Bitcoin’s Liquid Supply Faces Unprecedented Decline

Bitcoin may soon face one of the most significant liquidity crises in its history. According to Fidelity, up to 42% of Bitcoin’s circulating supply could become illiquid by 2032. This projection equates to roughly 8.3 million BTC locked away in wallets unlikely to re-enter the market. The growing adoption of Bitcoin by corporations and long-term investors is accelerating this structural shift in supply dynamics.

Corporate Treasuries Accelerate Bitcoin Accumulation

Fidelity’s research highlights that public companies are now key contributors to Bitcoin’s diminishing liquid supply. Currently, 105 publicly traded firms collectively hold more than 969,000 BTC—representing approximately 4.61% of Bitcoin’s total supply. This trend mirrors corporate adoption patterns seen in 2025, when more firms began using Bitcoin as a hedge against inflation and currency risk. As treasury adoption expands, fewer coins remain available for active trading.

Long-Term Holders Continue to Tighten Supply

Long-term holders, defined as entities retaining their BTC for at least seven years, form the backbone of Bitcoin’s illiquid supply. Fidelity reports that these holders have consistently increased their holdings since 2016. Their reluctance to sell even during volatile market phases underscores Bitcoin’s evolving role as a long-term store of value. With each cycle, the portion of Bitcoin locked in dormant wallets grows larger.

Recommended Article: SEC Cracks Down on Bitcoin ‘Ponzi’ Schemes Targeting Investors in Caraga

2025 Marks a Turning Point for Institutional Adoption

The year 2025 marked a major inflection point for Bitcoin’s institutional adoption curve. Several public companies announced strategic Bitcoin allocations as part of their treasury diversification strategies. This accelerated accumulation contributed to reduced market liquidity and heightened investor demand. Fidelity predicts that by late 2025, corporate and long-term holders combined will control over six million BTC—around 28% of the total maximum supply.

Structural Imbalance Between Supply and Demand

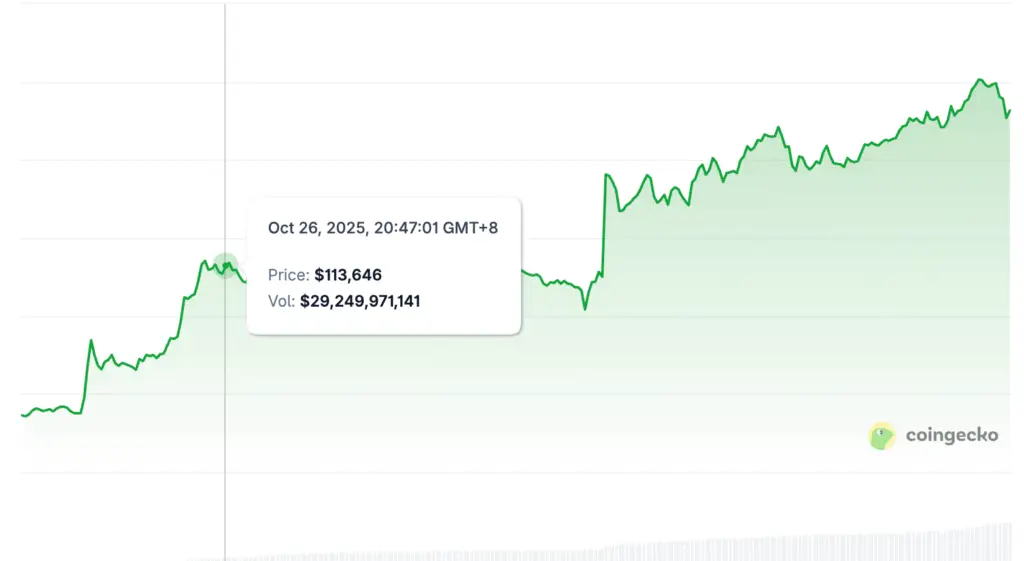

The imbalance between rising demand and shrinking available supply could reshape Bitcoin’s price trajectory. Historical data shows that supply contractions often precede sharp upward movements in BTC valuation. As liquid coins become scarcer, even moderate increases in demand can drive substantial price appreciation. Analysts warn, however, that concentrated ownership could also introduce new market risks.

The Risks of Concentrated Holdings

While illiquid supply tends to stabilize prices, it can also magnify volatility if large holders decide to sell. A coordinated liquidation by corporate or whale investors could trigger cascading effects on exchanges. Market observers emphasize the need for diversified ownership to maintain healthy liquidity. Despite these concerns, Fidelity maintains that the overall supply squeeze remains a bullish long-term signal.

Factors Driving the Supply Shortage

Fidelity’s model assumes current accumulation rates persist, without accounting for future corporate entrants or macroeconomic shocks. The firm’s analysis focuses strictly on observable wallet behavior, excluding speculative adoption scenarios. Bitcoin’s capped supply of 21 million coins ensures that increasing institutional participation will continue to tighten availability. These fundamentals set the stage for potentially historic supply pressure in the coming decade.

Market Implications for Bitcoin’s Future

As supply constraints intensify, Bitcoin’s market behavior may shift toward that of scarce commodities. Investors could view BTC less as a trading asset and more as a strategic reserve asset akin to digital gold. The interplay between scarcity, adoption, and regulation will determine how the market evolves. For now, Fidelity’s warning serves as a reminder that Bitcoin’s next bull cycle may be driven less by hype and more by mathematics.