Bitcoin Declines After Months of Bullish Momentum

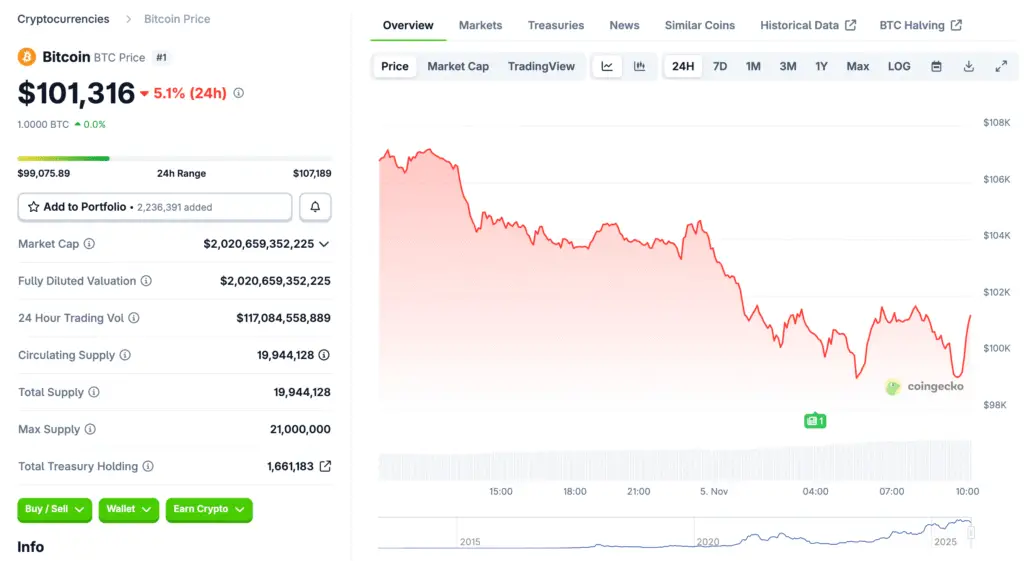

Bitcoin’s impressive 2025 rally has cooled as the world’s largest cryptocurrency fell below $100,000 for the first time since May. After reaching a record high above $126,000 in early October, Bitcoin’s price dropped more than 5% on Tuesday, signaling growing investor caution and broader market weakness.

Market Fear Replaces Neutral Sentiment

The market’s mood has shifted dramatically. According to CoinMarketCap’s Fear and Greed Index, sentiment turned from neutral to fear this week. This transition suggests that traders are becoming increasingly wary of continued volatility and profit-taking after months of aggressive buying and speculative euphoria.

ETF Outflows Intensify the Selling Pressure

Spot Bitcoin ETFs have seen $1.3 billion in outflows since October 29, based on data from SoSoValue. Prominent funds like BlackRock’s iShares Bitcoin Trust (IBIT), Fidelity Wise Origin Bitcoin Fund (FBTC), and Grayscale Bitcoin Trust (GBTC) have all recorded significant withdrawals. The sharp outflows underscore a cooling appetite for crypto exposure among institutional investors.

Recommended Article: Bitcoin Red October Ends With Bullish November on the Horizon

Ether and Solana Join the Downtrend

Altcoins followed Bitcoin’s decline, with Ethereum and Solana losing more than 8% each. The synchronized market drop emphasizes the ongoing correlation among leading cryptocurrencies. This downturn marks Bitcoin’s first red October since 2018, with weakness continuing into November.

Stocks Tied to Bitcoin Suffer Major Losses

Companies with exposure to Bitcoin also faced heavy losses. MicroStrategy, Coinbase Global, and Robinhood fell more than 6%, extending their declines after the close of trading. The downturn in these Bitcoin-linked equities highlights the impact of crypto sentiment on traditional financial markets.

Investor Uncertainty Surrounds Next Market Phase

Analysts remain divided over whether this pullback signals a deeper downturn or a healthy correction within Bitcoin’s ongoing market cycle. Some investors expect further declines, while others see it as an opportunity to accumulate at lower levels before the next bullish phase.

Bitcoin Bulls Still Buying the Dip

Despite the broader sell-off, certain long-term investors remain confident. MicroStrategy, led by Michael Saylor, announced the acquisition of 397 additional Bitcoins between October 27 and November 2, at an average price of $114,771. This move demonstrates continued institutional conviction in Bitcoin’s long-term potential.

Outlook: Volatility Returns to Crypto Markets

As outflows persist and market sentiment remains cautious, volatility is expected to stay elevated. Analysts suggest traders closely monitor ETF flows and macroeconomic indicators to gauge the next price direction. Whether this dip becomes a buying opportunity or the start of a prolonged correction, Bitcoin’s ability to hold near $100,000 will define the coming weeks.