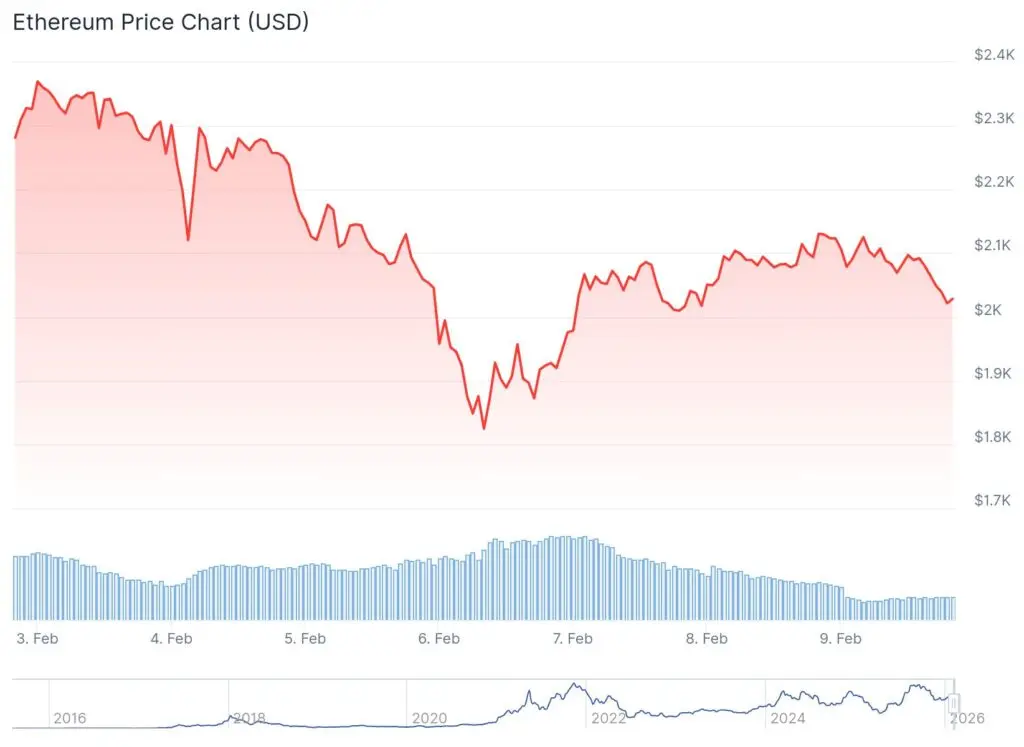

Ethereum’s Price History Reflects Cycles of Innovation and Speculation

Ethereum’s price trajectory over the past decade has been shaped by waves of technological optimism followed by abrupt market corrections. Unlike Bitcoin, Ethereum’s value has often been tied to expectations around innovation rather than scarcity alone.

From early smart contract adoption to today’s decentralized finance ecosystem, each rally has been fueled by new use cases. When enthusiasm cools, however, Ethereum has repeatedly faced sharp pullbacks that reset valuations.

The 2021 Boom Was Driven by Technology, Not Just Hype

Ethereum’s surge in 2021 was closely linked to major network upgrades and rapid growth in decentralized applications. Improvements aimed at reducing transaction fees and increasing efficiency generated optimism about Ethereum’s long-term viability.

This period also coincided with explosive interest in non-fungible tokens and on-chain finance. As developers and users flooded the network, demand for Ether rose sharply alongside activity.

DeFi Growth Anchors Ethereum’s Economic Role

Ethereum functions as the foundational infrastructure for decentralized finance rather than as a pure payment network. Protocols such as Uniswap and Maker rely on Ethereum’s blockchain to facilitate lending, trading, and asset issuance.

When DeFi expands, Ethereum benefits from higher transaction volumes and increased utility. Conversely, when DeFi activity slows, Ethereum’s price often weakens alongside reduced on-chain engagement.

Recommended Article: Ethereum Trading Enters a New Phase as Banana Gun Goes…

The FTX Collapse Marked a Structural Turning Point

The market downturn following the collapse of FTX in late 2022 reshaped Ethereum’s investment narrative. Confidence in centralized intermediaries collapsed, triggering widespread risk aversion across crypto markets.

Ethereum was not immune to the fallout, despite its decentralized architecture. Capital exited rapidly, and prices failed to recover to prior highs even as network development continued.

Ethereum’s Value Remains Tied to Broader Crypto Sentiment

While Ethereum’s fundamentals differ from Bitcoin’s, the two assets remain closely correlated during periods of stress. When investors retreat from crypto broadly, Ethereum typically follows Bitcoin lower regardless of internal progress.

This correlation highlights the market’s tendency to treat digital assets as a unified risk class. Technological differentiation becomes secondary when liquidity tightens and fear dominates trading behavior.

NFTs Cemented Ethereum’s Cultural and Economic Influence

Non-fungible tokens played a decisive role in establishing Ethereum as a cultural platform rather than just financial infrastructure. Record-breaking digital art sales introduced millions of new users to blockchain technology.

Although NFT activity has cooled significantly, the sector demonstrated Ethereum’s flexibility. Gaming, entertainment, and intellectual property applications continue to build on the foundation established during the NFT boom.

Ethereum’s Future Depends on DeFi Recovery and Regulation

Ethereum’s long-term outlook remains closely linked to the recovery of decentralized finance and regulatory clarity. Platforms such as Coinbase play a role in bridging traditional finance and blockchain-based systems.

If DeFi regains momentum under clearer legal frameworks, Ethereum’s utility-driven demand could strengthen. Until then, price action is likely to remain constrained by macroeconomic pressures and cautious investor sentiment.