Aster Sees $68M Transfer From Galaxy Digital Sparking Market Speculation

The price of Aster has experienced a surge of interest following reports that Galaxy Digital moved over 40.8 million tokens to Binance. A significant deposit, estimated at approximately $68 million, was succeeded by lesser inflows totaling $12 million in the past few hours. The unexpected increase in exchange deposits has ignited speculation regarding potential liquidity strategies or heightened involvement from institutions in the market expansion of the project.

Amid worries about possible sell pressure, traders interpret these deposits as a positive indicator of institutional confidence. In the past, when major entities gathered or injected liquidity, the ensuing trading depth fostered more robust and enduring market frameworks.

Market Response Indicates Optimistic Investor Attitude

In the wake of significant whale deposits, Aster’s price surged by nearly 18% within just one day, finding stability above the $1.55 threshold. This response indicates that investors view Galaxy Digital’s participation as a validation rather than a strategy for cashing out. The rise in open interest and daily volume highlights the increasing engagement from both retail traders and professional investors.

Experts observe that price movements supported by institutions typically result in more robust long-term positioning. If maintained, the blend of liquidity and optimism could lay the groundwork for another notable bullish surge in the months ahead.

Aster Fundamentals Strengthen as DEX Volume and Utility Show Sharp Growth

In addition to the exchange inflows, on-chain indicators highlight the strengthening fundamentals within the Aster ecosystem. The volume of the project’s decentralized exchange (DEX) has seen a significant increase, propelled by growth in revenue and an uptick in transaction counts. Heightened liquidity and enhanced utility serve as crucial indicators of a developing network ready for consistent adoption.

Concurrently, the surge in social mentions and discussions among influencers has significantly heightened community awareness. The signals indicate a growing presence of network effects, which are likely to bolster valuations as time progresses.

Recommended Article: No ASTER or XRP Price Prediction Can Compete with PDP’s 8,000% Upcoming Rally.

Technical Patterns Indicate Consolidation Before Breakout

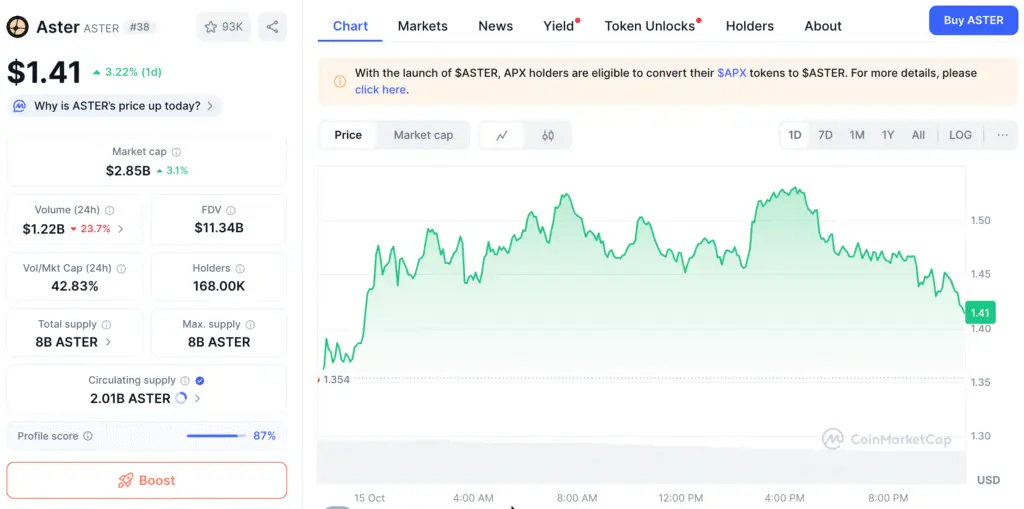

The Bollinger Bands on Aster’s chart are showing signs of tightening, indicating a compression of volatility and hinting at a possible breakout scenario. Although short-term oscillators like the Stochastic RSI indicate a momentary overbought scenario, these trends frequently signal an impending retest of lower support levels.

A retracement toward $1.44 that results in a successful rebound may serve as a confirmation of the bullish structure’s strength. Experts anticipate a continuation pattern that could push towards the $2.10 resistance level, provided that momentum holds steady through the fourth quarter.

Important Resistance and Support Levels to Monitor

Support is currently positioned at $1.44, with a more robust buying interest emerging around $1.20. Consistent trading above $1.55 may pave the way for a challenge at $2.10 and beyond. The inability to maintain the $1.20 threshold could lead to a resurgence of short-term correction phases.

Nonetheless, the sustained upward trajectory is preserved as long as Aster continues to establish a pattern of consistent higher highs and higher lows. The price must maintain strength above $2 to serve as a critical indicator for a potential medium-term rally.

Is It Possible for Aster to Hit $5 by 2025?

Should Bitcoin maintain its position above $110,000, we may see a ripple effect of optimism throughout prominent altcoins such as Aster. The token’s robust fundamentals, expanding decentralized exchange ecosystem, and increasing institutional interest position it well for a potential range of $3 to $5 in the coming year.

Experts warn that significant market downturns may hinder advancement, yet ongoing liquidity expansion is expected to create strong recovery prospects. Aster’s role in high-utility ecosystems significantly bolsters its long-term investment story.

Aster Gains Institutional Attention as Galaxy Digital Boosts Market Confidence

Galaxy Digital’s participation highlights the increasing recognition among institutions regarding mid-cap altcoins such as Aster. Liquidity provisioning, as opposed to profit-taking, underpins market stability and fosters opportunities for deeper price discovery.

Should the accumulation of whales continue and market sentiment stay favorable, Aster may aim for even loftier targets in the $8–$10 range by late 2025. The observed patterns suggest the emergence of a potential new growth cycle within the ecosystem.