Aster Suffers Sharp Decline in Broad Market Downturn

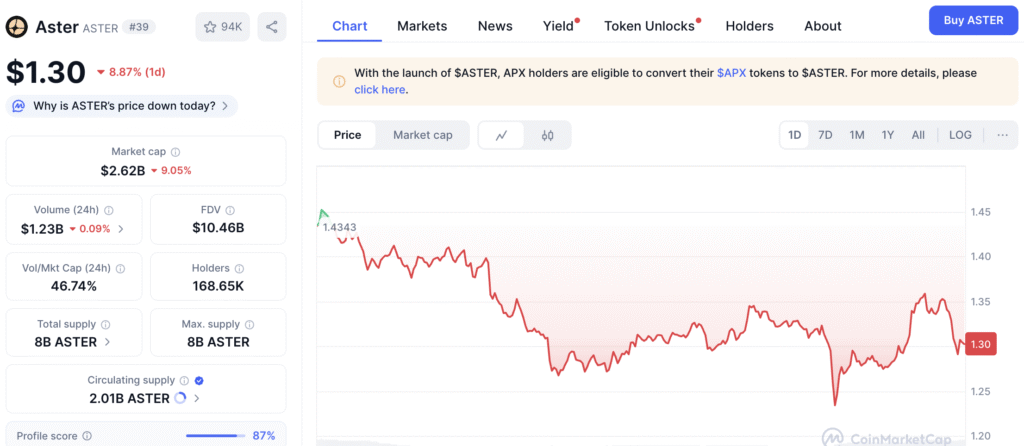

Early Thursday, the cryptocurrency market experienced a significant sell-off, with Aster (ASTER) being one of the most affected assets. The token experienced a significant drop of 13% within a 24-hour period, reflecting the broader downturn seen throughout the altcoin market.

Aster’s retreat showcases the caution permeating the digital asset landscape as traders begin to unwind their leveraged positions. The decision comes after a significant $100 billion decline in global crypto market capitalization during just one trading session.

Bitcoin’s Drop Sparks Chain Reaction Across Altcoins

The unsuccessful recovery effort of Bitcoin has heightened negative sentiment throughout the market. Following a brief peak at $116,000 earlier this week, the top cryptocurrency fell below $111,000 on Thursday morning.

The recent pullback has wiped out earlier gains and reignited concerns about a potential deeper correction heading towards the $110,000 psychological level. The selling pressure has pulled the total market capitalization down to approximately $3.85 trillion.

Ethereum and XRP Lead Declines Among Majors

Significant altcoins experienced a decline as Ethereum decreased by 4.4%, falling below $4,000, while XRP saw a 5% drop to $2.39. Other prominent projects, such as Solana, Cardano, and Chainlink, experienced declines ranging from 6% to 8%.

In the face of widespread weakness, market dominance has reverted to Bitcoin, which currently holds around 57.2% of the total market capitalization. Investors appear to be seeking refuge in safer options as volatility continues to persist.

Recommended Article: Aster Whale Deposits Fuel Strong Bullish Momentum Toward $5

Aster’s Technical Structure Faces Short-Term Pressure

After a period of notable strength, Aster’s recent pullback indicates a temporary fatigue in its upward momentum. The token’s price, which had previously stabilized above $1.55 earlier in the week, is now encountering fresh challenges as it approaches lower support levels.

Experts in technical analysis highlight the $1.20–$1.25 range as a crucial support level, suggesting that renewed buying may occur if overall sentiment begins to stabilize. A significant drop beneath this level could reveal additional downside potential towards $1.00 prior to any recovery effort.

Aster Hit by $19B Liquidation Wave as Market Volatility Intensifies Globally

Recent data from prominent exchanges indicates that more than $19 billion in leveraged positions were liquidated amid the market turmoil experienced last week. Over 1.6 million traders experienced closed positions, leading to heightened volatility and increased short-term selling pressure.

Experts link this wave of liquidations to a combination of broader economic worries and profit-taking in sectors that have stretched themselves too far. The enforced deleveraging has momentarily depleted liquidity, resulting in more pronounced price fluctuations in mid-cap assets like Aster.

Institutional and Retail Investors Await Clear Direction

Institutional desks and retail traders are exercising caution, with a significant number choosing to maintain stablecoins or hedge their positions via derivatives. Aster’s recent fluctuations highlight the industry’s responsiveness to Bitcoin’s performance and the prevailing mood in global markets.

Analysts indicate that a resurgence in buying interest may emerge if Bitcoin finds stability around $110,000 and investor confidence rebounds. Currently, accumulation seems constrained as traders look for signs of a wider market turnaround.

Aster’s Long-Term Fundamentals Continue to Be Strong

Even with the ongoing correction, Aster maintains strong network fundamentals, highlighted by growing DEX participation and a rise in on-chain liquidity. These elements may facilitate recovery as macroeconomic conditions enhance.

Should market sentiment change and trading volume increase, Aster may swiftly recover momentum towards the $1.50–$1.70 range. For the time being, a careful approach and effective risk management continue to be the prevailing strategies in the trading landscape.