Bitcoin’s Price Breaks a Key Uptrend Line

Bitcoin’s price recently dropped more than 13.75% from its all-time high, which is a big deal for investors. This sudden drop broke a very important multi-year uptrend line that had been holding the price up for more than two years. The technical break has made a lot of people in the market worried that the current bull cycle might end.

A lot of people are worried about this recent price movement because the Relative Strength Index is now under pressure. In the past, a simultaneous drop in the parabolic trend and the RSI has always come before some of Bitcoin’s biggest market corrections. The market is now in a very important testing phase, and any new breaks could speed up the corrective momentum.

Historical Examples of Big Price Changes

The analyst gives investors a few examples from the past to show how bad the current technical break is. The price dropped sharply by 85% in 2013 after both the parabolic and RSI supports were lost. In 2017, the token fell by 84% to about $3,100, which was a similar market trend.

In 2021, the market bubble burst dramatically, causing a drop of seventy-seven percent. This was also preceded by a similar technical break. The analyst says that Bitcoin’s price could drop quickly if the RSI keeps breaking its support. He thinks the token could drop to the bi-weekly 50-period exponential moving average at $80,000.

Is Bitcoin’s Price Drop a Trap?

Some of the best crypto market analysts are now saying that this drop in price is just a trap. They say that the current market manipulation is meant to scare new and very nervous investors into selling their stocks too soon. This is a very common way to get rid of weak hands before a strong price rise.

One analyst says that if Bitcoin falls below $100,000 for a short time, it would be in line with how it has acted in the past. He thinks that this recent drop in price should be seen as a chance to buy more, not as a sign that the cycle is coming to an end. This gives us a very different view of how the market is working right now.

Recommended Article: Bitcoin’s Volatile Market Ride and Investor Impact

The Pi Cycle Top Model Shows Things Differently

An analyst who uses the Pi Cycle Top model also backs up the bullish view. This model has a long history of correctly finding the tops of past bull cycles in the cryptocurrency market. It is based on a very accurate crossover of two moving averages that are on a certain time frame.

This model says that a Pi Cycle crossover has not yet happened, which means that the cycle’s real peak has not yet been reached. He thinks that Bitcoin could go up a lot more before investors start to lose money. This interpretation says that the current range of $80,000 to $100,000 is a very good place to buy.

Bitcoin at a Critical Technical Point

From a technical point of view, this is a very important time for the whole Bitcoin market ecosystem. If the parabolic trend and the RSI both go down at the same time, it could quickly start a new bearish sequence for investors. This would make the most optimistic short-term scenarios that a lot of people are hoping for impossible.

The market is now going through a new testing phase, and a clear break could speed up the correction without a clear end in sight. A new bearish sequence could start up quickly, which would make the most bullish short-term scenarios no longer valid. These important technical levels will now have an impact on the price of Bitcoin in the future.

The Limits of the Pi Cycle Top Model

The Pi Cycle Top model hasn’t sent out a peak signal yet, but that doesn’t mean that there can’t be any short-term corrections. The model does not take into account many other important macroeconomic, regulatory, and geopolitical factors that affect the market. These outside factors are now having a much bigger effect on how prices move.

There are a lot of things that affect the current market structure that aren’t included in most traditional technical models. If the RSI breaks its support line, it could start a new bearish trend for all investors very quickly. This would probably make a lot of people with weak hands in the market panic and sell.

Bitcoin’s Price at a Pivotal Point

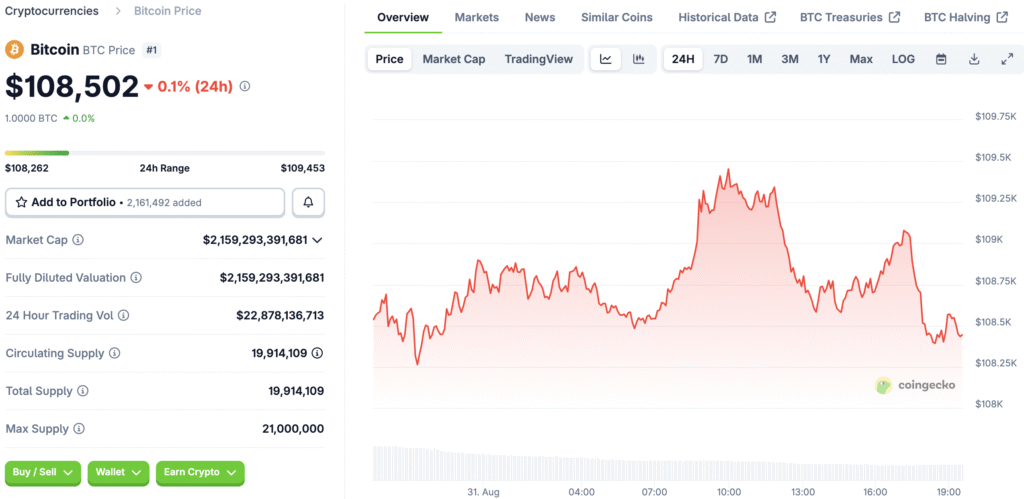

Bitcoin needs to quickly bounce back above a key price level to avoid a new bearish sequence. Many analysts say that one hundred fourteen thousand dollars is a very important price level. If this level is broken, it could easily invalidate the false breakout and start a long-term uptrend again.

A confirmed push past this level would also help the public and investors feel more confident in the market again. On the other hand, if the price doesn’t go back up to this level, a new bearish sequence could start very quickly for everyone. Bitcoin’s price is now in a very dangerous place for the future.