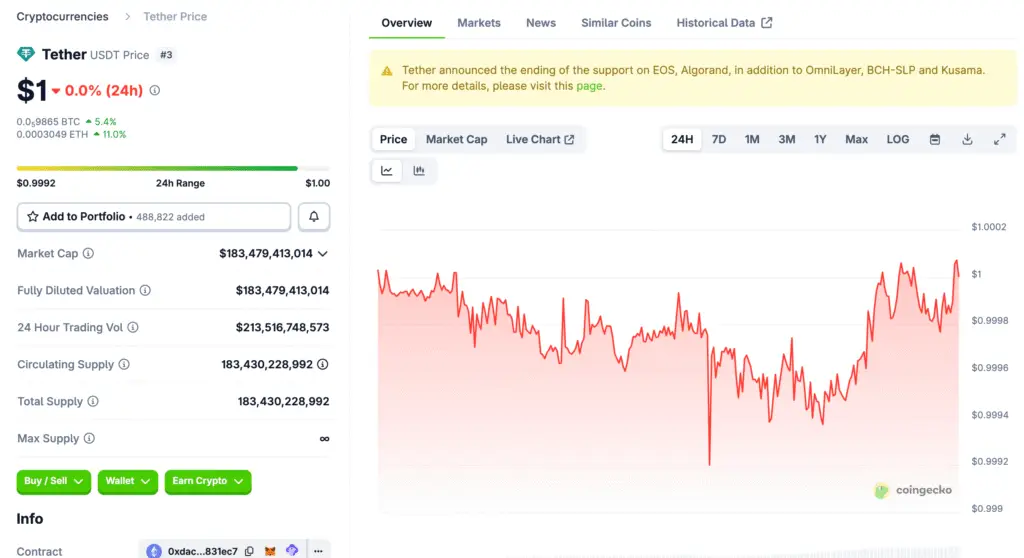

USDT Supply Surges to 122 Billion Tokens

Tether’s market dominance continues to grow, with USDT circulation surpassing 122 billion tokens. Nearly 70% of supply is issued on the Tron network, while Ethereum accounts for about 18%. The surge underscores stablecoin adoption across global exchanges and DeFi platforms.

Recommended Article: Tether Reports $10 Billion Profit and Expands Global Influence in 2025

Diversification Into Bitcoin Mining and AI Infrastructure

Beyond stablecoins, Tether has invested heavily in emerging sectors. Its Bitcoin mining operations and AI infrastructure initiatives represent a strategic effort to diversify revenue streams. These ventures aim to solidify the company’s role in both digital assets and next-generation technology.

CEO Paolo Ardoino Highlights Financial Resilience

Tether CEO Paolo Ardoino praised the company’s attestation results, emphasizing transparency and leadership in the sector. He asserted that Tether’s profitability reflects sound management and global demand for stable assets. His comments reaffirm Tether’s role as a pillar of crypto liquidity.

Too Big to Fail? Market Implications Grow

With over $120 billion in circulation, Tether has become integral to global crypto markets. Any disruption in its stability could have systemic consequences for exchanges and decentralized finance ecosystems. Regulators worldwide continue to scrutinize its scale and influence.

Political and Regulatory Risks on the Horizon

Analysts expect renewed debate over Tether’s operations as profits continue soaring. Lawmakers may question how a private firm earns billions from U.S. debt without formal oversight. Increased transparency and compliance initiatives could become key themes in 2026 policy discussions.

Outlook: Stablecoin Titan Eyes Further Expansion

As Tether reinvests its profits into innovation and global partnerships, it appears poised for sustained growth. Its profitability, diversification strategy, and influence over liquidity mark it as a cornerstone of the crypto economy. Observers believe that Tether’s financial empire will only expand as digital finance continues to mature.