Bitcoin Struggles to Build Momentum After Sharp Selloff

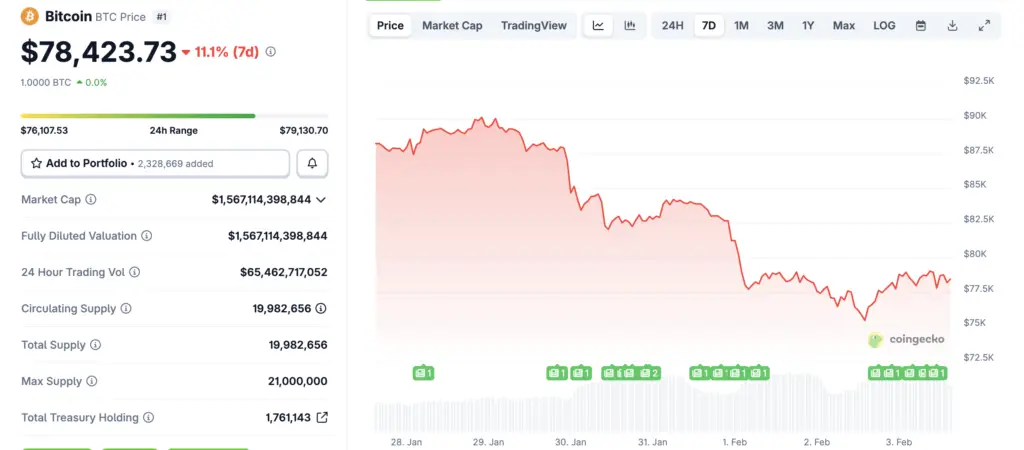

Bitcoin remained under sustained pressure in early February as a brief rebound failed to attract meaningful follow-through buying. The world’s largest cryptocurrency hovered near $78,500 in Asian trading, stalling after bouncing from a 10-month low reached earlier this week.

The muted recovery reflects lingering risk aversion across crypto markets following weeks of heavy selling. Prices are now trading near levels last seen shortly after Donald Trump returned to the White House, a period marked by heightened political and macroeconomic uncertainty that continues to weigh on investor sentiment.

Options Markets Flash Defensive Signals

Derivatives data suggests traders remain skeptical that Bitcoin has found a durable bottom. Options markets are showing increased demand for downside protection, with skew indicators pointing to a preference for puts over calls across near-term expiries.

This positioning signals that market participants are bracing for additional volatility rather than betting aggressively on a recovery. Analysts note that even as spot prices stabilized briefly, implied volatility remains elevated, reflecting unease about macro risks and liquidity conditions.

Weak Liquidity Amplifies Price Swings

Thin trading conditions have exacerbated Bitcoin’s recent moves. With fewer buyers willing to step in, relatively small sell orders have had an outsized impact on prices, deepening intraday swings and eroding confidence in short-term rebounds.

Market observers warn that until liquidity improves, Bitcoin may remain vulnerable to sudden downside shocks. The lack of strong inflows from institutional players suggests many are still waiting for clearer confirmation that the broader correction has run its course.

Recommended Article: Bitcoin Slides Below $80,000 as Market Liquidity Dries Up

Political Backdrop Adds to Market Anxiety

Political developments in the United States have added another layer of uncertainty. Since Trump’s return to office, markets have been forced to reassess regulatory priorities, fiscal policy direction, and geopolitical risks tied to tariffs and foreign policy.

While crypto advocates hoped for a friendlier regulatory climate, traders appear cautious about pricing in policy outcomes prematurely. Uncertainty around congressional action on digital asset legislation has further delayed any decisive shift in sentiment.

Confidence Erodes After Prolonged Decline

Bitcoin’s inability to reclaim key technical levels has reinforced bearish psychology. The asset is now on track for its longest monthly losing streak since 2018, a milestone that has prompted comparisons to previous late-cycle drawdowns.

Repeated failed rallies have conditioned traders to sell into strength rather than accumulate, a pattern that often persists until a clear catalyst reverses momentum. Analysts argue that without a convincing macro or policy trigger, confidence may continue to deteriorate.

Institutional Exposure Faces Renewed Scrutiny

The downturn has also revived scrutiny of firms with significant Bitcoin exposure. Companies that accumulated large holdings during higher price ranges are now facing renewed investor questions about balance-sheet risk and capital discipline.

High-profile Bitcoin proponents such as Michael Saylor have reiterated long-term conviction, but equity markets tied to crypto performance have shown increasing sensitivity to price weakness. This feedback loop between crypto and traditional markets has amplified caution.

Support Zones Tested as Market Searches for Direction

Technically, Bitcoin is hovering near a critical support zone that has historically attracted long-term buyers. Some analysts argue that current levels may represent a “value area” where selling pressure could ease.

However, others warn that if macro conditions worsen or risk assets face broader stress, Bitcoin could break lower before stabilizing. The divergence in outlook highlights how evenly balanced sentiment has become after months of decline.

What Comes Next for Bitcoin Markets

For now, Bitcoin appears stuck in a fragile equilibrium, supported by long-term believers but capped by defensive positioning and weak liquidity. Options markets suggest traders are preparing for turbulence rather than recovery.

Until clearer signals emerge — whether from policy clarity, improved liquidity, or renewed institutional demand — Bitcoin’s path is likely to remain choppy. The coming weeks may determine whether this stall becomes a base for recovery or a pause before another leg lower.