Avalanche Demonstrates Resilient Potential Amidst Price Challenges

Avalanche (AVAX) is at a crucial juncture in its development, with experts highlighting its cross-chain architecture as a significant factor for upcoming expansion. In the face of recent fluctuations and significant weekly downturns, analysts maintain that the underlying strengths of AVAX are solid, suggesting that its potential for recovery surpasses that of many other Layer-1 contenders.

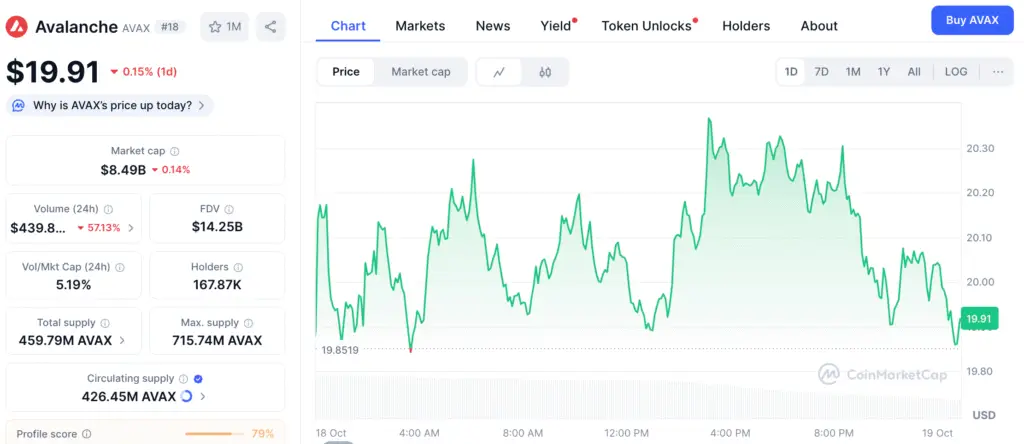

At present, AVAX is fluctuating between $10 and $33, indicative of the prevailing market volatility. The token has experienced a decline of approximately one-third in its value over the last month, but technical indicators imply that the downward trend may be approaching its limit. Market analysts suggest that this range may act as a significant accumulation area for traders looking forward to a potential rebound.

Analytical Perspective: Critical Resistance Points Under Examination

Experts have pinpointed $43 as the forthcoming significant resistance level for Avalanche, indicating a potential increase of around 40% from its current upper price range. If the positive momentum continues, AVAX may see its rally push towards $65, potentially doubling its value from where it stands now.

Recent pullbacks, as illustrated by chart patterns from TradingView, suggest a potential reversal setup, bolstered by stabilizing on-chain activity. If validated, a significant surge beyond $43 might signal the onset of a midterm upward trend, propelling AVAX closer to its historical averages and rejuvenating investor confidence.

Avalanche Pushes Ahead of Ethereum in Cross-Chain and DeFi Integration

Avalanche’s innovative approach to multi-chain technology sets it apart from other Layer-1 blockchains. Through enabling fluid interaction among various networks, AVAX seeks to address a significant hurdle in the cryptocurrency landscape: achieving scalability while maintaining both speed and decentralization.

This method utilizes Avalanche’s Subnet framework, allowing developers to create tailored blockchains that combine liquidity and interoperability, all while ensuring independent performance. Experts emphasize that this characteristic establishes AVAX as a frontrunner in cross-chain decentralized finance and enterprise integration, providing it with a tangible edge over singular networks such as Ethereum.

Recommended Article: AVAX Gains Ground in Crypto Payroll Adoption Despite Risk

Challenging the Dominance of Layer-1 Titans

As competitors like Solana, Cardano, and Polkadot advance in enhancing scalability and user experience, Avalanche stands out with its innovative architecture and cross-chain approach, providing it with a unique advantage in the landscape. Solana showcases remarkable speed, yet it frequently faces scrutiny regarding its network reliability. In contrast, Cardano’s governance model is secure, but its progress tends to be gradual.

Polkadot is actively developing its parachain ecosystem, while AVAX’s advantages in lower latency and higher throughput could lead to quicker real-world applications. The current dynamics support expert forecasts that Avalanche is poised to be among the most robust assets during the Layer-1 recovery phase.

Avalanche Gains Traction as Preferred Settlement Layer for Enterprises

The growing Avalanche ecosystem is drawing in developers, businesses, and institutional investors in search of robust infrastructure solutions. Recent reports indicate an increasing trend of decentralized applications and token launches on the platform, particularly in the realms of finance, gaming, and asset tokenization.

Institutional investors are actively seeking exposure to AVAX via derivative products and venture partnerships, indicating a strong belief in the network’s design for the long haul. Experts highlight that this degree of involvement emphasizes AVAX’s capacity to emerge as a favored Layer-1 settlement layer for enterprise blockchain applications.

Market Volatility Offers Strategic Entry Opportunities

Despite the notable fluctuations in AVAX’s price, those with a long-term perspective see the current levels as opportune moments to invest. The blend of reduced valuation and robust technical groundwork presents an enticing risk-reward dynamic. Observers monitoring on-chain metrics have noted a rise in wallet activity and a steady accumulation of indicators that may suggest a potential bottom formation.

Should market conditions stabilize, the forthcoming cross-chain updates for Avalanche may act as a significant driver for recovery, enabling the token to recover its previous standing and regain its position among the top altcoins.

Avalanche’s Layer-1 Advancements Could Redefine Blockchain Connectivity

Through its groundbreaking cross-chain technology, user-centric subnets, and strong community backing, Avalanche consistently proves its status as a leading Layer-1 recovery option for 2025. Experts concur that the forthcoming growth phase of AVAX is expected to be propelled by increased adoption, enhanced interoperability, and ongoing technical advancements.

If its ecosystem momentum persists and overall market sentiment shifts positively, Avalanche may rise again as a significant player in the evolution of scalable blockchain infrastructure, transforming the ways networks connect, interact, and grow in the future.