The New Bitcoin All-Time High and Subsequent Fall

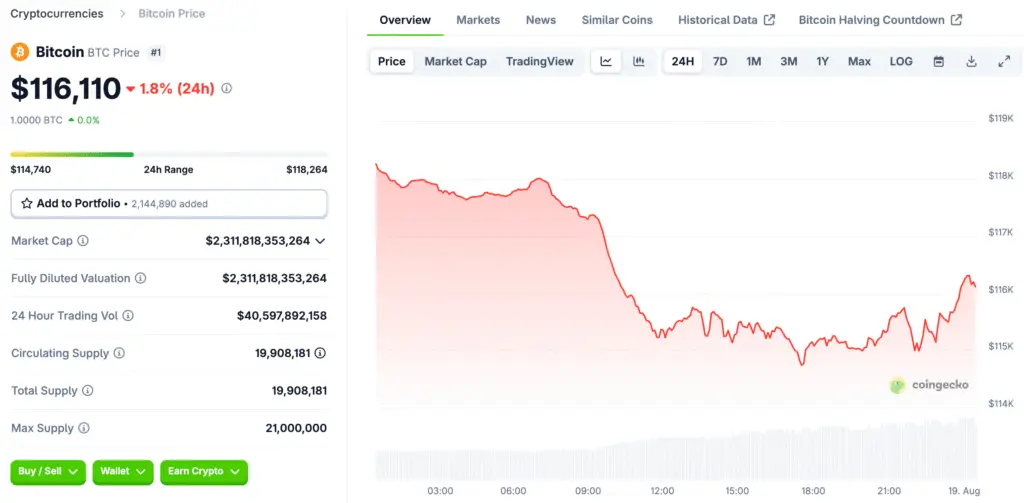

The cryptocurrency market began the week with a notable downturn, following a period of significant upward momentum. Bitcoin, the largest digital asset by market capitalisation, had recently touched a new all-time high of nearly $125,000, marking its fourth such record this year. However, this peak was short-lived, as the price quickly retreated. Within a matter of hours, Bitcoin’s value had fallen to approximately $115,000, and at one point, it dipped as low as $114,706.

This swift reversal in price action demonstrated the highly volatile nature of the crypto market and showed how quickly investor sentiment can change. The sell-off was not confined to Bitcoin alone, as Ether also experienced a significant slide, dropping 4% to $4,283.15 after nearly reaching its own record of $4,800 just last week. The synchronised movement of these major assets highlights a market-wide reaction to external pressures.

Macroeconomic Concerns Spark a Market Retreat

The primary catalyst for this widespread crypto market tumble appears to be heightened macroeconomic concerns. Investors were spooked by the release of higher-than-expected July wholesale inflation data. This information raised new questions and uncertainties about the Federal Reserve’s future policy decisions, specifically regarding a potential interest rate cut in September.

In a global financial landscape, cryptocurrencies are often viewed as risk-on assets, meaning their prices can be particularly sensitive to changes in economic outlook and central bank policy. When the prospect of a rate cut seems less certain, investors may become more risk-averse, leading them to pull capital from volatile markets like crypto and reallocate it to safer, more stable investments. This shift in focus from the ongoing institutional adoption narrative to broader economic worries created a powerful headwind for the market.

The Impact of Investor Profit-Taking and Liquidations

A major factor exacerbating the price decline was a wave of profit-taking by investors, which then triggered a cascade of liquidations. According to data from Coin Glass, over the last 24 hours, sales from more than 133,000 traders totalled a staggering $576.35 million. This figure includes significant liquidations of long positions, with approximately $124 million in long Bitcoin liquidations and $184 million in long Ether liquidations.

A long liquidation occurs when a trader, who has borrowed funds to place a leveraged bet on a price increase, is forced to sell their assets at the current market price to cover their debt. This forced selling adds further downward pressure on prices, creating a domino effect that can accelerate a market slump. The immense scale of these liquidations underscores the high leverage present in the crypto market and its vulnerability to sudden price swings.

Government Policy and the Strategic Bitcoin Reserve

Adding to the sense of investor disappointment were recent comments from Treasury Secretary Scott Bessent regarding the strategic bitcoin reserve. While President Donald Trump established the reserve back in March, Bessent’s clarification on its funding mechanism introduced a new layer of uncertainty. He stated that the reserve would be confined to bitcoin forfeited to the federal government as it explores “budget-neutral pathways to acquire more bitcoin.”

This statement cooled expectations for a more aggressive, government-led accumulation of the digital asset, which many had hoped would provide a new source of institutional demand. The clarification likely dampened some of the bullish sentiment that had been building around institutional and governmental adoption narratives.

A Broader Market Trend A Look at Other Crypto and Stocks

The recent downturn was not isolated to just the two largest cryptocurrencies. The sell-off spread across the entire digital asset ecosystem. The CoinDesk 20 index, which serves as a measure of the broader crypto market, was down 3.7%, indicating a widespread decline. This market movement also affected crypto-related stocks, which came under significant pressure. Companies such as Bitmine Immersion saw their share prices drop by 8%, while the crypto exchange Bullish, which had only recently made its public debut, was lower by 7%.

Other notable companies in the space, like Circle and Coinbase, each fell by 2%. The correlated decline across these different asset classes suggests that the macroeconomic and market-wide concerns were the dominant forces at play, rather than any specific issues related to a single coin or company.

Upcoming Economic Events and Future Outlook

Looking ahead, investors are closely monitoring several key economic events that could provide further clues about the future direction of the market. This week, the Federal Reserve’s annual economic symposium in Jackson Hole, Wyoming, will be a focal point. Market participants will be listening for any commentary from central bank officials that might shed light on the likelihood of future rate cuts. Additionally, traders will be paying close attention to Thursday’s jobless claims data.

Positive or negative news on the jobs front could influence the Fed’s decisions and, consequently, impact risk asset valuations. The market’s sensitivity to these upcoming announcements underscores the tight link between traditional macroeconomic indicators and the future trajectory of the crypto market.

Is This a Crisis or a Healthy Cooldown?

Despite the sharp price correction, many market analysts view this recent pullback as a healthy and strategic cooldown rather than a sign of a looming crisis. This perspective is largely supported by the continued strong institutional demand for crypto. Even though funds tracking the price of Bitcoin and Ether saw net outflows on Friday, they logged net weekly inflows of $547 million and $2.9 billion, respectively.

For Ether funds, this marked a record week of inflows and their 14th consecutive week of positive flows. This sustained institutional accumulation provides a crucial layer of support for the market, suggesting that while short-term volatility will persist, the long-term trend of institutional adoption remains intact.

Read More: Bitcoin Holds Above $116,000 Support Amid Institutional Buying