Bitcoin Volume Surges to Highest Level Since March

Bitcoin (BTC) has experienced its busiest trading week since March, with total weekly volume reaching $3.68 billion, as reported by Binance data. Even with the drop in price, the rise in liquidity indicates that institutional and large-scale traders are making a comeback in the market.

Analyst Arab Chain pointed out that this surge in activity corresponds with a time of increased volatility, indicating that investors are preparing for a possible rebound in late October. As BTC hovers around $104,900, the increasing involvement highlights a resurgence of trust among seasoned traders.

BTC Price Dips Under $105K Amid Turmoil From Tariff Impacts

The decline in Bitcoin comes on the heels of a tumultuous week characterized by escalating trade tensions between the U.S. and China. On October 10, the cryptocurrency experienced a significant decline, dropping nearly $17,000 from $122,000 to a low of $101,000 on various exchanges before finding some stability around the $105,000 mark.

The incident led to extensive liquidations amounting to approximately $19 billion, although subsequent assessments by market analyst Carmelo Alemán adjusted the figure to around $2.31 billion. In the wake of a significant sell-off, Bitcoin experienced a momentary surge to $116,000, only to retreat once more amid ongoing market volatility.

Record Liquidations Shake Traders but Confidence Builds

Recently, a significant correction prompted close to 300,000 traders to liquidate more than $1.1 billion in leveraged positions. Experts contend that significant deleveraging events frequently reset the market, setting the stage for the subsequent accumulation phase.

Market analysts observe that the increased trading volume alongside diminished leverage suggests that more resilient players, such as institutional and long-term investors, might be taking in supply at lower prices. This phase of “reaccumulation” usually comes before the next upward movement in Bitcoin’s cycle.

Recommended Article: Deutsche Bank Says Bitcoin Could Join Gold in Global Reserves

Exchange Data Reveals Diverging Market Flows

Analysis from CryptoQuant reveals varied circumstances among leading exchanges. The persistent negative funding rate on Binance over the past four days indicates that derivative traders continue to favor a short position. Nonetheless, a favorable Coinbase Premium indicates consistent demand in the U.S. spot market, suggesting that long-term investors are still in the process of accumulating BTC.

This difference between derivatives and spot markets suggests that speculative pressure might be diminishing while genuine buying is gaining momentum, an optimistic indication for a possible short-term turnaround.

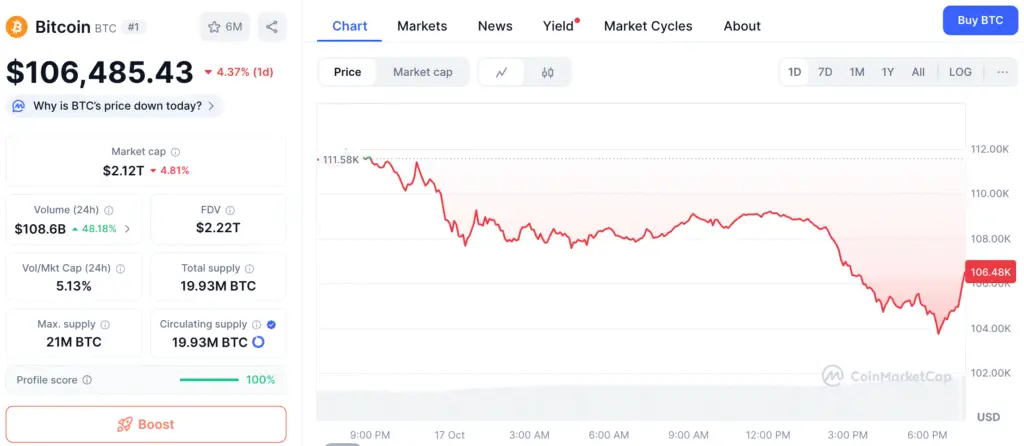

Bitcoin Tests Crucial $106K Support but Retains Long-Term Strength

Market strategist Axel Adler Jr. indicates that Bitcoin’s crucial support is positioned between $106,000 and $107,000. A significant drop beneath this range may pave the way for a revisit of the $100,000 mark. Nonetheless, as long as BTC maintains its position above that base, the overall optimistic framework continues to hold strong.

BTC has experienced a 4% decline in the last 24 hours and a 12% drop over the week, but it still boasts a remarkable 58% increase over the year, highlighting its resilience in the face of short-term fluctuations.

Late-October Recovery Supported by Seasonal Trends

Traditionally, October, referred to as “Uptober,” has shown robust performance for Bitcoin, frequently signaling the beginning of year-end surges. Data from CryptoQuant indicates a notable decrease in exchange reserves during October, highlighting a trend towards greater self-custody and HODL behavior.

As coins exit exchanges and availability diminishes, market conditions frequently align to support potential price increases. The current seasonal liquidity crunch, along with ongoing reaccumulation efforts, creates a compelling scenario for possible upward movement as we approach the end of the month.

Bitcoin Consolidates as Traders Target $117K–$120K Breakout Zone

Bitcoin’s market is on the verge of stabilization, with elevated trading activity, robust institutional interest, and solid long-term backing near $106,000. Experts predict a potential retest of the $117,000–$120,000 range in the near future if buying momentum persists and BTC surpasses $110,000.

However, a drop below $100,000 might prolong the correction phase before recovery. The increasing liquidity of Bitcoin during price drops suggests a trend of accumulation, and investors are gearing up for another possible upswing as favorable October trends take shape.