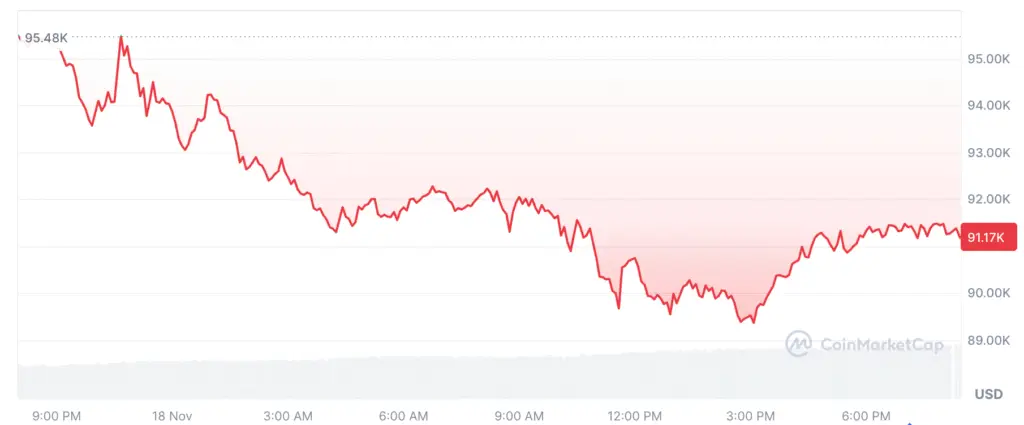

SINGAPORE / LONDON — November 18, 2025 — Bitcoin fell below $90,000 for the first time in seven months, signaling a renewed decline in market confidence. The world’s largest cryptocurrency has now erased all its 2025 gains, down nearly 30 percent from its October peak above $126,000.

Market analysts attribute the drop to growing caution over U.S. interest-rate uncertainty and an overall retreat from riskier assets. Around $1.2 trillion in total crypto value has been wiped out since October 7, according to data from CoinGecko.

Traders Note Rapid Shift In Market Sentiment

The decline highlights how quickly sentiment can reverse across digital-asset markets. Analysts said institutional players and listed firms began off-loading holdings once broader macroeconomic risks intensified.

Joshua Chu, co-chair of the Hong Kong Web3 Association, noted that institutional selling has amplified market contagion. He said that “when support thins and macro uncertainty rises, confidence can erode with remarkable speed.”

ETF Outflows Add Pressure To Falling Prices

Investor withdrawals from exchange-traded funds have worsened the slide. Joseph Edwards of Enigma Securities said many speculators initially entered crypto expecting regulatory support but are now retreating as that optimism fades.

He added that the selling pressure is not extreme but coincides with a weak buying environment after October’s massive leverage wipeout. Retail investors who were hit by liquidations are now hesitant to re-enter the market.

Recommended Article: Bitcoin Slips To $93,684 As Crypto Market Weakness Persists

Crypto Stocks Mirror Bitcoin’s Decline

Shares of major crypto-related firms have also moved lower. MicroStrategy, Riot Platforms, Mara Holdings, and Coinbase all fell alongside Bitcoin’s decline. These companies, heavily exposed to cryptocurrency valuations, have mirrored Bitcoin’s trajectory through multiple cycles.

Analysts said equity investors now view crypto stocks as proxies for market sentiment rather than growth plays, leaving them vulnerable to volatility and macro shocks.

Ethereum Also Suffers Extended Losses

The second-largest cryptocurrency, Ethereum, has been under consistent pressure for months, falling nearly 40 percent from its August high of $4,955. Technical analysts warn that Ether could test deeper support zones if risk aversion persists into December.

Despite emerging signs of reduced selling intensity, traders said liquidity remains fragile and confidence low after weeks of cascading declines across leveraged markets.

Broader Markets Turn Risk-Averse

The downturn in crypto coincides with weakness across global stock markets. European indices opened lower as investors grew wary of overvalued technology shares. Asian trading also reflected reduced appetite for speculative assets.

Analysts pointed out that the uncertainty surrounding U.S. rate-cut expectations has disrupted market rhythm. Investors are shifting toward cash and short-term bonds, awaiting clearer policy direction from the Federal Reserve.

Experts See Temporary Weakness, Not Structural Collapse

Matthew Dibb, chief investment officer at Astronaut Capital, said overall sentiment in crypto has been subdued since October’s liquidation wave. However, he described the current phase as cyclical rather than structural.

Dibb emphasized that Bitcoin’s long-term fundamentals remain intact despite the correction. He added that volatility should persist until macro conditions stabilize and institutional flows return to risk assets.

Outlook: Market Eyes Next Support Zone

Technical traders now focus on whether Bitcoin can hold the $89,000 to $90,000 range. A sustained drop below this zone could expose deeper support near $85,000. Conversely, a rebound above $95,000 may restore short-term confidence.

For now, analysts expect trading volumes to remain thin, with cautious sentiment dominating ahead of upcoming U.S. economic data. As one trader remarked, “the mood has changed — risk is out, patience is in.”