Bitcoin Starts 2026 With Renewed Market Uncertainty

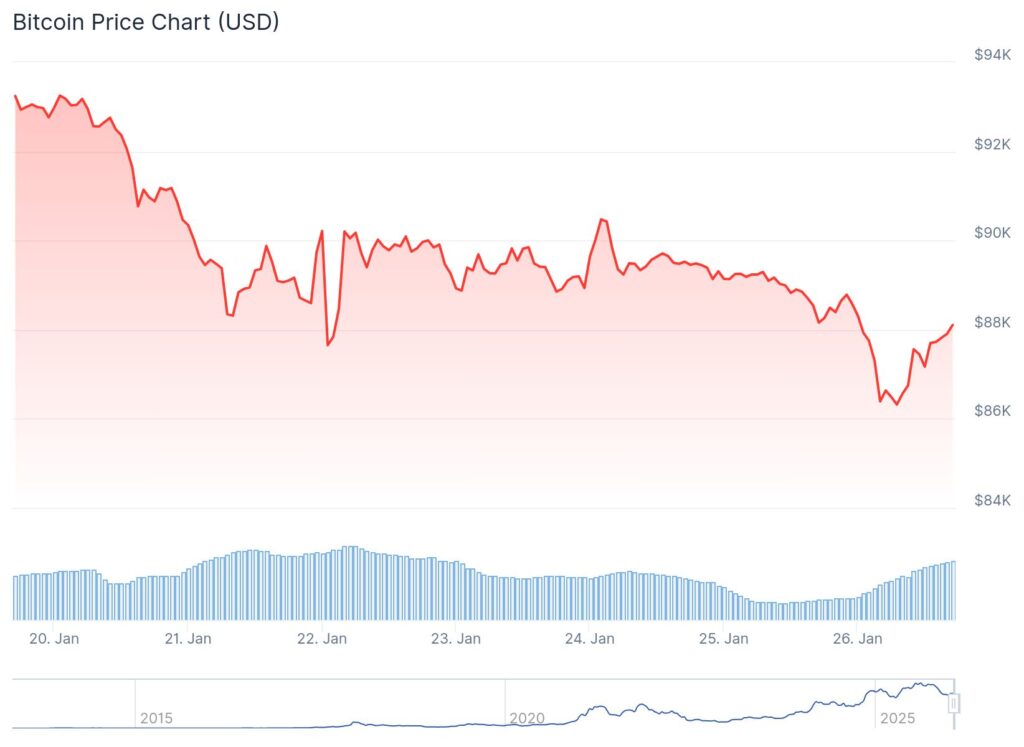

Bitcoin opened 2026 amid renewed uncertainty as investors reassessed risk following a volatile end to the previous year. While long-term adoption trends remain intact, short-term price movements increasingly reflect political developments and institutional positioning.

Market participants now treat Bitcoin as both a speculative asset and a macro signal. This dual role has amplified sensitivity to policy announcements, election rhetoric, and regulatory signals, according to recent market analysis.

ETF Flows Become the Primary Market Driver

Spot Bitcoin ETFs continue to dominate trading dynamics, shaping liquidity and intraday volatility. Large inflows during optimistic sessions are often followed by sharp pullbacks as institutional traders rebalance exposure.

This behavior has altered traditional market cycles, reducing the influence of retail momentum. Analysts note that ETF flow data now provides clearer signals than on-chain metrics, as highlighted in a recent financial report.

Political Narratives Gain Influence Over Price Action

Bitcoin’s price increasingly reacts to political narratives, particularly in the United States. Discussions around inflation control, government debt, and monetary sovereignty frequently reference digital assets as alternatives.

Donald Trump’s renewed economic messaging has also reintroduced Bitcoin into political discourse. While no direct policy changes have occurred, rhetoric alone has been enough to move markets, according to political coverage.

Recommended Article: Bitcoin Market Reacts to Trump’s Crypto Policy Push as Volatility…

Global Adoption Offsets Western Regulatory Pressure

Outside Western markets, Bitcoin adoption continues expanding steadily. In regions facing currency instability or limited banking access, Bitcoin remains a practical financial tool rather than a speculative investment.

Latin America, Africa, and parts of Southeast Asia continue to report rising wallet activity. These trends provide long-term structural support, even as regulatory pressure persists in developed economies, based on global adoption data.

Mining Economics Adjust After the Halving Cycle

The most recent halving has reshaped Bitcoin mining economics, accelerating consolidation across the sector. Smaller operators face tighter margins, while large firms benefit from energy contracts and scale advantages.

Despite short-term strain, network security remains strong. Industry observers suggest the post-halving environment promotes operational efficiency, according to a mining industry brief.

Bitcoin’s Role in a Fragmenting Global System

Bitcoin increasingly reflects broader geopolitical fragmentation. Capital controls, sanctions, and divergent monetary policies have driven interest in decentralized financial systems.

Rather than replacing traditional finance, Bitcoin now exists alongside it as a parallel settlement layer. This coexistence remains controversial but increasingly normalized, as discussed in a recent policy review.

Outlook for Bitcoin Through 2026

Looking ahead, Bitcoin’s trajectory in 2026 appears shaped more by institutions and politics than technology alone. Volatility is likely to persist as markets react to policy uncertainty and macroeconomic shifts.

For long-term holders, fundamentals such as adoption, security, and scarcity remain unchanged. The challenge lies in navigating short-term noise without losing sight of structural trends, a theme echoed in recent market commentary.