Asian Session Leads Global Bitcoin Returns

Crypto market data shows that Asian trading sessions have outperformed their U.S. and EU counterparts over the past year. According to Velo, Asian sessions delivered 47% cumulative returns, compared to 31% in the U.S. and 29% in Europe. This reflects Asia’s growing role in crypto trading momentum.

Ryan Lee, chief analyst at Bitget, linked this rise to a “69% year-over-year increase in APAC trading volumes, reaching $2.36 trillion by mid-2025.” He added that regulatory clarity in Hong Kong has significantly boosted institutional interest and stablecoin adoption in the region.

Retail-Driven Volatility in Asian Markets

Analysts point out that the key driver behind Asia’s strong returns is the retail-heavy nature of its market. Jeffrey Ding, chief analyst at HashKey Group, explained that “Asian markets are still more retail-driven, which naturally brings higher volatility and a stronger speculative element.”

While U.S. and EU flows remain dominated by institutional investors, Asia’s speculative appetite has pushed volume and returns higher. This retail activity has made Asia’s sessions more dynamic but also more unpredictable compared to Western markets.

The Kimchi Premium Signals Demand in Korea

One indicator of Asia’s strong trading demand is the so-called “Kimchi Premium.” This premium measures the difference between Bitcoin prices on South Korean exchanges like Upbit and Bithumb versus global exchanges such as Coinbase and Binance.

According to CryptoQuant data, the Kimchi Premium has remained mostly positive throughout the past year, signaling sustained local demand. Periodic spikes have reinforced the perception that South Korean traders pay more for Bitcoin, highlighting Asia’s outsized influence in global price action.

Recommended Article: Bitcoin Options Traders Brace for More Downside Amid Market Rout

Eastward Liquidity Shift Strengthens Asian Exchanges

The increase in Asian returns also reflects a broader liquidity migration toward APAC exchanges. Analysts note that the U.S. versus offshore exchange reserve ratio has declined, further cementing platforms like Binance, Bybit, and Bitget as dominant venues.

Lee suggested that this “eastward liquidity shift,” when combined with high speculative flows, could help sustain Asia’s market dominance. However, he cautioned that the next stage of Bitcoin’s bull run will still require institutional participation from the West.

U.S. Policy Still Shapes the Bigger Picture

Despite Asia’s strong returns, analysts stress that the U.S. remains central to Bitcoin’s long-term trajectory. Ding emphasized that global liquidity cycles, Federal Reserve decisions, and U.S. regulatory frameworks continue to guide institutional flows.

“The Asian session is amplifying the Bitcoin bull run,” Ding noted, but he added that it is ultimately “a product of U.S. policy and positive expectations around liquidity.”

Speculative Surge May Not Sustain Bull Run Alone

While Asian speculative flows may temporarily slow Western institutions, analysts argue this won’t fundamentally alter the bull run’s second phase. The sustainability of the cycle will depend on broader liquidity conditions, leverage in derivatives markets, and institutional confidence.

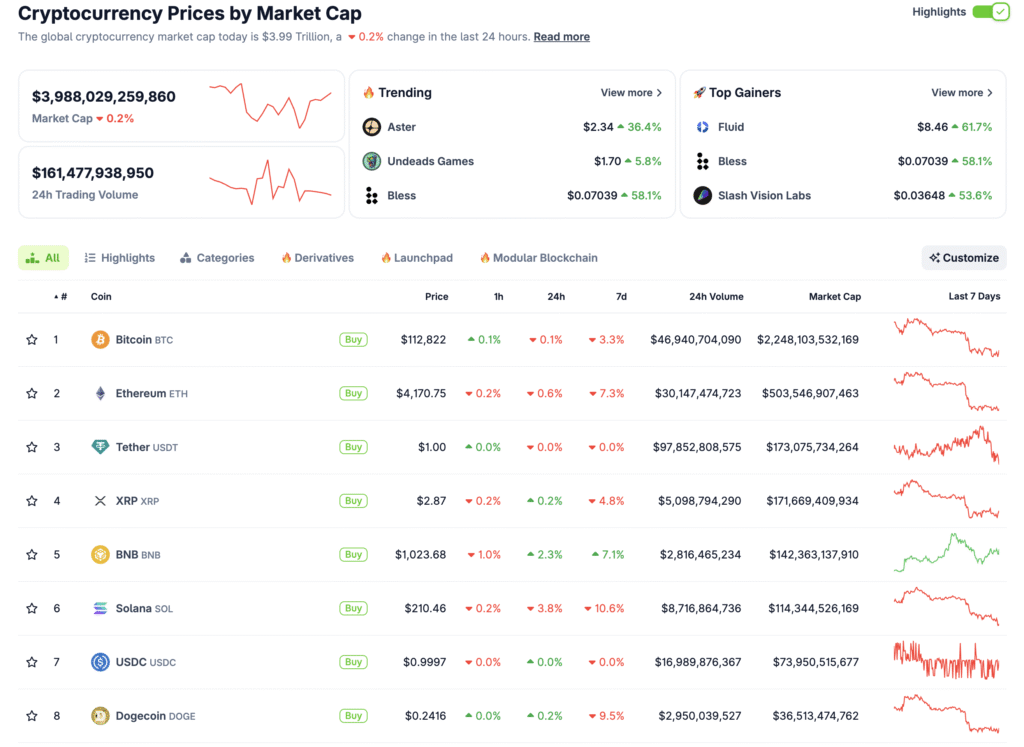

Bitcoin is currently trading at $113,000 after attempting a recovery bounce following Monday’s liquidation cascade, per CoinGecko data. Analysts remain divided on whether retail-driven surges can carry the rally, or if Wall Street inflows will be needed to sustain the next major leg upward.