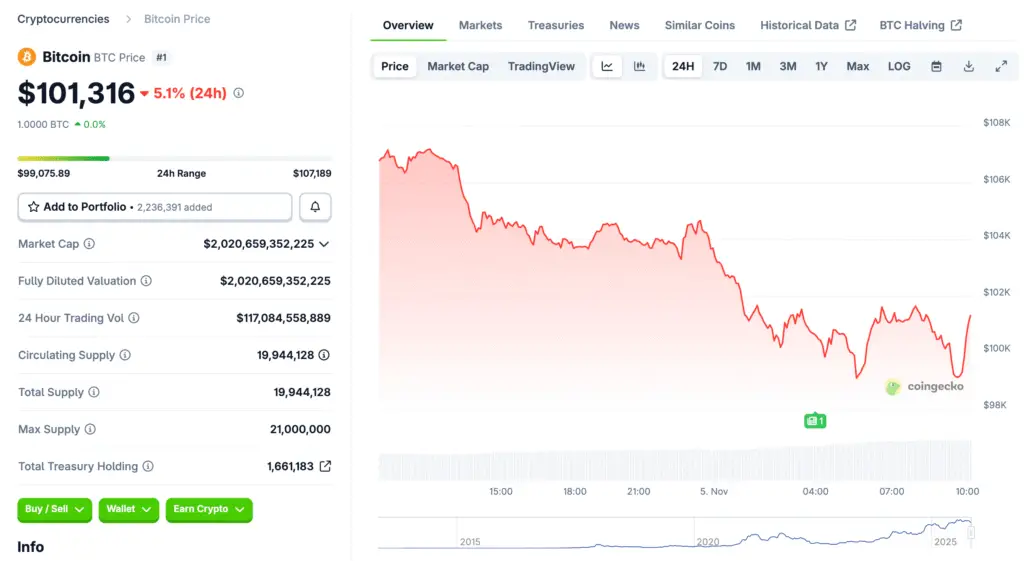

Bitcoin Faces Rare Red October After Six Years of Gains

Bitcoin closed its first negative October in six years, slipping below $108,000 and sparking debate among traders. Analysts, however, say this correction reflects a mid-cycle reset rather than a bearish reversal. The drop aligns with broader market uncertainty following mixed signals from the Federal Reserve.

Analysts Describe the Pullback as a Healthy Reset

Experts argue that Bitcoin’s recent weakness is part of a normal market cycle. Rachel Lin, CEO of SynFutures, told Decrypt that such corrections often mark midpoints of bull markets. She expects the crypto leader to stabilize before resuming its uptrend in the weeks ahead.

Macro Headwinds Add to Short-Term Volatility

Bitcoin’s downturn occurred amid a volatile macro backdrop. The Federal Reserve’s shifting stance on rate cuts and ongoing global economic uncertainty dampened risk appetite. U.S. Treasury yields and a firm dollar added pressure, while investors continued monitoring geopolitical developments.

Recommended Article: Bitcoin Veterans Offload Massive BTC Holdings, Stirring Market Uncertainty

Trade War De-Escalation Offers Some Relief

Recent diplomatic progress between the United States and China has slightly improved sentiment. A temporary truce between the Trump and Xi administrations eased fears of additional tariffs. This stabilization may support risk assets, including Bitcoin, as November trading unfolds.

Institutional Sentiment Shifts as ETFs See Outflows

Despite strong long-term fundamentals, Bitcoin exchange-traded funds experienced significant outflows in late October. BlackRock’s IBIT led with $290 million in redemptions, signaling cautious institutional sentiment. Other ETFs, including those from Ark and Bitwise, followed suit, contributing to the week’s softness.

Historical Trends Point to Stronger November Performance

Historically, November has been one of Bitcoin’s most profitable months, averaging 42% returns over 12 years. Analysts cite this seasonal pattern as a reason for optimism, especially following October’s deleveraging. With improved liquidity and easing inflation, conditions could support a rebound toward $120,000–$150,000.

On-Chain Data Reinforces Structural Strength

On-chain metrics indicate that Bitcoin’s long-term holders remain confident. Exchange reserves have continued to decline, while realized caps stay elevated above $1.1 trillion. These data points suggest structural demand persists despite short-term corrections.

Outlook: Bullish Momentum May Resume Into Year-End

Analysts maintain that Bitcoin’s path forward depends on macroeconomic cues and ETF flows. If stability returns and rate expectations moderate, a renewed rally could follow. Market participants anticipate that Bitcoin’s November performance could once again align with its historical strength, setting the stage for a potential climb toward $150,000 by year-end.