Avalanche Price Gains Renewed Attention From Crypto Investors in October

Avalanche has gotten investors’ attention again as its price stabilizes near important support levels before October. The cryptocurrency was very volatile in September, creating both bullish and bearish price patterns on its daily chart.

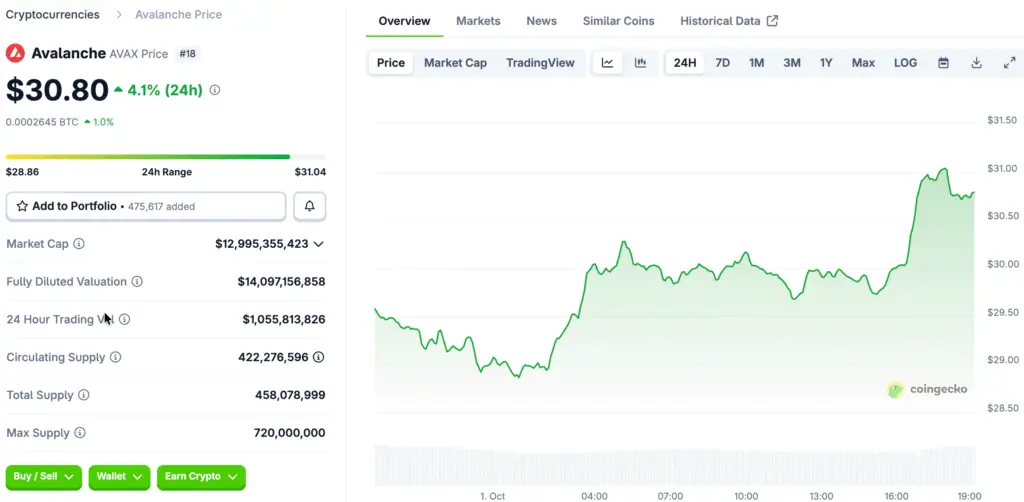

Avalanche went back down to the $30 range after going up from $23 to $36 earlier in September. Traders now think that this phase of consolidation could be the start of a bullish breakout that aims for much higher resistance levels.

Avalanche Network Activity Grows Quickly Across Many Important Metrics

The Avalanche network has grown a lot in the last few weeks, which is a sign of more transactions and more active addresses. Nansen data shows that transactions went up by 178% in the last thirty days, reaching almost 49.75 million recorded activities.

Active addresses went up by 29%, reaching 734,035 during the same time, which shows that more people are using the service. This increase in use also raised network fees by 102% to $1.43 million, which shows how Avalanche is becoming more important in decentralized finance ecosystems.

Major Institutional Partnerships Strengthen Avalanche Ecosystem Fundamentals

Adoption by institutions has sped up, and important changes have made Avalanche’s broader ecosystem stronger. Anthony Scaramucci’s SkyBridge Capital recently announced plans to start a $300 million tokenized fund that will use Avalanche’s blockchain infrastructure to grow.

In the meantime, developers made a final deal with Mirae Asset, a company that manages $316 million in assets. Mirae wants to tokenize investment products on Avalanche, and Balcony wants to tokenize real estate. This shows that more and more institutions trust Avalanche’s technology.

Recommended Article: Cardano vs Avalanche vs Remittix Top Crypto Battle

Strategic Capital Inflows Boost AVAX Token Market Demand Outlook

Avalanche’s bullish potential has been strengthened even more by large amounts of money coming in as we head into October’s trading sessions. HiveMind was able to raise $550 million to buy AVAX tokens, which shows that smart investors believe in Avalanche’s long-term value proposition.

Avalanche is also getting ready to start a $1 billion treasury acquisition fund that will focus on getting more AVAX. This strategic treasury initiative is expected to make the market more liquid while also increasing demand for tokens in the coming months.

Anticipated ETF Approvals Could Unlock New Investor Demand Channels

People in the market are keeping a close eye on possible regulatory changes that could have a positive effect on Avalanche’s price. Several industry experts say that the Securities and Exchange Commission will likely approve a number of AVAX-based exchange-traded funds in October.

Such approvals would be a big step forward, allowing more institutional capital to get exposure to Avalanche through regulated financial instruments. If American investors buy more AVAX, it could speed up the accumulation of AVAX, which could lead to a price rise toward the $50 resistance level.

Technical Analysis Highlights Bullish Cup and Handle Breakout Formation

Technical indicators point to the fact that Avalanche may be getting ready for a big bullish breakout pattern to form. The AVAX daily chart shows that prices are currently moving sideways in the handle part of a classic cup-and-handle structure, which has historically come before upward continuation moves.

Also, AVAX is still well above both its fifty-day and one-hundred-day exponential moving averages. This alignment of moving averages shows that the trend is likely to continue, with bulls increasingly focusing on the next resistance cluster near $50.

Avalanche Traders Watch $28 Support as ETF Hopes and Activity Grow

October looks like it will bring important changes that could help Avalanche move higher toward important resistance levels. A strong bullish story comes from more network activity, partnerships with institutions, money coming in, and possible ETF approvals.

Traders will keep a close eye on how prices act around the $28 support zone. If prices stay above this level, the bullish scenario stays in place. If Avalanche breaks out toward $50, it will strengthen its position as a top blockchain ecosystem in the current market cycle.