NEW YORK — November 11, 2025 — Bitcoin traders are positioning cautiously ahead of the upcoming U.S. Consumer Price Index (CPI) release, a key economic indicator expected to influence Federal Reserve policy and determine the crypto market’s next major move.

Traders Await CPI Data to Shape Market Direction

The October CPI, due Thursday, marks the first major inflation reading since the U.S. government shutdown began 43 days ago. Economists forecast annual inflation to hold steady at 3%, according to estimates from FXStreet.

Analysts note that the CPI release will be pivotal in shaping expectations for a December rate cut, directly affecting liquidity and investor appetite across risk assets.

Inflation Data May Influence Fed’s Next Move

“The October CPI figure will serve as the benchmark for short-term positioning,” said Tim Sun, Senior Researcher at HashKey Group. “It will dictate how traders price in a potential rate cut and gauge overall risk tolerance.”

Data from the FedWatch tool shows that the odds of a rate cut have dropped to 67.9%, down from 85% last week, reflecting a more hawkish tone from Fed Chair Jerome Powell in recent speeches.

Recommended Article: Cryptoqueen Faces UK Sentencing Over £5 Billion Bitcoin Laundering

Bitcoin Reacts to Pre-Inflation Market Jitters

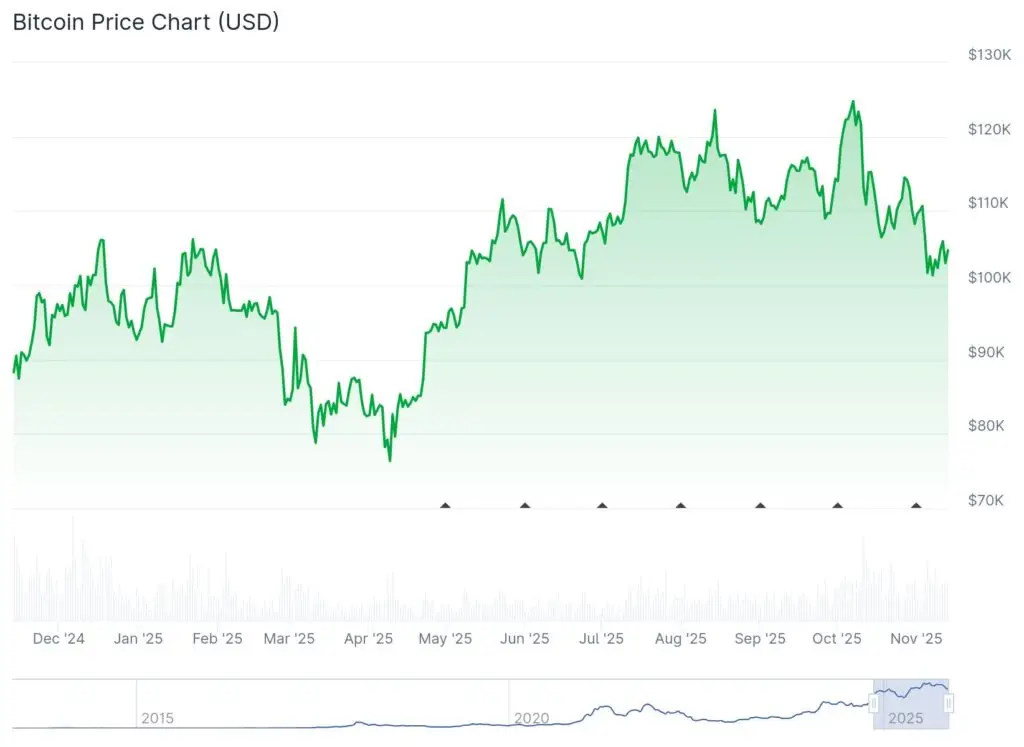

Bitcoin’s price fell 2.7% to $103,600 in the past 24 hours, according to CoinGecko, erasing gains from the weekend. Analysts attribute the decline to a broad pullback in risk appetite, as traders shift capital away from high-volatility assets.

“Yesterday’s drop was driven by investor caution,” Sun explained. “Funds are rotating from technology and crypto sectors into more stable blue-chip holdings.”

Potential Outcomes of the CPI Announcement

A cooler-than-expected inflation print could renew optimism for a dovish Fed pivot, weakening the U.S. dollar and providing tailwinds for Bitcoin and other digital assets.

Conversely, a hotter report could strengthen the dollar, tighten financial conditions, and extend Bitcoin’s current downtrend. Traders view the inflation data as a make-or-break moment for near-term price recovery.

Broader Market Sentiment Remains Fragile

The crypto market remains in a delicate balance between fading risk appetite and renewed confidence from improved macroeconomic stability. Liquidity in top digital assets like Bitcoin and Ethereum has slightly recovered following weeks of volatility triggered by the October 10 liquidation event, which wiped out $19 billion in leveraged positions.

“The market is constrained by weak sentiment,” Sun added. “Any sign of easing liquidity or policy clarity could reignite demand across risk assets.”

Investors Eye December for Possible Rebound

If inflation readings align with forecasts, analysts expect short-term price stability before renewed upside momentum in December, when the Federal Reserve’s rate decision could act as a fresh catalyst for Bitcoin.

For now, the crypto community watches closely, aware that Thursday’s inflation print could set the tone for the remainder of 2025’s trading landscape.