BNB Remains Resilient as Market Prepares for Upcoming Surge

Binance Coin (BNB) is currently stabilizing around its significant $1,000 support level, which experts suggest may signal the onset of a robust new upward trend. Although there has been a slight decline of 3.34% in the past 24 hours, investor confidence continues to be robust, with the majority of traders anticipating a forthcoming breakout.

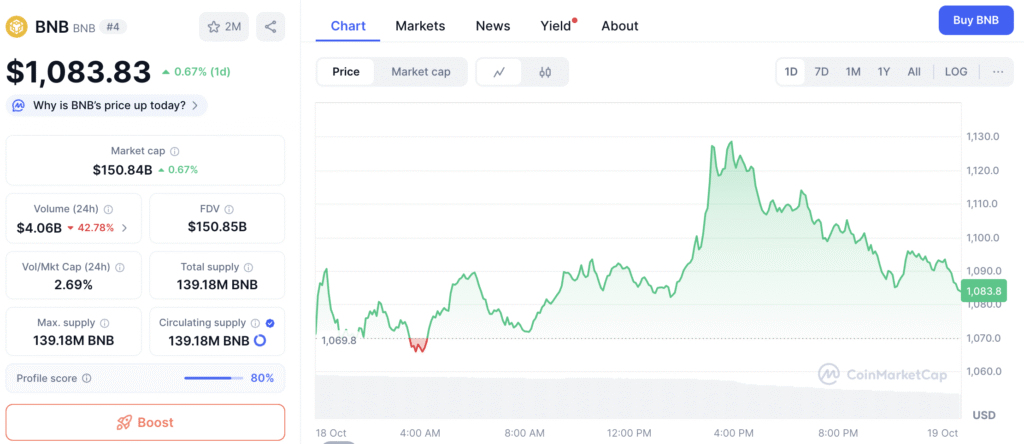

As of the latest update, BNB is priced at $1,092, boasting a market capitalization of $150.54 billion and a daily trading volume of $13.04 billion, as reported by CoinMarketCap. This price zone has traditionally acted as a launchpad for significant upward movements, and current market sentiment suggests that the forthcoming shift could be dramatic.

Experts Indicate the Onset of a ‘Binance Super Cycle’

Crypto analyst Books (@DaoKwonDo) has characterized the present market phase as the “onset of the Binance super cycle.” He suggests that a short correction phase might come before a significant surge in growth, potentially pushing BNB to surpass its previous peaks.

He presented a chart indicating that the token’s technical configuration mirrors previous accumulation phases that sparked significant rallies of several hundred percent. The concept of a BNB-driven “super cycle” has recently captured attention on social media, igniting enthusiasm among traders who draw comparisons to the token’s previous bullish trends.

BNB Charts Show Bullish Structure as Analysts Eye $2,000 Price Target

In a notable development, analyst Crypto Patel highlighted the importance of sustaining price action above $1,000 to validate the forthcoming significant movement. Patel observed that maintaining a strong position at this level could ignite a surge toward the $2,000 mark, indicating a possible doubling in value if the momentum persists.

Technical charts indicate that consolidation patterns are emerging above BNB’s 100-day moving average, pointing to potential accumulation by significant investors. The asset’s ability to withstand recent fluctuations showcases its fundamental robustness and ongoing appeal to investors, despite the broader markets facing temporary downturns.

Recommended Article: BNB Faces Post-Crash Uncertainty as Volatility Levels Intensify

Market Sentiment Indicates a Resurgence of Confidence

Recent sentiment surveys indicate that a significant 82% of traders maintain a positive outlook on BNB’s trajectory, whereas merely 18% convey a negative sentiment. This optimism highlights an increasing confidence in Binance Coin’s future prospects and its capacity to excel in the upcoming market growth.

Experts emphasize that increased involvement from both institutional and retail investors has strengthened liquidity, aiding in the mitigation of price fluctuations and reinforcing support levels. The combination of robust fundamentals and prevailing market sentiment indicates that BNB is poised for its next rise.

Core Principles Reinforce Ongoing Resilience

Beyond market speculation, the strength of Binance Coin is rooted in its practical applications within the Binance ecosystem, facilitating trading fee discounts, enabling staking pools, and covering gas fees on the BNB Chain network. The ongoing expansion of the platform in areas such as decentralized finance, payments, and NFTs significantly boosts BNB’s inherent worth.

Recent enhancements to the network have boosted transaction efficiency and lowered fees, leading to ongoing demand. As Binance continues to lead in global crypto trading volume, experts identify BNB as one of the select large-cap tokens poised for notable growth in the upcoming cycle.

Analyzing BNB’s Trajectory in Relation to Previous Bull Markets

The current configuration of BNB reflects previous market patterns, where the token stabilized around crucial support levels prior to significant surges. Historical data indicates that following comparable pullbacks of 20–30%, BNB has frequently experienced a strong rebound, surpassing the performance of many leading altcoins.

Market participants are intently observing the critical ranges between $1,000 and $1,200, identified as the key accumulation zone. Analysts suggest that a breakout above the $1,200–$1,250 range could confirm the bullish trend and set the stage for a rapid ascent toward $1,800–$2,000.

BNB Maintains Bullish Long-Term Outlook Amid Market Volatility and Recovery

In light of recent fluctuations, the long-term perspective on BNB continues to be optimistic. The interplay of robust fundamentals, on-chain accumulation, and a shift in sentiment suggests a favorable outlook for the upcoming weeks.

Should Binance Coin maintain its position above $1,000 and draw in ongoing buying interest, experts concur that a transformative phase may be in progress, one that could reshape its price path and market influence as we approach 2026.