Avalanche Enters a Bearish Phase After Losing Key Support

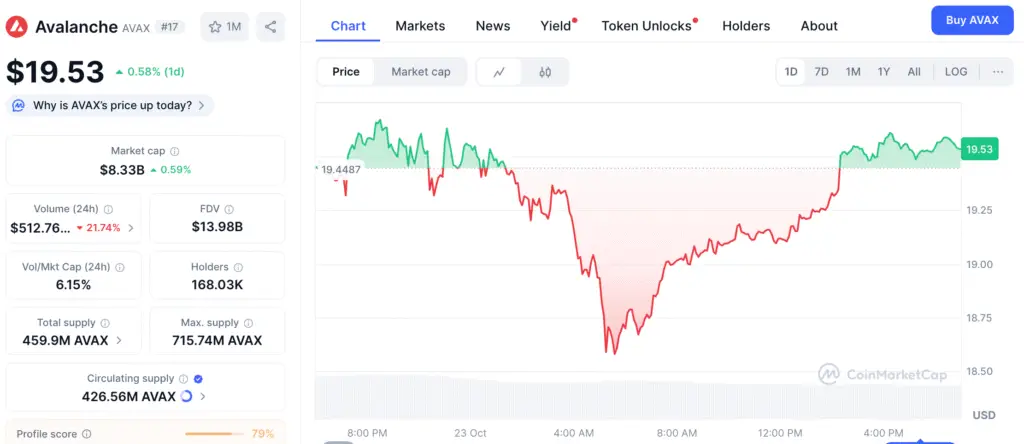

The price of Avalanche’s native cryptocurrency, AVAX, is going down again as technical indications turn negative for the first time in months. Over the past week, the token has lost around 15% of its value and is already below the important $21.50 support zone. At the time of writing, AVAX is trading at about $19.43, which means that bears are firmly in charge of short-term momentum.

During the same time frame, trade volume rose by more than 26%, which is a clear sign that this drop is happening. The increase in activity shows that more sellers are becoming involved in the market and seem intent on cutting prices, maybe aiming for the next important milestone around $17 or even $15.

First Bearish MACD Crossover Since January Raises Alarms

The Moving Average Convergence Divergence (MACD) indicator has shown its first bearish crossing since January 13. This is a big change in the direction of the trend. When this kind of crossing happened before, Avalanche’s price dropped quickly from $54.61 to $14.96 in three months, which makes traders cautious.

This crossing usually means that momentum is slowing down and the chance of going down is higher. Analysts say that AVAX’s pattern of lower highs and lower lows makes the bearish argument stronger. This means that any effort to rebound may run into trouble around past breakdown zones.

Avalanche Price Stuck Below Key Resistance, Eyes $17 Support Retest

Avalanche is still stuck in a declining channel on the weekly chart, which is still guiding its long-term price action. Sellers have turned down many efforts to break higher, holding AVAX below important resistance levels. This pattern shows that the bears are still in charge and there are no signs of a change right now.

If things keep going the way they are now, the token might drop near its next key support zone, which is about $17. A clear breach below that level would show the psychological $15 barrier, which was a level that caused recovery rallies earlier this year.

Recommended Article: Avalanche Market Rebounds as Smart Money Loads Up on AVAX

Momentum Indicators Confirm Seller Dominance

Short-term indicators show obvious signals that the market will keep going down. The Awesome Oscillator is now at -0.29, which shows that sellers are still in charge of the market’s strength. The steady red histogram bars show that bullish energy is diminishing and negative pressure is building.

The Bull Bear Power (BBP) indicator also shows a value of -1.12, which is more proof that selling is getting stronger. Analysts say that this reading strongly supports the idea that bears have taken over the market and buyers are having a hard time getting back on their feet.

Avalanche Oversold Readings May Trigger Short Rebound Before Recovery

The Money Flow Index (MFI) is presently close to 29.00, which means that money is leaving the market quicker than it is coming in. This drop in buying volume generally comes before more negative movement, especially when it is combined with oversold momentum readings.

The Relative Strength Index (RSI) is also close to 30.84, which means that AVAX is getting close to being oversold. This might cause a short-term rally, but the overall trend is still negative until momentum indicators indicate a steady recovery above important resistance levels.

Fibonacci Levels Define Avalanche’s Critical Price Zones

Fibonacci retracement analysis shows that AVAX is presently trading below the 0.236 level, which makes its technical position worse. The next level of structural support is at $15.66. If this level is breached, it might cause further selling pressure and worse losses.

On the other hand, a bounce back from this support zone might aim for the 0.236 retracement line, which is close to $20.51. If the market closes above that level every day, it will be the first step toward stopping the decline and maybe even starting a reversal pattern in the next few sessions.

Avalanche Faces Bearish Phase as Price Risks Drop Toward $15 Support

Avalanche’s overall technical structure shows that it will become weaker before it gets better, even though it is now oversold in the short term. If the price stays below $17 for a long time, it will probably indicate that it is going to keep going down to the $15 objective, where there may be more buying activity.

Traders are still being careful for now since Avalanche is about to have its first significant bearish crossing in almost 10 months. AVAX’s downturn looks like it will continue until bulls can get back to the $20–$21 range and start moving up again. This makes the $15 support test more likely to happen in the next few weeks.