Avalanche Gains Momentum Close to Crucial $30 Support Level

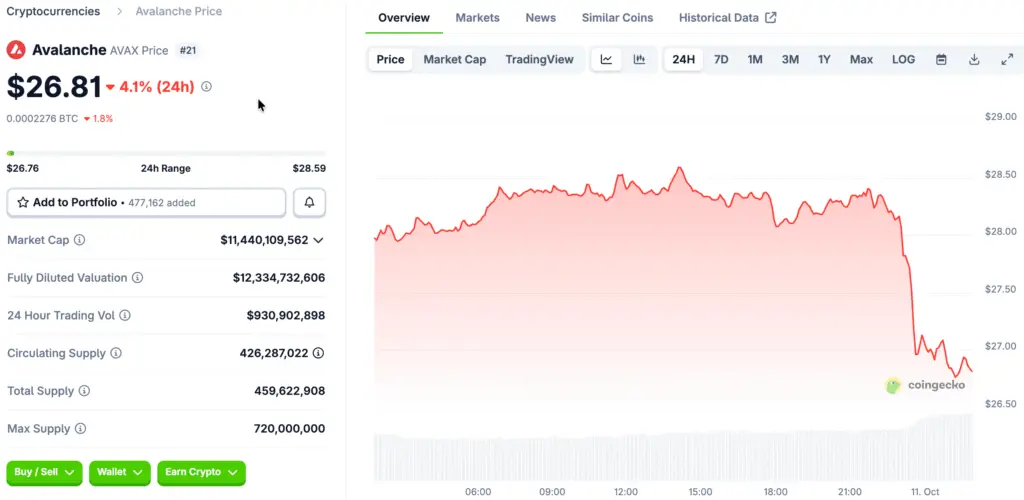

Avalanche is currently stabilizing near the important $30 support level, as traders keep a keen eye on price movements within this accumulation area. The current market structure reveals a narrowing range, implying that a significant breakout may occur as volume begins to increase.

Experts emphasize that sustaining support within the $29 to $30 range will be crucial for validating the upcoming bullish movement. If the current trend continues, AVAX may reach $35 again before moving towards the $50 area as part of a larger recovery effort.

Developer Engagement Soars as Avalanche Ecosystem Grows

Contracts deployed on Avalanche have exceeded 44 million, marking a threefold increase in just one year. This remarkable growth highlights the network’s increasing significance in the DeFi and smart contract arenas.

Growing developer involvement plays a crucial role in enhancing ecosystem robustness, boosting the demand for AVAX and strengthening investor trust. This ongoing engagement enhances on-chain liquidity and creates a stable atmosphere conducive to innovation and adoption.

Avalanche Forms Bullish Flag Pattern Signaling Possible Rally Toward $108 Resistance

The AVAX chart is showing a bullish flag pattern forming just below key resistance levels. Historically, these formations indicate a robust potential for continuation after periods of consolidation.

If validated, the pattern’s projected movement aims for around $108, coinciding with Avalanche’s earlier supply zone. Experts suggest that a move past $35 may initiate a push towards elevated resistance levels.

Recommended Article: Remittix, Shiba Inu, and AVAX Drive PayFi Growth Globally

On-Chain Activity Nears $1 Trillion Milestone

The total volume on the Avalanche network has exceeded $950 billion, nearing the significant $1 trillion mark. This underscores significant liquidity and increasing involvement from institutions within DeFi platforms.

The significant capital flow underscores Avalanche’s status as one of the most dynamic blockchain ecosystems in the world. It additionally offers robust on-chain backing for possible price increases as investor confidence rebounds.

Indicators Reinforce Bullish Sentiment for AVAX

Technical indicators suggest a positive perspective for Avalanche. The 50-day and 200-day moving averages continue to hold steady, indicating persistent accumulation. Momentum oscillators such as RSI and MACD are slowly shifting towards a positive direction.

The Pi Cycle Top and VMC Cipher tools indicate conditions that are conducive to a resurgence of upward momentum. Experts anticipate that surpassing the $38 to $40 range may signal a significant transition toward bullish control.

Institutional and Retail Confidence Strengthen Avalanche Outlook

Institutional players are steadily boosting their engagement with Avalanche, attracted by its impressive throughput and supportive environment for developers. This surge of strategic investment strengthens network resilience in the face of wider market fluctuations.

Retail traders are once again getting involved as enthusiasm grows regarding the expansion of the ecosystem. With the introduction of new applications and the growth of DeFi liquidity, the long-term fundamentals of Avalanche seem to be more robust than ever.

Avalanche Targets $50 as Price Holds $30 Support and Momentum Builds Toward $108

Should Avalanche uphold its framework above the $30 accumulation base, experts anticipate a steady ascent toward $50 in the coming weeks. Continuing momentum past that range may pave the way to $108.

The robust involvement of developers, unprecedented liquidity levels, and optimistic chart patterns all contribute to Avalanche’s positive momentum. With both fundamentals and technicals in harmony, AVAX stands out as a leading altcoin to monitor as we approach late 2025.