Bitcoin Experiences Significant Pullback Following Recent Peak

Bitcoin (BTC) recently surged to a new high of $126,000 before experiencing a significant drop to approximately $106,000, sparking extensive speculation regarding the upcoming phase of the market. Experts are currently debating whether this decline signifies a typical consolidation phase or serves as an initial alert of a more extensive downward trend.

Seasoned analyst Mr. Anderson characterizes this action as a manifestation of Bitcoin’s ongoing psychological trend. In the past, BTC has experienced its most significant surges after substantial pullbacks, during which the mood among investors transitioned from excitement to doubt. He underscores that identifying these emotional patterns is crucial for predicting Bitcoin’s forthcoming trajectory.

Market Analysts Monitor Crucial Psychological Levels

Experts have pinpointed $112,000 as the immediate support level for Bitcoin, while $120,000 is recognized as a key resistance threshold. Keeping strength above these levels will dictate if the asset can continue its upward trajectory.

If Bitcoin cannot maintain its current support level, traders anticipate a resurgence of volatility, with many gearing up for possible reaccumulation phases. These crucial price levels indicate where market participants often modify their approaches, influenced more by the collective mindset than by mere technical signals.

Bitcoin Inflows Surge as Institutions Seize Buying Opportunity in Dip

While there may be temporary declines in prices, the actions of institutional players suggest a contrasting narrative. Recent findings indicate that more than $180 million has been directed into Bitcoin investment vehicles in the last week, highlighting a notable comeback in institutional interest.

This pattern of accumulation stands in stark contrast to the cautious approach of retail investors, suggesting that significant market participants perceive the current range as an opportunity for value purchases. In the past, comparable inflows have frequently signaled a rise in momentum, as the accumulation by institutions aids in reducing volatility and rebuilding trust among investors.

Recommended Article: Bitcoin Price Dips Under $105K With Trading Volume at $3.68B

Accumulation Phases Point to Structural Strength

Periods of consolidation frequently precede significant breakouts, and experts suggest that this trend may occur again. The historical framework of Bitcoin indicates that prolonged periods of reaccumulation have often come before its most significant price increases.

It seems that institutional investors, especially those with a focus on long-term strategies, are slowly starting to reestablish their positions. This trend of accumulation indicates a belief in Bitcoin’s core principles and an increasing assurance in its ability to withstand regulatory and macroeconomic challenges.

Bitcoin Targets $116K Breakout as Key Resistance Blocks Next Major Rally

From a technical perspective, $116,000 stands as the pivotal breakout level. A significant breakthrough above this threshold may open the path to $125,000, with additional upward potential should institutional investments persist.

Market participants perceive this level as a significant psychological and structural hurdle. Breaking through this level would undermine the existing downtrend and signal a resurgence of positive sentiment, possibly paving the way for Bitcoin’s next significant surge.

The Mindset of Investors Continues to Play a Key Role

The fluctuations in Bitcoin’s price frequently mirror the prevailing sentiments of anxiety during downturns and eagerness during upswings. Recent market data reveals a sentiment index that remains balanced, indicating that traders are navigating uncertainty rather than succumbing to panic.

Experts contend that the essential factor in maneuvering through this phase is grasping these behavioral patterns. By analyzing public sentiment and market dynamics, traders can predict the shift from doubt to confidence prior to significant price changes.

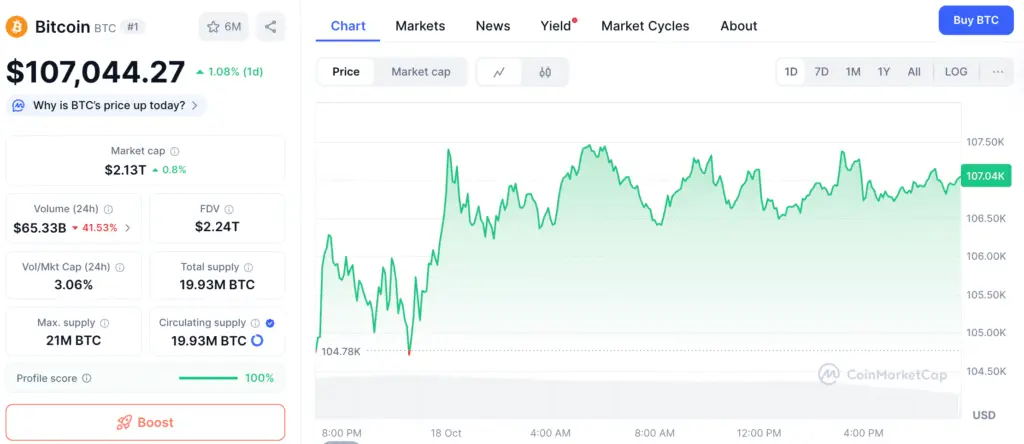

Bitcoin Holds Steady Near $106K as Market Seeks Direction and Support

In light of the recent market fluctuations, Bitcoin’s stabilization around $106,000 seems to be establishing a foundation for a possible rebound. Should institutional backing continue and resistance thresholds be surpassed, BTC may experience a resurgence in upward movement in the weeks ahead.

At this moment, the trajectory of Bitcoin relies on the intricate interplay of sentiment and scrutiny. Individuals who accurately interpret the psychological signals and correlate them with technical validations could position themselves advantageously for the upcoming bullish movement.