The President’s trade war has recently escalated with the implementation of a 25% tariff on iPhones not assembled in the United States. This is an attempt to coerce Apple into shifting its manufacturing base to the US, a demand that poses significant challenges for the company.

Apple has continuously leveraged a complex ecosystem of contract manufacturers in China, spending billions building factories and developing supply chains. In response to earlier threats of tariffs, Tim Cook, the CEO, stated that during the March to June timeframe, most of the iPhones sold in the US would be assembled in India. Even with these efforts, Cook admitted Apple would face an additional $900 million in costs due to the trade war during that quarter.

The Expense of Producing Domestically

Experts have cautioned that moving the production of the iPhone to the U.S. would trigger price surges. Dan Ives from Wedbush Securities estimated that the $1,000 price for an iPhone manufactured in China or India would exceed $3,000 if production shifts to the U.S. He also believes that such a transition could not be completed until after 2028. Bank of America analysts expect at least a 25% increase on top of growing labor costs; considering tariffs on imported parts, the overall cost would increase by 90% or even more.

South China Morning Post

The U.S. iPhone manufacturing supply chain has a gap in skilled workers in the vocational sectors. “In the U.S. you could have a meeting of tooling engineers and I’m not sure we could fill the room. In China, you could fill multiple football fields,” noted Cook during a 2017 Apple conference.

Apple’s Strategic Investments and Challenges (new header)

Apple said in a bid to appease the administration, which seemed concerned regarding job creation, they would invest 500 billion and hire 20,000 by 2028. These investments, however, focus on data centers and artificial intelligence, not on Apple smartphone production. The company also pledged to fund an AI server dedicated data center in Houston, Texas, aligning with the industry’s shift toward turns of roteem artificial intelligence.

However these initiatives were set forth by the company, it will still be immensely difficult to move the production of the iPhone because of the intricateness of the supply chain and infrastructure for manufacturing in the US.

Market Reactions and Future Implications (new header)

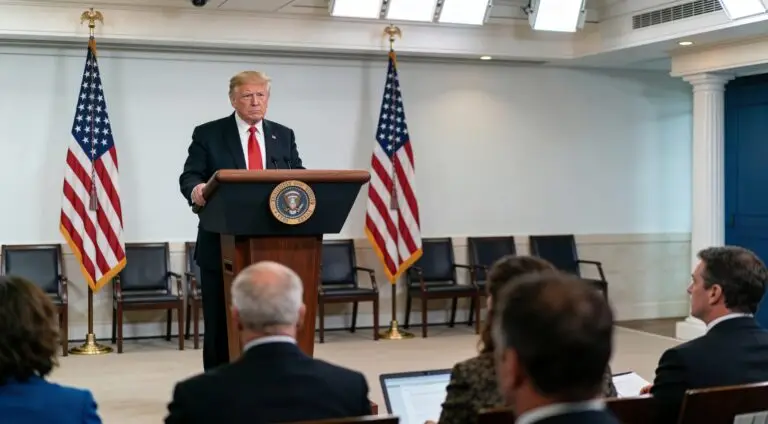

The iPhone maker has experienced high volatility in their stock price because of the increasing trade war fears. When Trump made his speech announcing the tariffs, this had resulted in a 2.3% drop in stock value, followed by bearish sentiment from the rest of the market.

Increased pricing on iPhones may have a negative impact on consumer demand. Industry experts speculate that Apple is likely to increase the pricing for their phones in the fall when new models are released. Apple’s product line valuation forecasted by Morgan Stanley’s Erik Woodring anticipates a price surge of 17% to 18% in the U.S. market due to increases in tariffs.

The services division of Apple, which had an impressive revenue of $96 billion last fiscal year, still remains operational without the concern of tariffs. This additional revenue helps Apple mitigate the losses that would occur from higher tariffs on hardware production.

Tariff Threats and Supply Chain Realities: Apple Faces Tough Choices Amid Political Pressure

President Trump’s proposed tariffs leave Apple negotiating political pressure with practical business scenarios, putting them squarely between a rock and a hard place. The administration’s “make it in America” mantra is suffocating any chance of relocating overseas given the current time frame. With everything that is happening, Apple has pivotal choices to make that will influence their manufacturing approaches and alter their markets for decades to come.